Answered step by step

Verified Expert Solution

Question

1 Approved Answer

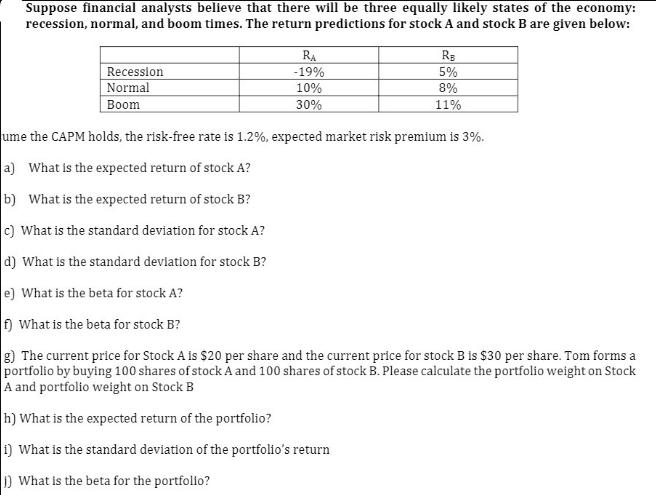

Suppose financial analysts believe that there will be three equally likely states of the economy: recession, normal, and boom times. The return predictions for

Suppose financial analysts believe that there will be three equally likely states of the economy: recession, normal, and boom times. The return predictions for stock A and stock B are given below: Recession Normal Boom RA -19% 10% 30% RE 5% 8% 11% ume the CAPM holds, the risk-free rate is 1.2%, expected market risk premium is 3%. a) What is the expected return of stock A? b) What is the expected return of stock B? c) What is the standard deviation for stock A? d) What is the standard deviation for stock B? e] What is the beta for stock A? f) What is the beta for stock B? g) The current price for Stock A is $20 per share and the current price for stock B is $30 per share. Tom forms a portfolio by buying 100 shares of stock A and 100 shares of stock B. Please calculate the portfolio weight on Stock A and portfolio weight on Stock B h) What is the expected return of the portfolio? 1) What is the standard deviation of the portfolio's return 1) What is the beta for the portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the expected return standard deviation beta portfolio weights and portfolio statistics we will use the Capital Asset Pricing Model CAPM and the given return predictions for stocks A and B ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started