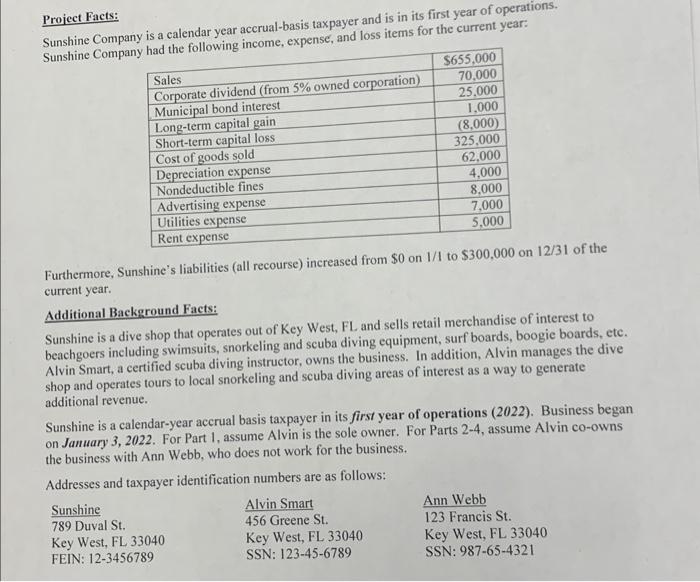

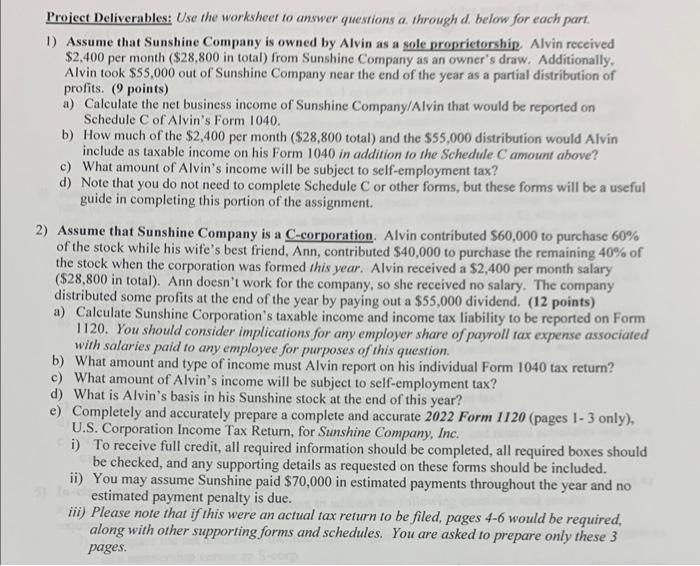

Sunshine Company is a calendar year accrual-basis taxpayer and is in its first year of operations. Project Facts: Sunshine Company Furthermore, Sunshine's liabilities (all recourse) increased from $0 on 1/1 to $300,000 on 12/31 of the current year. Additional Background Facts: Sunshine is a dive shop that operates out of Key West, FL and sells retail merchandise of interest to beachgoers including swimsuits, snorkeling and scuba diving equipment, surf boards, boogie boards, etc. Alvin Smart, a certified scuba diving instructor, owns the business. In addition, Alvin manages the dive shop and operates tours to local snorkeling and scuba diving areas of interest as a way to generate additional revenue. Sunshine is a calendar-year accrual basis taxpayer in its first year of operations (2022). Business began on January 3, 2022. For Part 1, assume Alvin is the sole owner. For Parts 2-4, assume Alvin co-owns the business with Ann Webb, who does not work for the business. Project Deliverables: Use the worksheet to answer questions a. through d. below for each part. 1) Assume that Sunshine Company is owned by Alvin as a sole proprietorship. Alvin received $2,400 per month ( $28,800 in total) from Sunshine Company as an owner's draw. Additionally. Alvin took $55,000 out of Sunshine Company near the end of the year as a partial distribution of profits. ( 9 points) a) Calculate the net business income of Sunshine Company/Alvin that would be reported on Schedule C of Alvin's Form 1040. b) How much of the $2,400 per month ($28,800 total) and the $55,000 distribution would Alvin include as taxable income on his Form 1040 in addition to the Schedule Camount above? c) What amount of Alvin's income will be subject to self-employment tax? d) Note that you do not need to complete Schedule C or other forms, but these forms will be a useful guide in completing this portion of the assignment. 2) Assume that Sunshine Company is a C-corporation. Alvin contributed $60,000 to purchase 60% of the stock while his wife's best friend, Ann, contributed $40,000 to purchase the remaining 40% of the stock when the corporation was formed this year. Alvin received a $2,400 per month salary ($28,800 in total). Ann doesn't work for the company, so she received no salary. The company distributed some profits at the end of the year by paying out a $55,000 dividend. (12 points) a) Calculate Sunshine Corporation's taxable income and income tax liability to be reported on Form 1120. You should consider implications for any employer share of payroll tax expense associated with salaries paid to any employee for purposes of this question. b) What amount and type of income must Alvin report on his individual Form 1040 tax return? c) What amount of Alvin's income will be subject to self-employment tax? d) What is Alvin's basis in his Sunshine stock at the end of this year? e) Completely and accurately prepare a complete and accurate 2022 Form 1120 (pages 1-3 only), U.S. Corporation Income Tax Return, for Sunshine Company, Inc. i) To receive full credit, all required information should be completed, all required boxes should be checked, and any supporting details as requested on these forms should be included. ii) You may assume Sunshine paid $70,000 in estimated payments throughout the year and no estimated payment penalty is due. iii) Please note that if this were an actual tax return to be filed, pages 4-6 would be required, along with other supporting forms and schedules. You