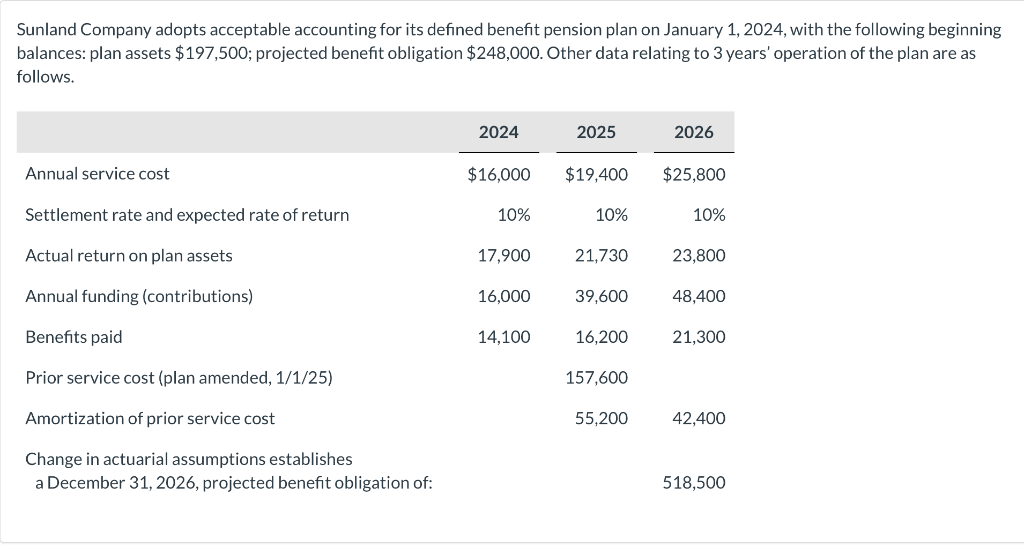

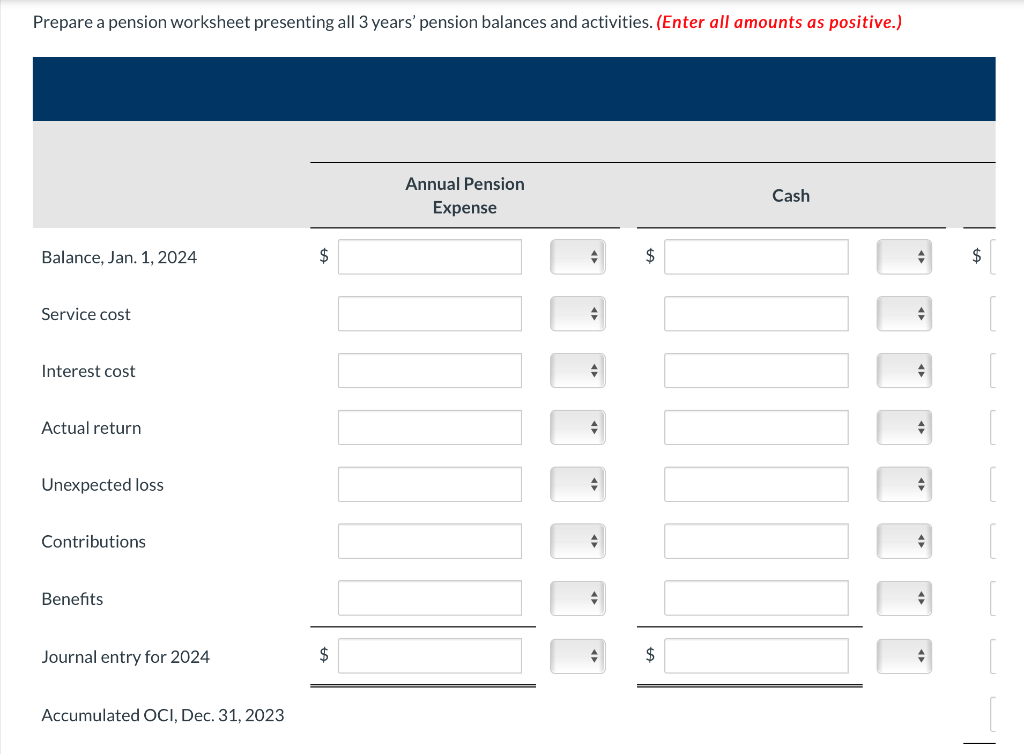

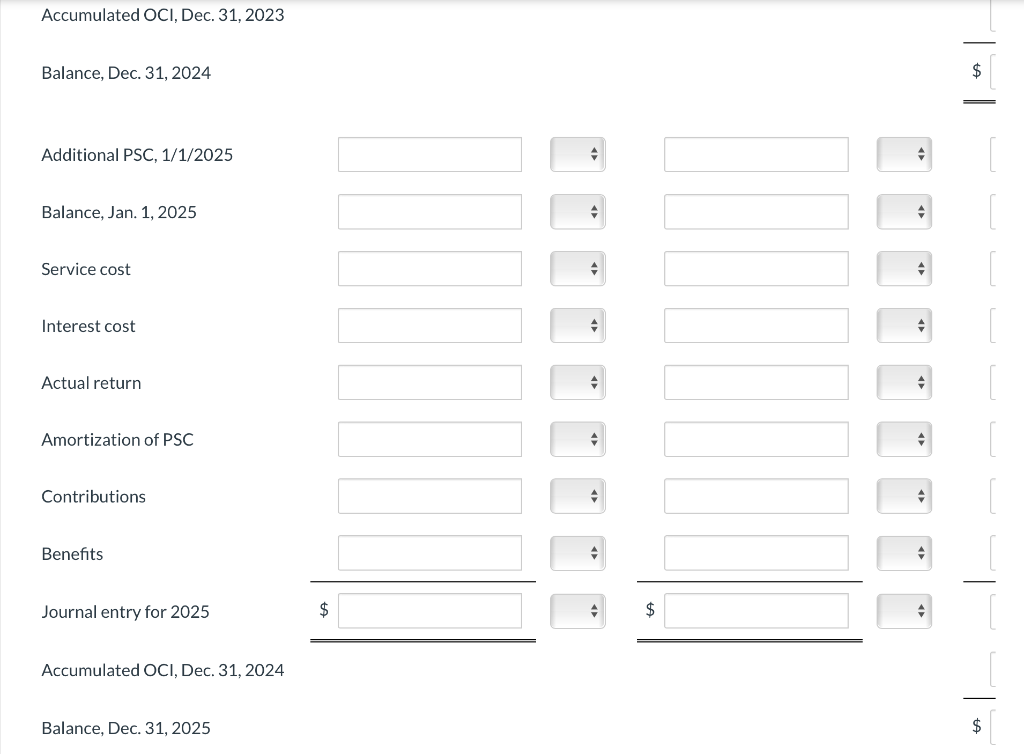

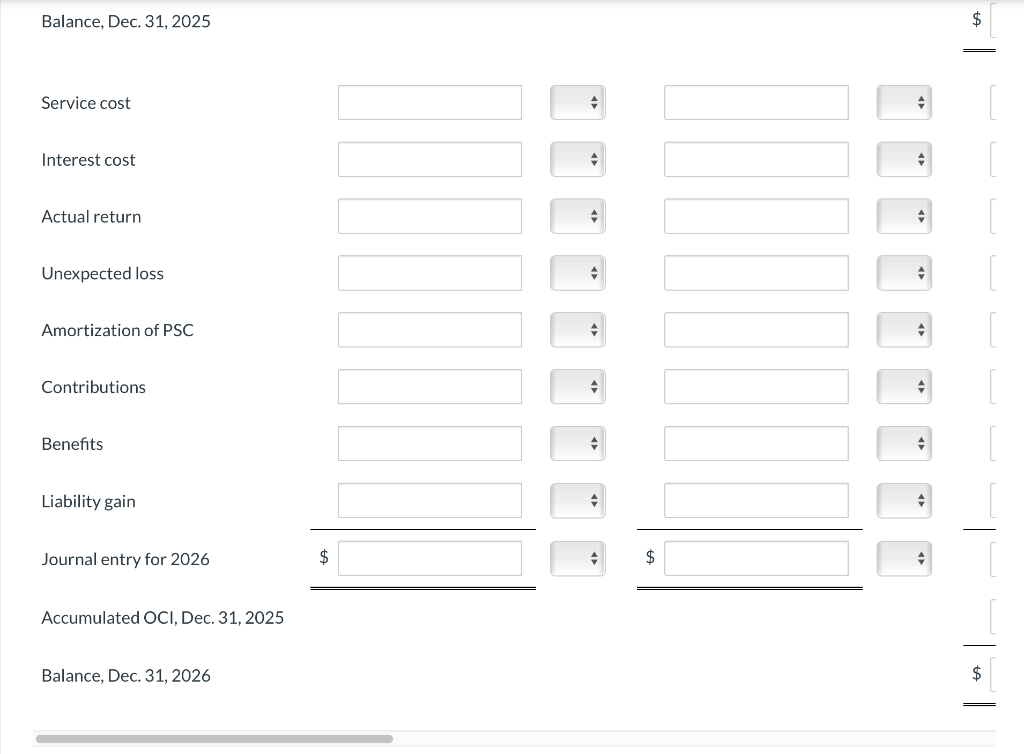

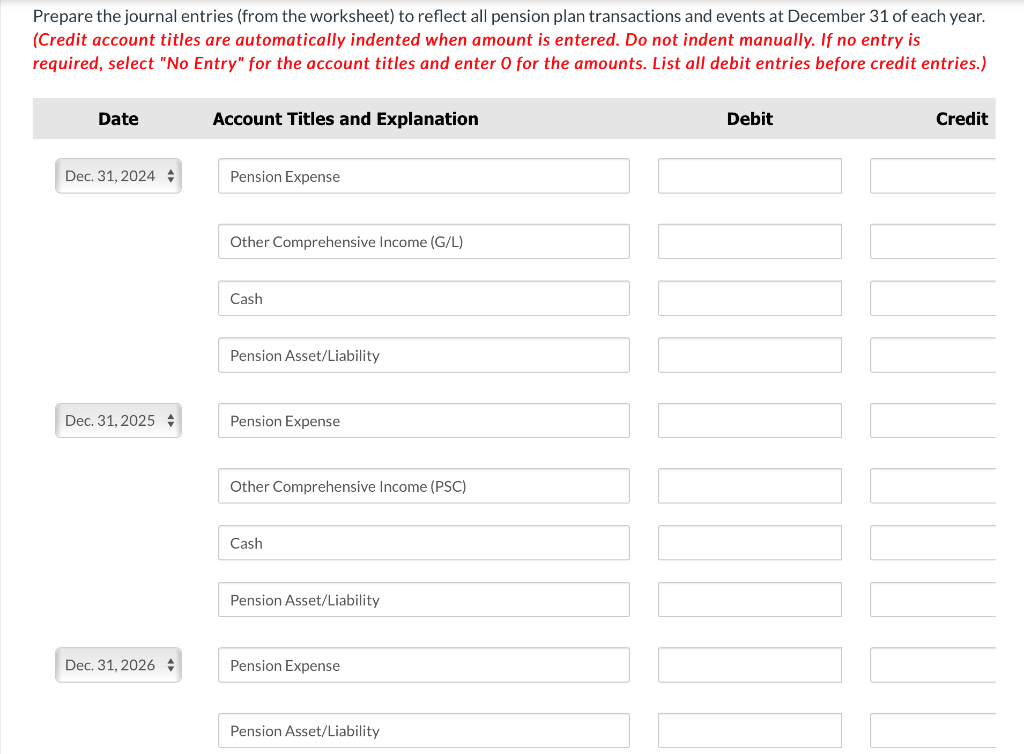

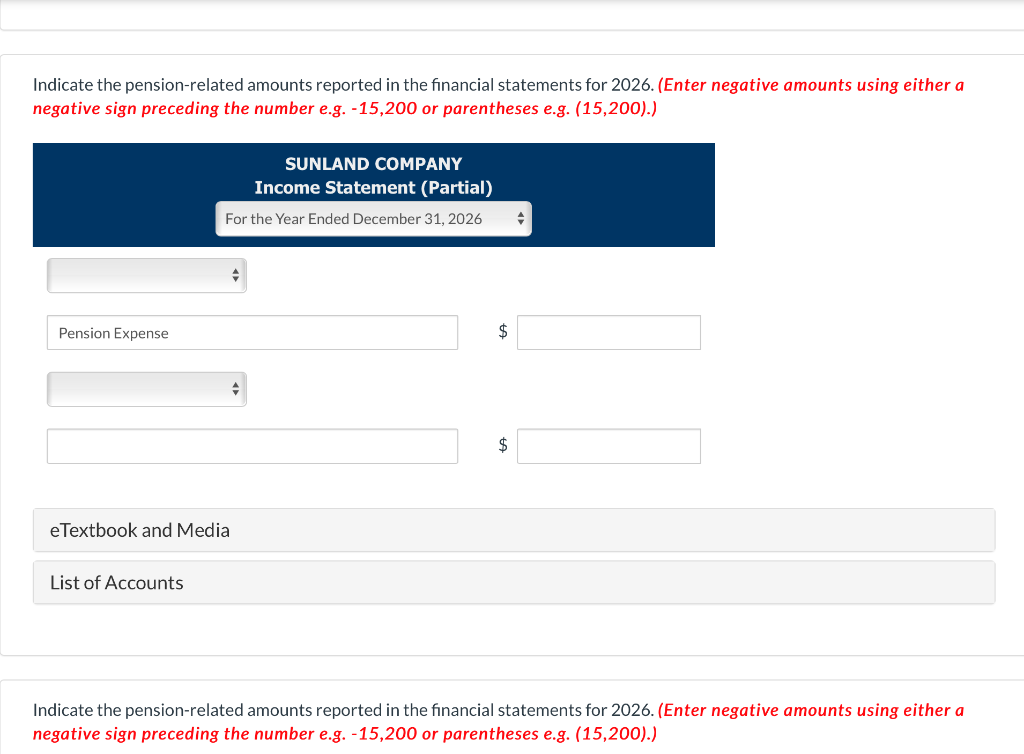

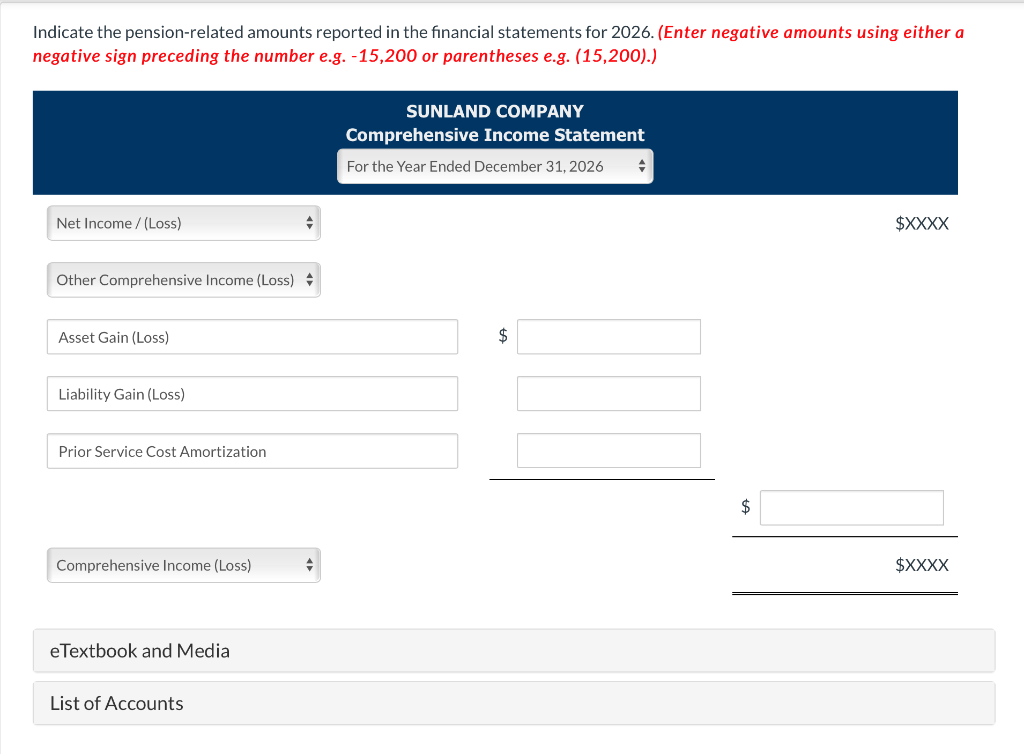

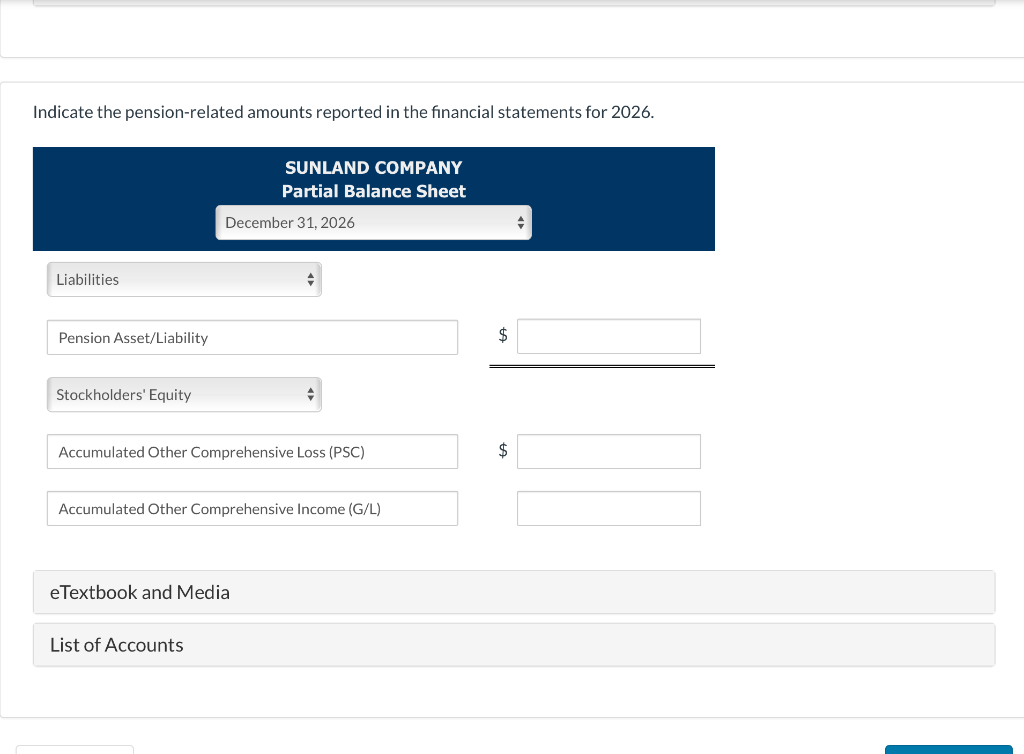

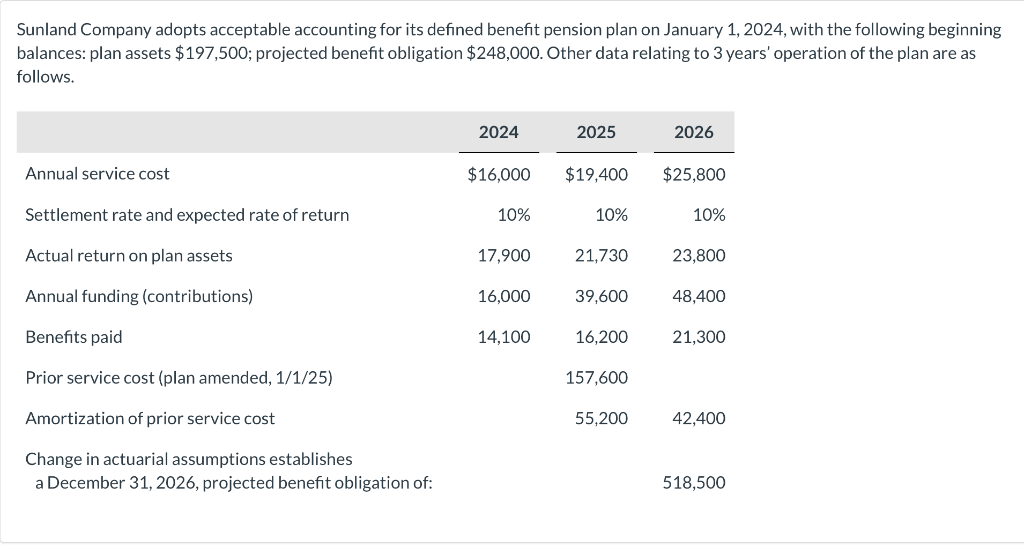

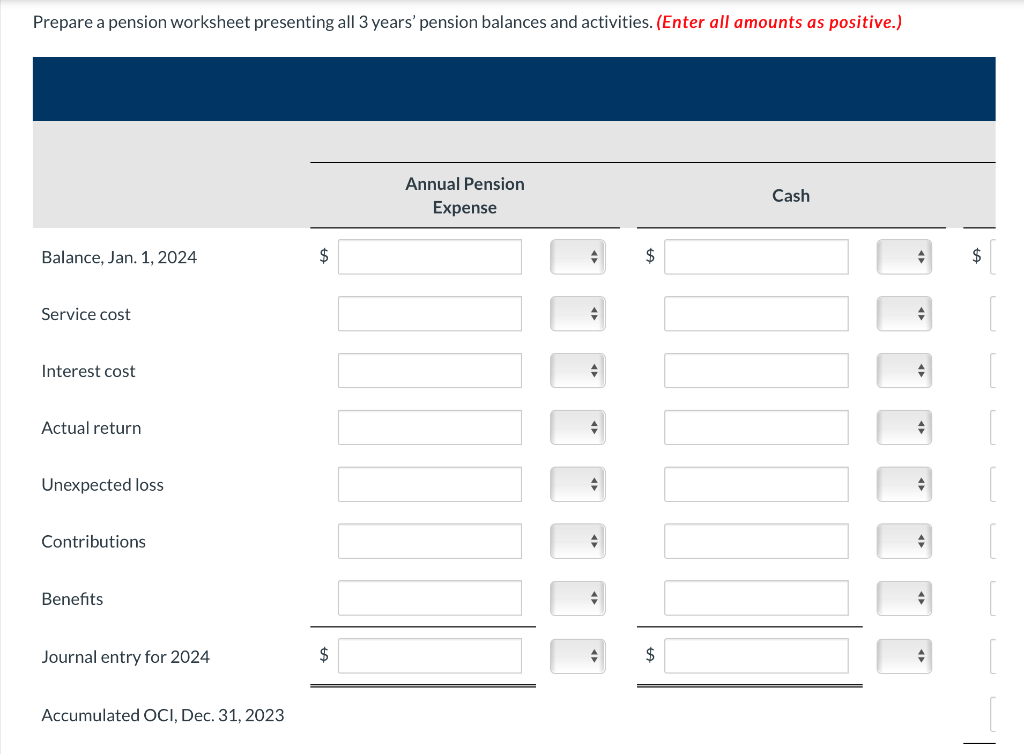

