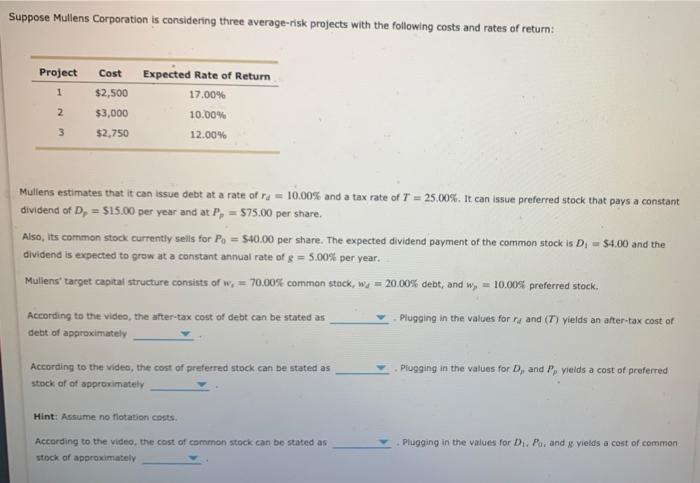

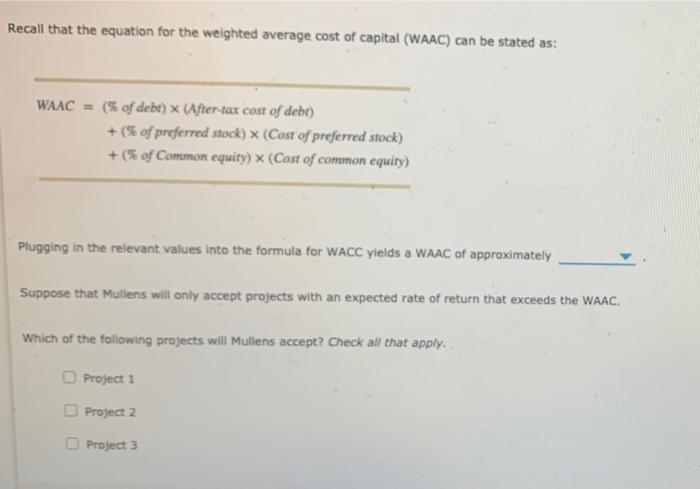

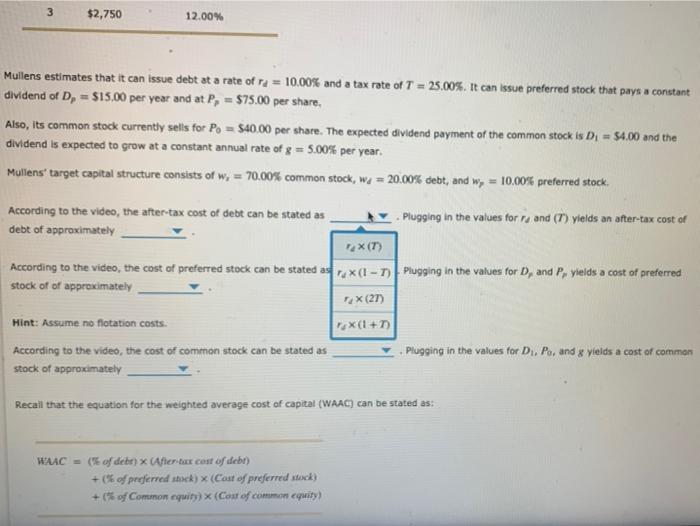

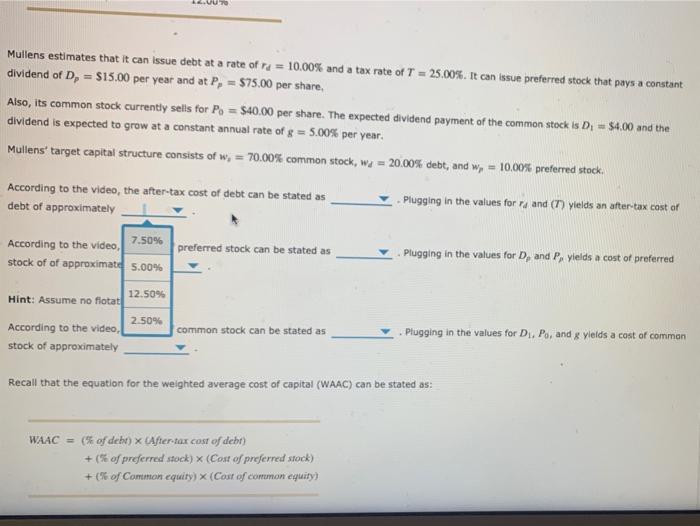