are asked to prepare only these 3 pages. Sunshine Company is a calendar year accrual-basis taxpayer and is in its first year of operations. Project Facts: Sunshine Company Furthermore, Sunshine's liabilities (all recourse) increased from $0 on 1/1 to $300,000 on 12/31 of the current year. Additional Background Facts: Sunshine is a dive shop that operates out of Key West, FL and sells retail merchandise of interest to beachgoers including swimsuits, snorkeling and scuba diving equipment, surf boards, boogie boards, etc. Alvin Smart, a certified scuba diving instructor, owns the business. In addition, Alvin manages the dive shop and operates tours to local snorkeling and scuba diving areas of interest as a way to generate additional revenue. Sunshine is a calendar-year accrual basis taxpayer in its first year of operations (2022). Business began on January 3, 2022. For Part 1, assume Alvin is the sole owner. For Parts 2-4, assume Alvin co-owns the business with Ann Webb, who does not work for the business. Project Deliverables: Use the worksheet to answer questions a. through d. below for each part. 1) Assume that Sunshine Company is owned by Alvin as a sole proprietorship. Alvin received $2,400 per month ( $28,800 in total) from Sunshine Company as an owner's draw. Additionally. Alvin took $55,000 out of Sunshine Company near the end of the year as a partial distribution of profits. ( 9 points) a) Calculate the net business income of Sunshine Company/Alvin that would be reported on Schedule C of Alvin's Form 1040. b) How much of the $2,400 per month ($28,800 total) and the $55,000 distribution would Alvin include as taxable income on his Form 1040 in addition to the Schedule Camount above? c) What amount of Alvin's income will be subject to self-employment tax? d) Note that you do not need to complete Schedule C or other forms, but these forms will be a useful guide in completing this portion of the assignment. 2) Assume that Sunshine Company is a C-corporation. Alvin contributed $60,000 to purchase 60% of the stock while his wife's best friend, Ann, contributed $40,000 to purchase the remaining 40% of the stock when the corporation was formed this year. Alvin received a $2,400 per month salary ($28,800 in total). Ann doesn't work for the company, so she received no salary. The company distributed some profits at the end of the year by paying out a $55,000 dividend. (12 points) a) Calculate Sunshine Corporation's taxable income and income tax liability to be reported on Form 1120. You should consider implications for any employer share of payroll tax expense associated with salaries paid to any employee for purposes of this question. b) What amount and type of income must Alvin report on his individual Form 1040 tax return? c) What amount of Alvin's income will be subject to self-employment tax? d) What is Alvin's basis in his Sunshine stock at the end of this year? e) Completely and accurately prepare a complete and accurate 2022 Form 1120 (pages 1-3 only), U.S. Corporation Income Tax Return, for Sunshine Company, Inc. i) To receive full credit, all required information should be completed, all required boxes should be checked, and any supporting details as requested on these forms should be included. ii) You may assume Sunshine paid $70,000 in estimated payments throughout the year and no estimated payment penalty is due. iii) Please note that if this were an actual tax return to be filed, pages 4-6 would be required, along with other supporting forms and schedules. You are asked to prepare only these 3 pages