Answered step by step

Verified Expert Solution

Question

1 Approved Answer

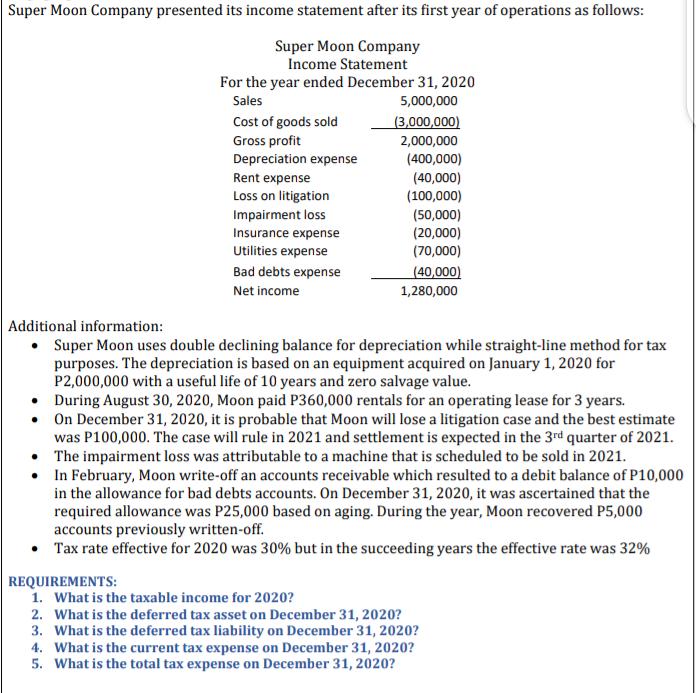

Super Moon Company presented its income statement after its first year of operations as follows: Super Moon Company Income Statement For the year ended

Super Moon Company presented its income statement after its first year of operations as follows: Super Moon Company Income Statement For the year ended December 31, 2020 Sales 5,000,000 Cost of goods sold Gross profit Depreciation expense Rent expense Loss on litigation Impairment loss Insurance expense Utilities expense Bad debts expense Net income (3,000,000) 2,000,000 (400,000) (40,000) (100,000) (50,000) (20,000) (70,000) (40,000) 1,280,000 Additional information: Super Moon uses double declining balance for depreciation while straight-line method for tax purposes. The depreciation is based on an equipment acquired on January 1, 2020 for P2,000,000 with a useful life of 10 years and zero salvage value. During August 30, 2020, Moon paid P360,000 rentals for an operating lease for 3 years. On December 31, 2020, it is probable that Moon will lose a litigation case and the best estimate was P100,000. The case will rule in 2021 and settlement is expected in the 3rd quarter of 2021. The impairment loss was attributable to a machine that is scheduled to be sold in 2021. In February, Moon write-off an accounts receivable which resulted to a debit balance of P10,000 in the allowance for bad debts accounts. On December 31, 2020, it was ascertained that the required allowance was P25,000 based on aging. During the year, Moon recovered P5,000 accounts previously written-off. Tax rate effective for 2020 was 30% but in the succeeding years the effective rate was 32% REQUIREMENTS: 1. What is the taxable income for 2020? 2. What is the deferred tax asset on December 31, 2020? 3. What is the deferred tax liability on December 31, 2020? 4. What is the current tax expense on December 31, 2020? 5. What is the total tax expense on December 31, 2020?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the taxable income for 2020 we need to adjust the net income by considering the tax treatments and adjustments Lets go through each adjustment step by step 1 Taxable Income Calculation Ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started