Supply Chain Problem - Analysis

1. Explain the differences you see in their performance based on their supply chain strategy and structure.

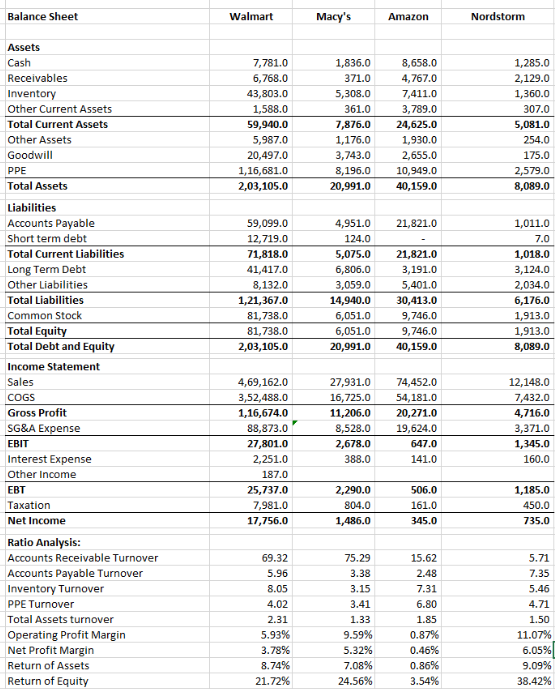

2. Compare the metrics for each company with similar metrics for Amazon and Nordstrom in the Table.

3. Which metrics does each company perform better on?

4. What supply chain drivers and metrics might explain this difference in performance?

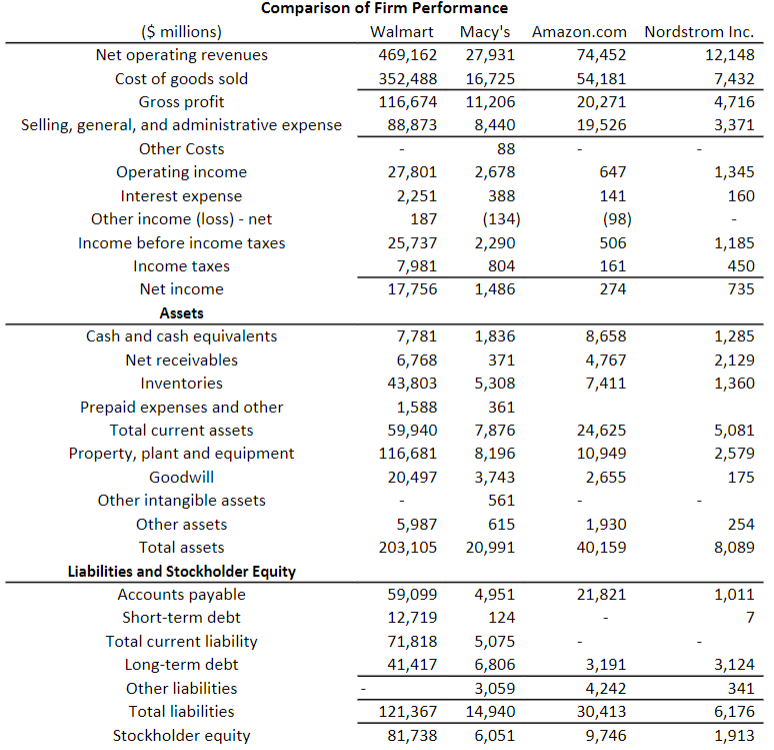

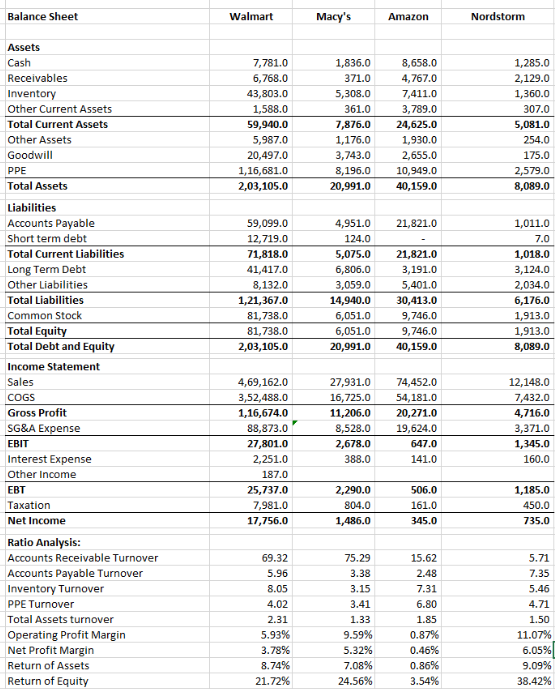

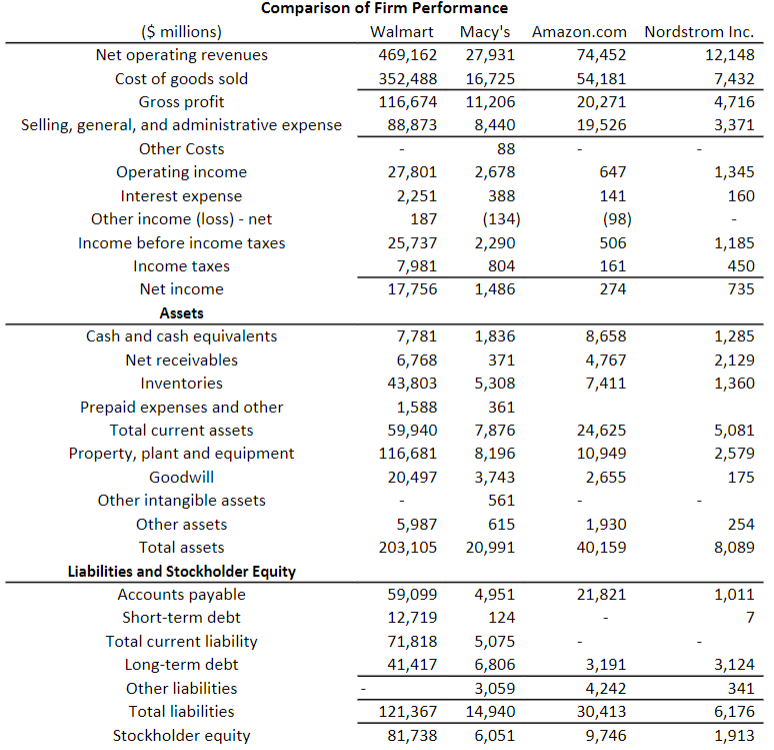

Comparison of Firm Performance ($ millions) Walmart Macy's Amazon.com Nordstrom Inc. Net operating revenues 469,162 27,931 74,452 12,148 Cost of goods sold 352,488 16,725 54,181 7,432 Gross profit 116,674 11,206 20,271 4,716 Selling, general, and administrative expense 88,873 8,440 19,526 3,371 Other Costs 88 Operating income 27,801 2,678 647 1,345 Interest expense 2,251 388 141 160 Other income (loss) - net 187 (134) (98) Income before income taxes 25,737 2,290 506 1,185 Income taxes 7,981 804 161 450 Net income 17,756 1,486 274 735 Assets Cash and cash equivalents 7,781 1,836 8,658 1,285 Net receivables 6,768 371 4,767 2,129 Inventories 43,803 5,308 7,411 1,360 Prepaid expenses and other 1,588 361 Total current assets 59,940 7,876 24,625 5,081 Property, plant and equipment 116,681 8,196 10,949 2,579 Goodwill 20,497 3,743 2,655 175 Other intangible assets 561 Other assets 5,987 615 1,930 254 Total assets 203,105 20,991 40,159 8,089 Liabilities and Stockholder Equity Accounts payable 59,099 4,951 21,821 1,011 Short-term debt 12,719 124 7 Total current liability 71,818 5,075 Long-term debt 41,417 6,806 3,191 3,124 Other liabilities 3,059 4,242 341 Total liabilities 121,367 14,940 30,413 6,176 Stockholder equity 81,738 6,051 9,746 1,913 Balance Sheet Walmart Macy's Amazon Nordstorm 7,781.0 6,768.0 43,803.0 1,588.0 59,940.0 5,987.0 20,497.0 1,16,681.0 2,03,105.0 1,836.0 371.0 5,308.0 361.0 7,876.0 1,176.0 3,743.0 8,196.0 20,991.0 8,658.0 4,767.0 7,411.0 3,789.0 24,625.0 1,930.0 2,655.0 10,949.0 40,159.0 1,285.0 2,129.0 1,360.0 307.0 5,081.0 254.0 175.0 2,579.0 8,089.0 21,821.0 59,099.0 12,719.0 