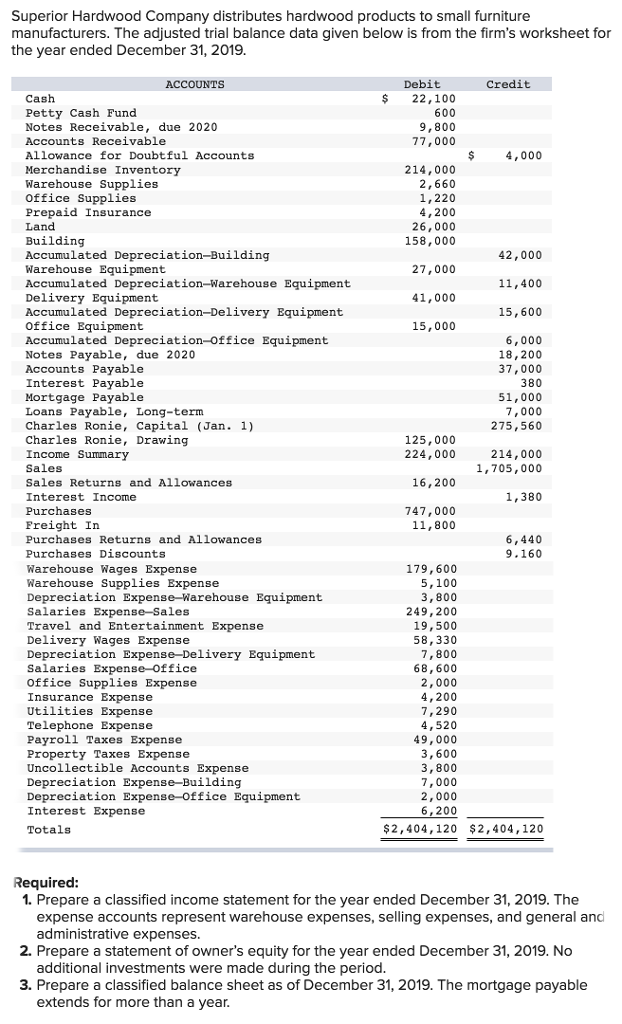

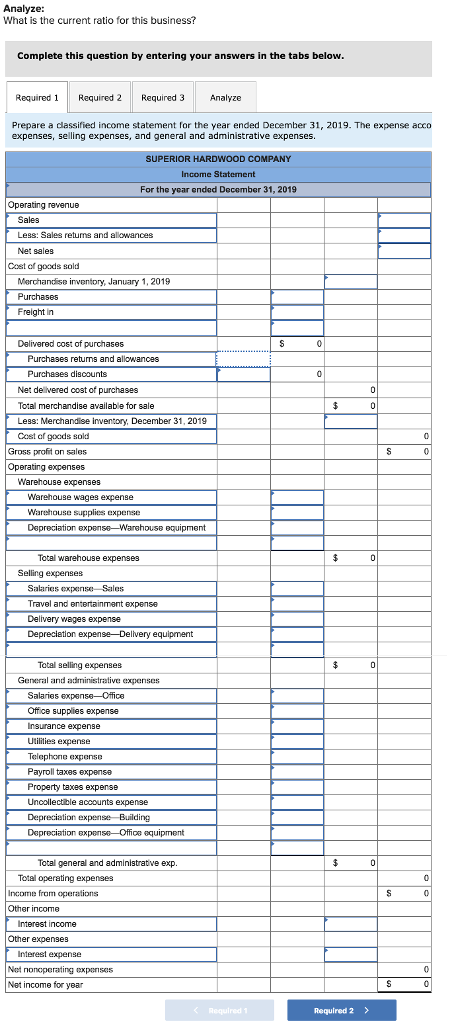

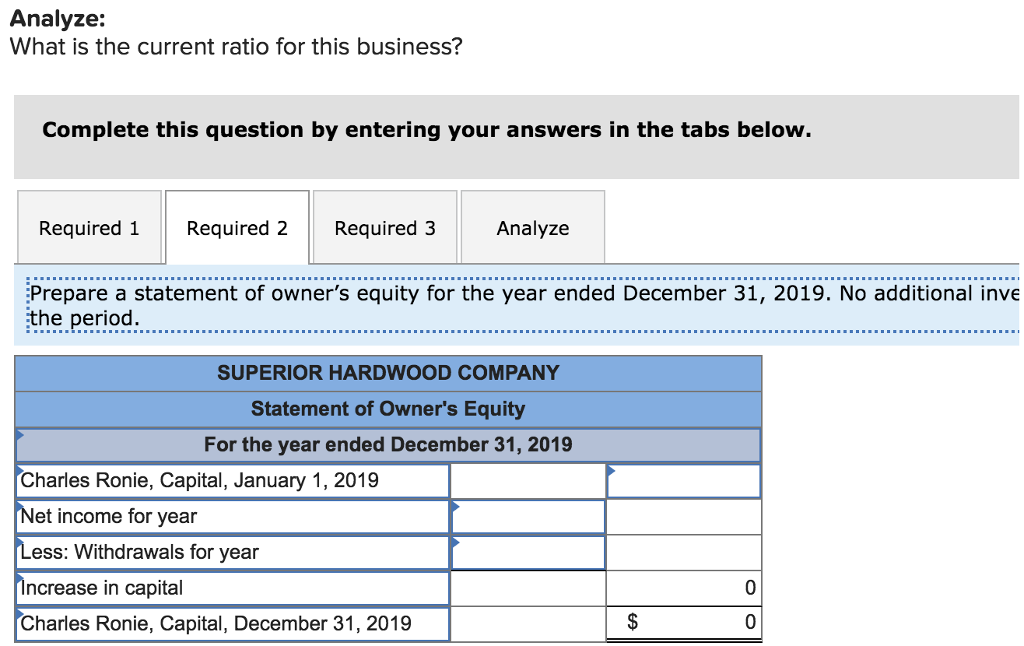

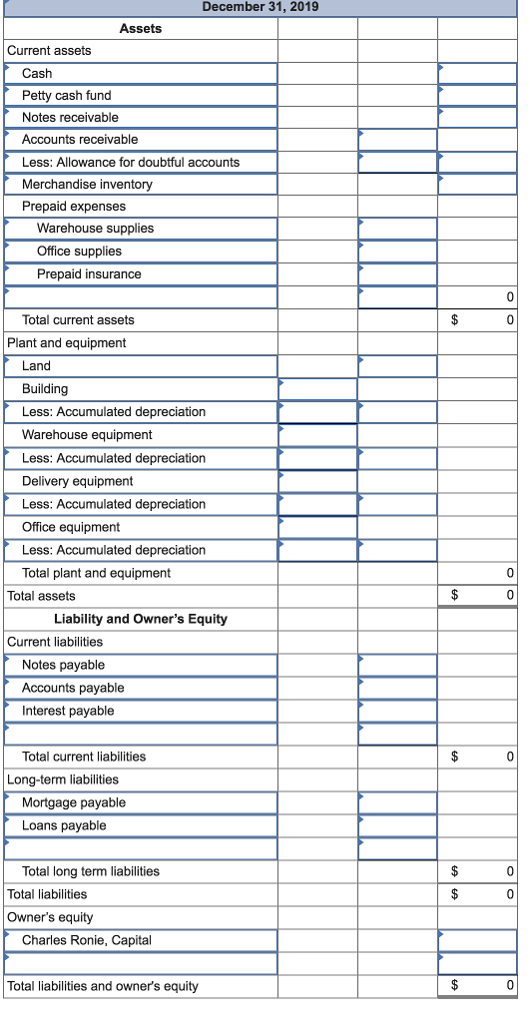

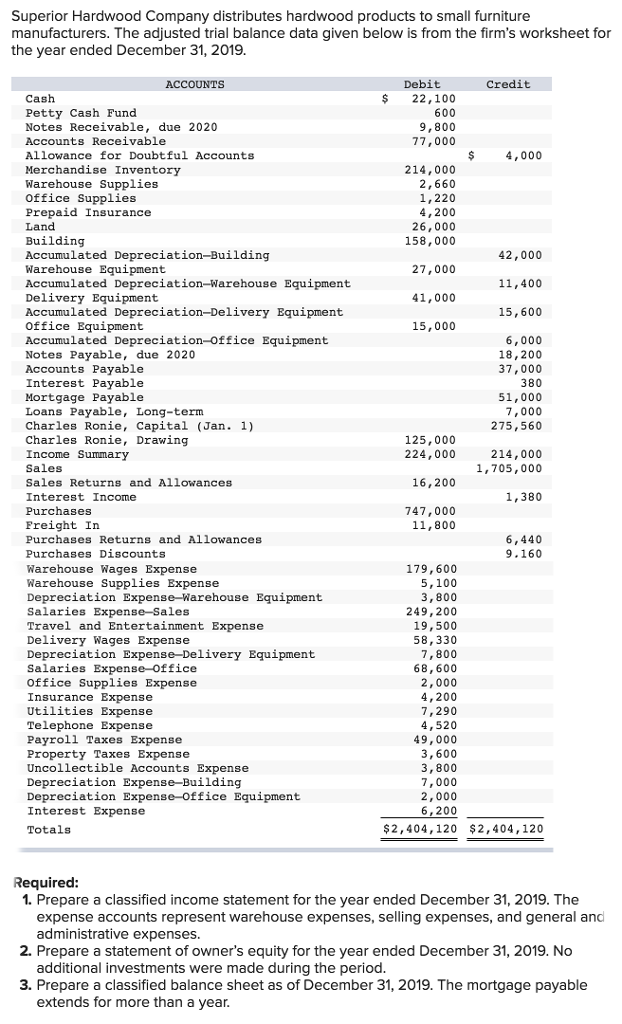

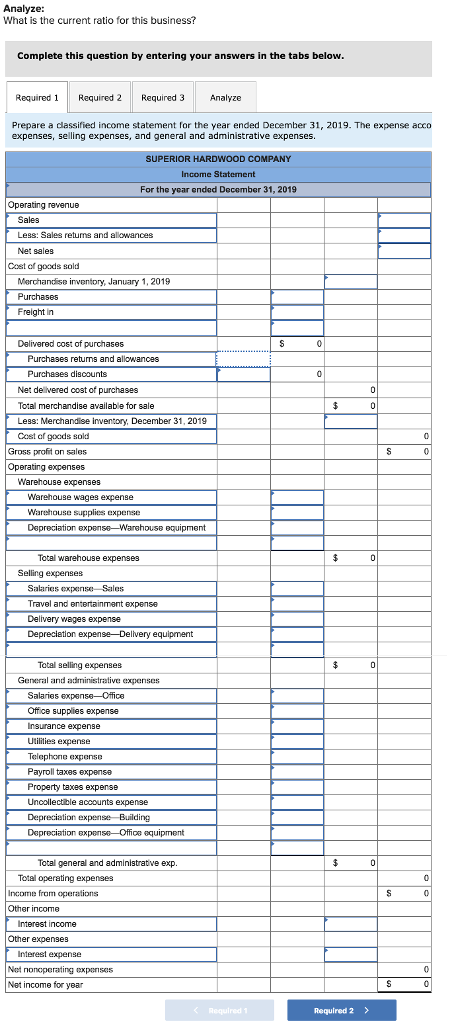

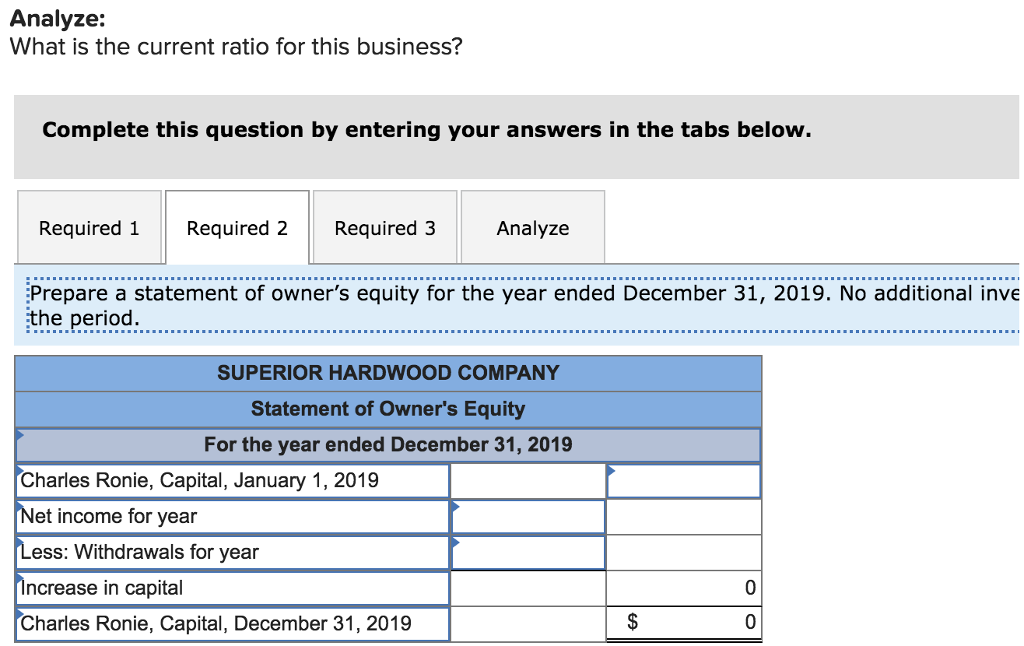

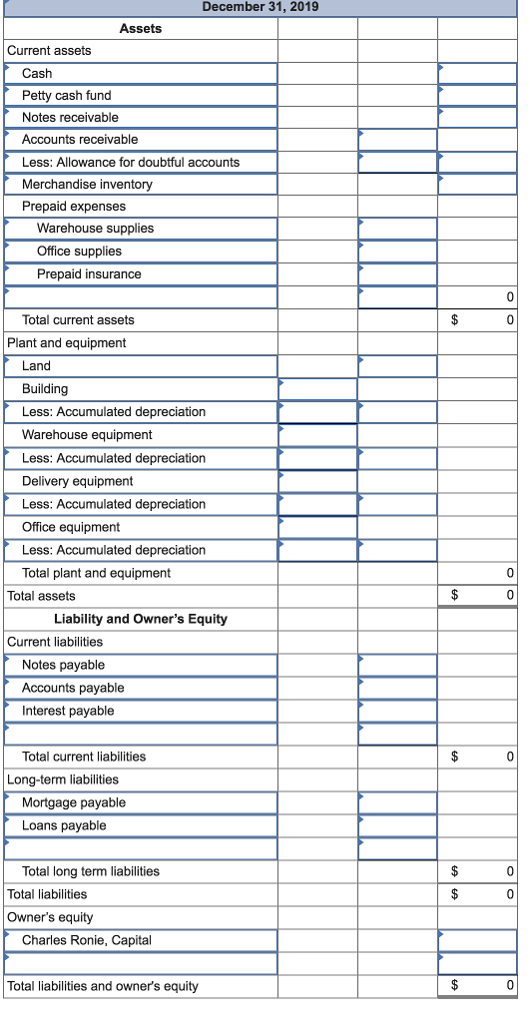

Superior Hardwood Company distributes hardwood products to small furniture manufacturers. The adjusted trial balance data given below is from the firm's worksheet for the year ended December 31, 2019. Credit $ Debit 22,100 600 9,800 77,000 4,000 214,000 2,660 1,220 4,200 26,000 158,000 