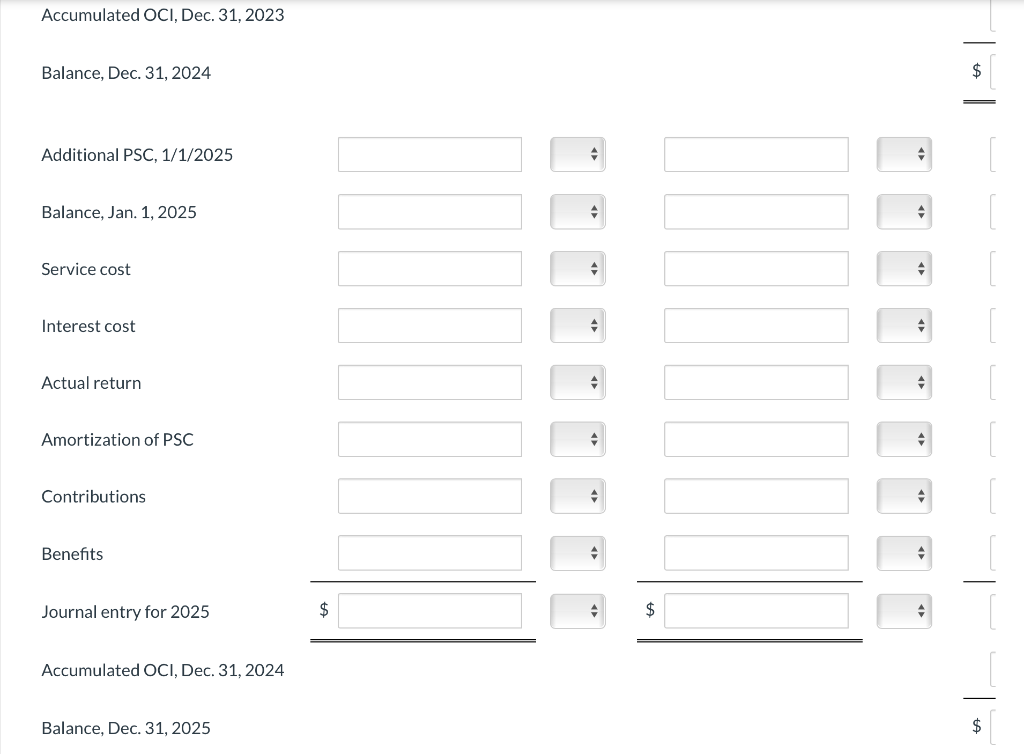

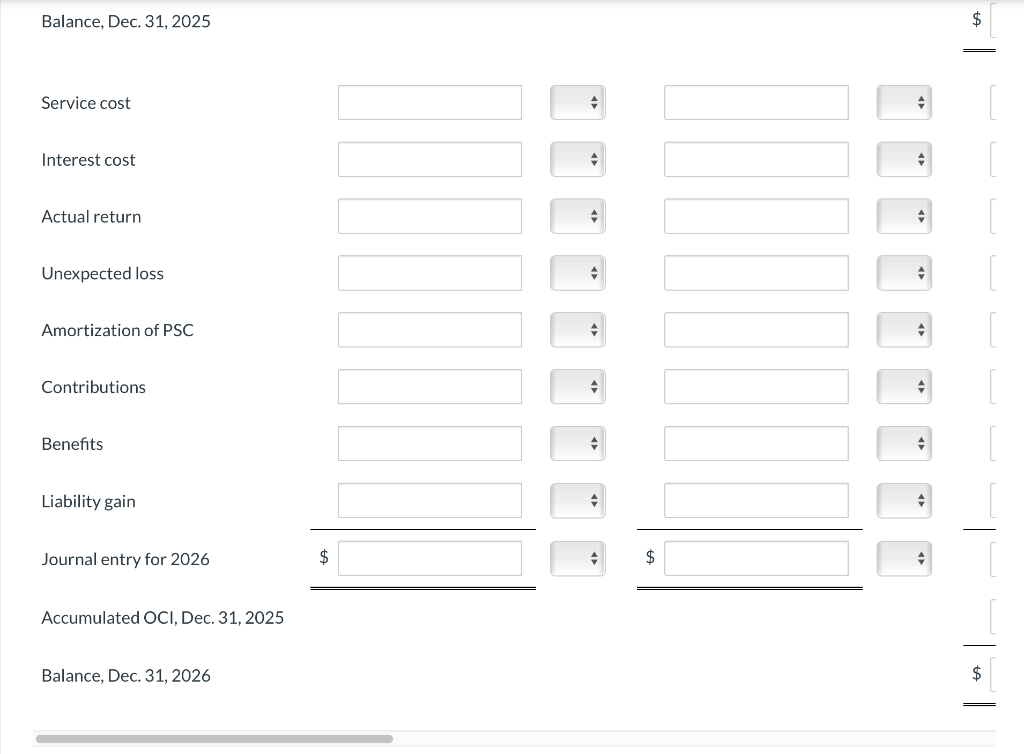

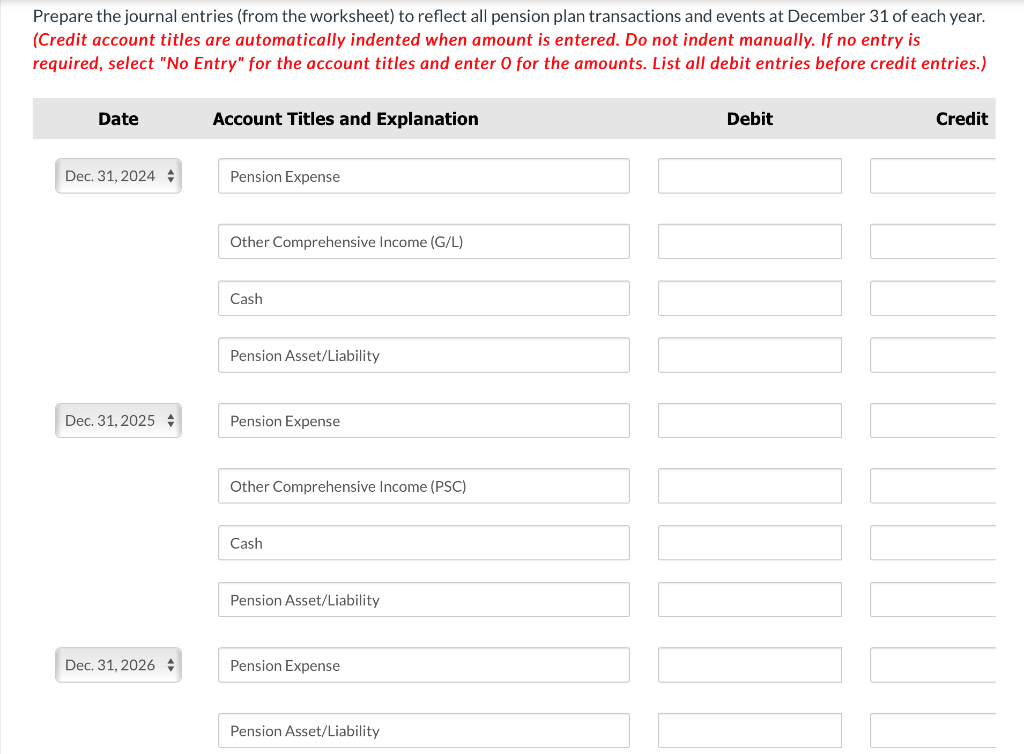

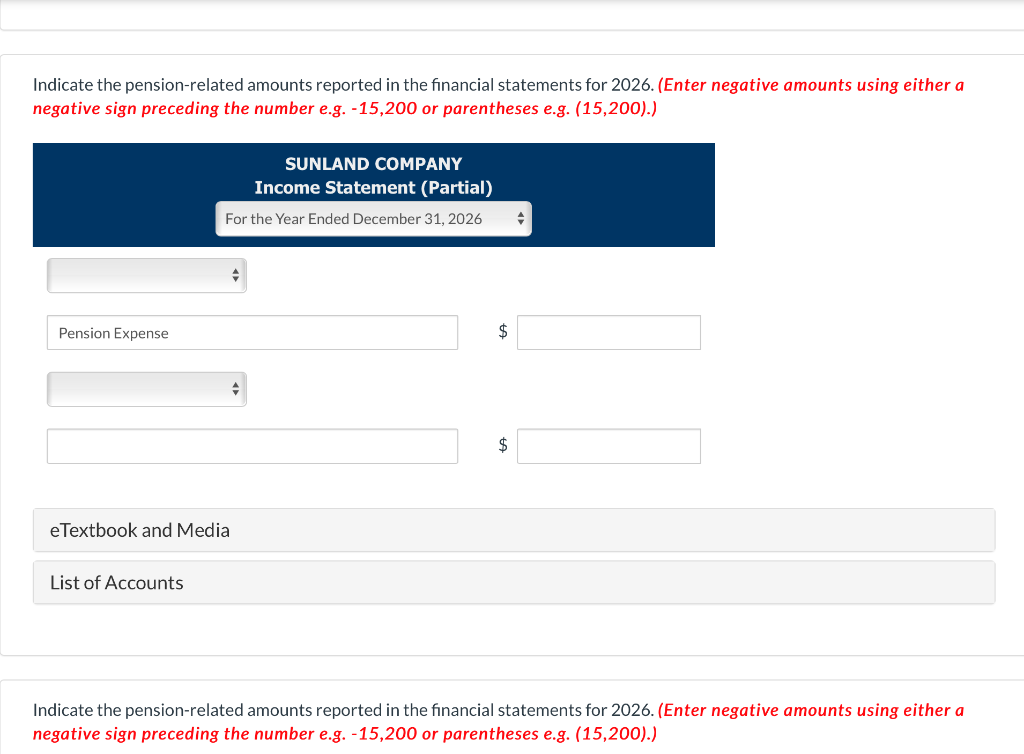

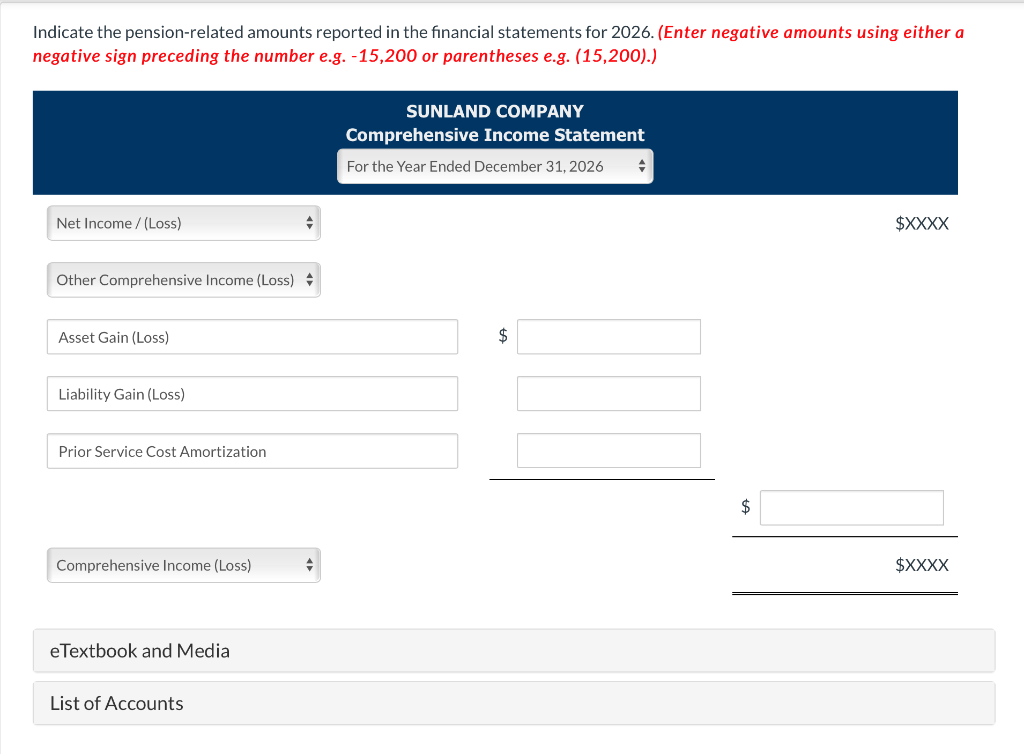

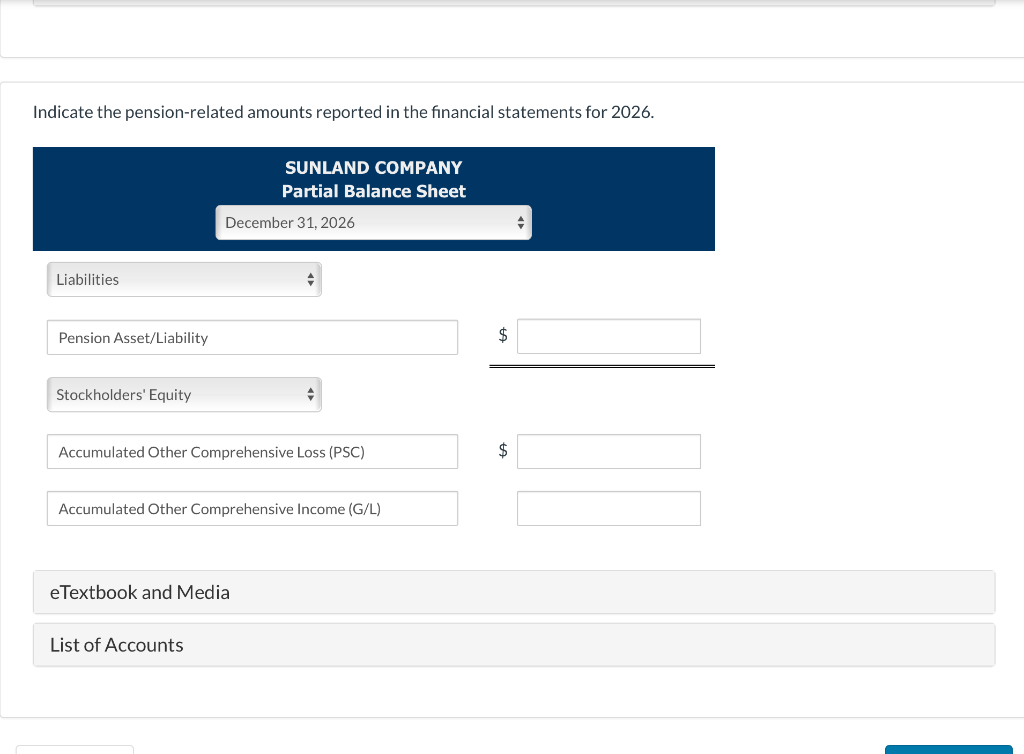

Sunland Company adopts acceptable accounting for its defined benefit pension plan on January 1,2024 , with the following beginning