Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose it is March 2020 and you are meeting up with an old friend from university. He has been running a successful hedge fund for

Suppose it is March 2020 and you are meeting up with an old friend from university. He has been running a successful hedge fund for three years. He tells you about a current short position that he has in place.

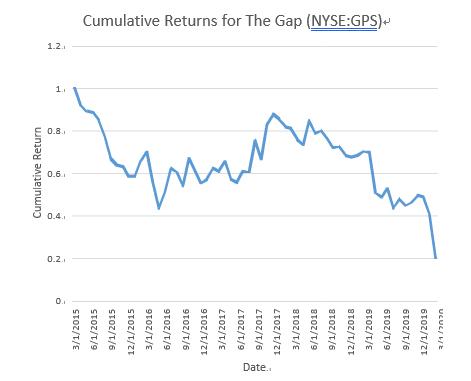

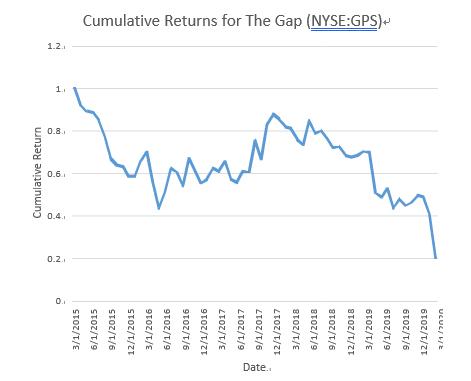

The retail clothing sector has been going down for some time. Consumers all around the world have shifted to online shopping. He expects this trend will continue, and that traditional retail firms will continue to lose value. He tells you he has a short position on The Gap (NYSE: GPS), a large American clothing retailer. From March 2015 to February 2020.

The Gap went from a price of $34.25 per share to $6.78 per share, or a decrease of over 80% (see figure below). What else (if anything)does he need to tell you in order to convince you that The Gap is overpriced?

The Gap went from a price of $34.25 per share to $6.78 per share, or a decrease of over 80% (see figure below). What else (if anything)does he need to tell you in order to convince you that The Gap is overpriced?

The retail clothing sector has been going down for some time. Consumers all around the world have shifted to online shopping. He expects this trend will continue, and that traditional retail firms will continue to lose value. He tells you he has a short position on The Gap (NYSE: GPS), a large American clothing retailer. From March 2015 to February 2020.

The Gap went from a price of $34.25 per share to $6.78 per share, or a decrease of over 80% (see figure below). What else (if anything)does he need to tell you in order to convince you that The Gap is overpriced?

The Gap went from a price of $34.25 per share to $6.78 per share, or a decrease of over 80% (see figure below). What else (if anything)does he need to tell you in order to convince you that The Gap is overpriced? Date.. 3/1/2015 6/1/2015 9/1/2015 12/1/2015 3/1/2016 6/1/2016 9/1/2016 12/1/2016 3/1/2017 6/1/2017 9/1/2017 12/1/2017 3/1/2018 6/1/2018 9/1/2018 12/1/2018 3/1/2019 6/1/2019 9/1/2019 12/1/2019 3/1/2020 0. 0.2 Cumulative Return 0.4. 0.6. 0.8. 10 1.2. Cumulative Returns for The Gap (NYSE:GPS)

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To persuade you that The Gap is overpriced your friend would need to provide additional evide...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started