42,000 27,000 11,400 41,000 15,600 15,000 6,000 18,200 37,000 380 51,000 7,000 275,560 ACCOUNTS Cash Petty Cash Fund Notes Receivable, due 2020 Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Warehouse Supplies Office Supplies Prepaid Insurance Land Building Accumulated Depreciation-Building Warehouse Equipment Accumulated Depreciation Warehouse Equipment Delivery Equipment Accumulated Depreciation-Delivery Equipment Office Equipment Accumulated Depreciation-office Equipment Notes Payable, due 2020 Accounts Payable Interest Payable Mortgage Payable Loans Payable, Long-term Charles Ronie, Capital (Jan. 1) Charles Ronie, Drawing Income Summary Sales Sales Returns and Allowances Interest Income Purchases Freight In Purchases Returns and Allowances Purchases Discounts Warehouse Wages Expense Warehouse Supplies Expense Depreciation Expense Warehouse Equipment Salaries Expense-Sales Travel and Entertainment Expense Delivery Wages Expense Depreciation Expense-Delivery Equipment Salaries Expense-Office Office Supplies Expense Insurance Expense Utilities Expense Telephone Expense Payroll Taxes Expense Property Taxes Expense Uncollectible Accounts Expense Depreciation Expense-Building Depreciation Expense office Equipment Interest Expense Totals 125,000 224,000 214,000 1,705,000 16,200 1,380 747,000 11,800 6,440 9.160 179,600 5, 100 3,800 249,200 19,500 58,330 7,800 68,600 2,000 4,200 7,290 4,520 49,000 3,600 3,800 7,000 2,000 6, 200 $2,404, 120 $2,404, 120 Required: 1. Prepare a classified income statement for the year ended December 31, 2019. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses. 2. Prepare a statement of owner's equity for the year ended December 31, 2019. No additional investments were made during the period. 3. Prepare a classified balance sheet as of December 31, 2019. The mortgage payable extends for more than a year