balances: plan assets $197,500; projected benefit obligation $248,000. Other data relating to 3 years' operation of the plan are as follows. Prepare a pension worksheet presenting all 3 years' pension balances and activities. (Enter all amounts as positive.) $ Balance, Dec. 31, 2025 Service cost Interest cost Actual return Unexpected loss Amortization of PSC Contributions Benefits Liability gain Journal entry for 2026 Accumulated OCl, Dec. 31, 2025 Balance, Dec. 31, 2026 Prepare the journal entries (from the worksheet) to reflect all pension plan transactions and events at December 31 of each year. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Indicate the pension-related amounts reported in the financial statements for 2026 . (Enter negative amounts using either a negative sign preceding the number e.g. 15,200 or parentheses e.g. (15,200).) negative sign preceding the number e.g. 15,200 or parentheses e.g. (15,200).) Indicate the pension-related amounts reported in the financial statements for 2026. (Enter negative amounts using either a Indirate the nension-related amnunts renorted in the financial statements for 2026 Sunland Company adopts acceptable accounting for its defined benefit pension plan on January 1,2024 , with the following beginning balances: plan assets $197,500; projected benefit obligation $248,000. Other data relating to 3 years' operation of the plan are as follows. Prepare a pension worksheet presenting all 3 years' pension balances and activities. (Enter all amounts as positive.) $ Balance, Dec. 31, 2025 Service cost Interest cost Actual return Unexpected loss Amortization of PSC Contributions Benefits Liability gain Journal entry for 2026 Accumulated OCl, Dec. 31, 2025 Balance, Dec. 31, 2026 Prepare the journal entries (from the worksheet) to reflect all pension plan transactions and events at December 31 of each year. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Indicate the pension-related amounts reported in the financial statements for 2026 . (Enter negative amounts using either a negative sign preceding the number e.g. 15,200 or parentheses e.g. (15,200).) negative sign preceding the number e.g. 15,200 or parentheses e.g. (15,200).) Indicate the pension-related amounts reported in the financial statements for 2026. (Enter negative amounts using either a Indirate the nension-related amnunts renorted in the financial statements for 2026