71,818.0 41,417.0 8,132.0 1,21,367.0 81,738.0 81,738.0 2,03,105.0 4,951.0 124.0 5,075.0 6,806.0 3,059.0 14,940.0 6,051.0 6,051.0 20,991.0 21,821.0 3,191.0 5,401.0 30,413.0 9,746.0 9,746.0 40,159.0 1,011.0 7.0 1,018.0 3,124.0 2,034.0 6,176.0 1,913.0 1,913.0 8,089.0 Assets Cash Receivables Inventory Other Current Assets Total Current Assets Other Assets Goodwill PPE Total Assets Liabilities Accounts Payable Short term debt Total Current Liabilities Long Term Debt Other Liabilities Total Liabilities Common Stock Total Equity Total Debt and Equity Income Statement Sales COGS Gross Profit SG&A Expense EBIT Interest Expense Other Income EBT Taxation Net Income Ratio Analysis: Accounts Receivable Turnover Accounts Payable Turnover Inventory Turnover PPE Turnover Total Assets turnover Operating Profit Margin Net Profit Margin Return of Assets Return of Equity 4,69,162.0 3,52,488.0 1,16,674.0 88,873.0 27,801.0 2,251.0 187.0 25,737.0 7,981.0 17,756.0 27,931.0 16,725.0 11,206.0 8,528.0 2,678.0 388.0 74,452.0 54,181.0 20,271.0 19,624.0 647.0 141.0 12,148.0 7,432.0 4,716.0 3,371.0 1,345.0 160.0 2,290.0 804.0 1,486.0 506.0 161.0 345.0 1,185.0 450.0 735.0 69.32 5.96 8.05 4.02 2.31 5.93% 3.78% 8.74% 21.72% 75.29 3.38 3.15 3.41 1.33 9.59% 5.32% 7.08% 24.56% 15.62 2.48 7.31 6.80 1.85 0.87% 0.46% 0.86% 3.54% 5.71 7.35 5.46 4.71 1.50 11.07% 6.05% 9.09% 38.42% Comparison of Firm Performance ($ millions) Walmart Macy's Amazon.com Nordstrom Inc. Net operating revenues 469,162 27,931 74,452 12,148 Cost of goods sold 352,488 16,725 54,181 7,432 Gross profit 116,674 11,206 20,271 4,716 Selling, general, and administrative expense 88,873 8,440 19,526 3,371 Other Costs 88 Operating income 27,801 2,678 647 1,345 Interest expense 2,251 388 141 160 Other income (loss) - net 187 (134) (98) Income before income taxes 25,737 2,290 506 1,185 Income taxes 7,981 804 161 450 Net income 17,756 1,486 274 735 Assets Cash and cash equivalents 7,781 1,836 8,658 1,285 Net receivables 6,768 371 4,767 2,129 Inventories 43,803 5,308 7,411 1,360 Prepaid expenses and other 1,588 361 Total current assets 59,940 7,876 24,625 5,081 Property, plant and equipment 116,681 8,196 10,949 2,579 Goodwill 20,497 3,743 2,655 175 Other intangible assets 561 Other assets 5,987 615 1,930 254 Total assets 203,105 20,991 40,159 8,089 Liabilities and Stockholder Equity Accounts payable 59,099 4,951 21,821 1,011 Short-term debt 12,719 124 7 Total current liability 71,818 5,075 Long-term debt 41,417 6,806 3,191 3,124 Other liabilities 3,059 4,242 341 Total liabilities 121,367 14,940 30,413 6,176 Stockholder equity 81,738 6,051 9,746 1,913 Balance Sheet Walmart Macy's Amazon Nordstorm 7,781.0 6,768.0 43,803.0 1,588.0 59,940.0 5,987.0 20,497.0 1,16,681.0 2,03,105.0 1,836.0 371.0 5,308.0 361.0 7,876.0 1,176.0 3,743.0 8,196.0 20,991.0 8,658.0 4,767.0 7,411.0 3,789.0 24,625.0 1,930.0 2,655.0 10,949.0 40,159.0 1,285.0 2,129.0 1,360.0 307.0 5,081.0 254.0 175.0 2,579.0 8,089.0 21,821.0 59,099.0 12,719.0 71,818.0 41,417.0 8,132.0 1,21,367.0 81,738.0 81,738.0 2,03,105.0 4,951.0 124.0 5,075.0 6,806.0 3,059.0 14,940.0 6,051.0 6,051.0 20,991.0 21,821.0 3,191.0 5,401.0 30,413.0 9,746.0 9,746.0 40,159.0 1,011.0 7.0 1,018.0 3,124.0 2,034.0 6,176.0 1,913.0 1,913.0 8,089.0 Assets Cash Receivables Inventory Other Current Assets Total Current Assets Other Assets Goodwill PPE Total Assets Liabilities Accounts Payable Short term debt Total Current Liabilities Long Term Debt Other Liabilities Total Liabilities Common Stock Total Equity Total Debt and Equity Income Statement Sales COGS Gross Profit SG&A Expense EBIT Interest Expense Other Income EBT Taxation Net Income Ratio Analysis: Accounts Receivable Turnover Accounts Payable Turnover Inventory Turnover PPE Turnover Total Assets turnover Operating Profit Margin Net Profit Margin Return of Assets Return of Equity 4,69,162.0 3,52,488.0 1,16,674.0 88,873.0 27,801.0 2,251.0 187.0 25,737.0 7,981.0 17,756.0 27,931.0 16,725.0 11,206.0 8,528.0 2,678.0 388.0 74,452.0 54,181.0 20,271.0 19,624.0 647.0 141.0 12,148.0 7,432.0 4,716.0 3,371.0 1,345.0 160.0 2,290.0 804.0 1,486.0 506.0 161.0 345.0 1,185.0 450.0 735.0 69.32 5.96 8.05 4.02 2.31 5.93% 3.78% 8.74% 21.72% 75.29 3.38 3.15 3.41 1.33 9.59% 5.32% 7.08% 24.56% 15.62 2.48 7.31 6.80 1.85 0.87% 0.46% 0.86% 3.54% 5.71 7.35 5.46 4.71 1.50 11.07% 6.05% 9.09% 38.42%