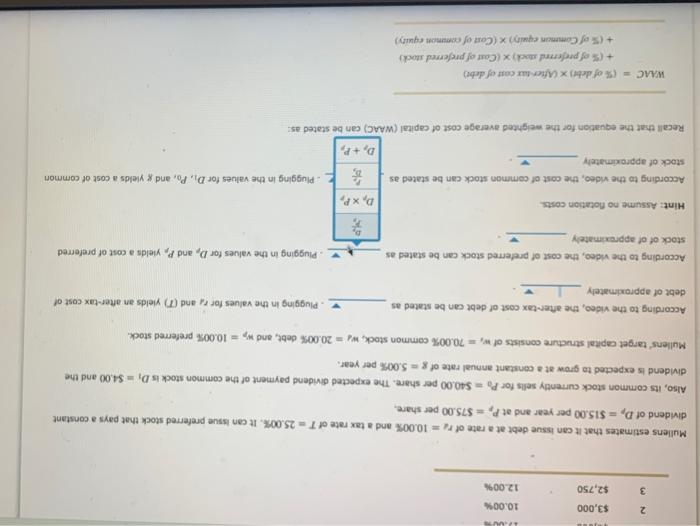

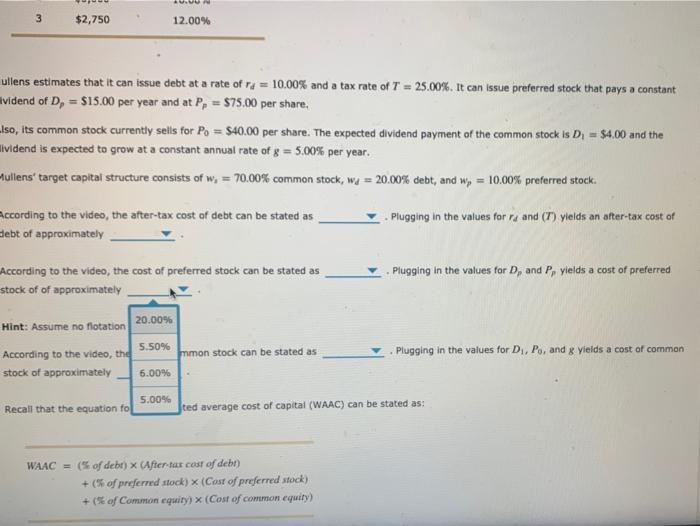

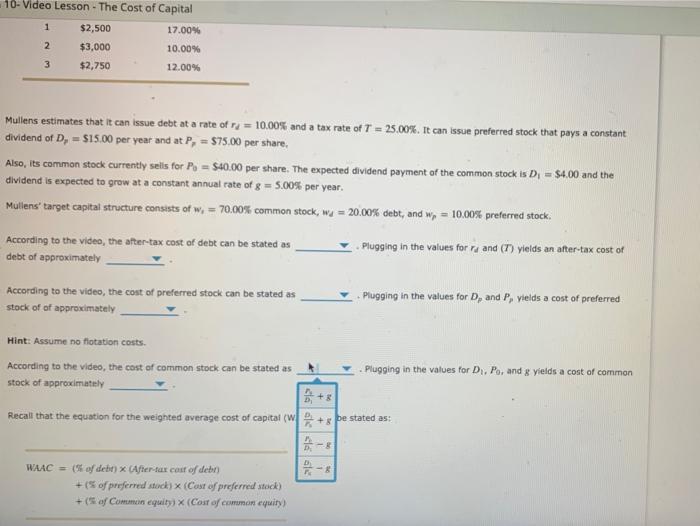

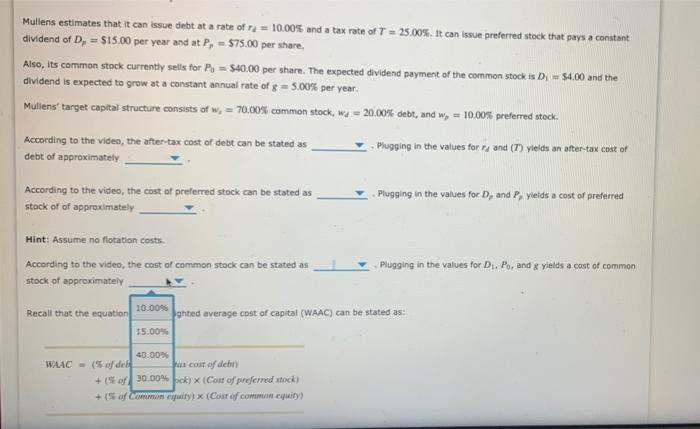

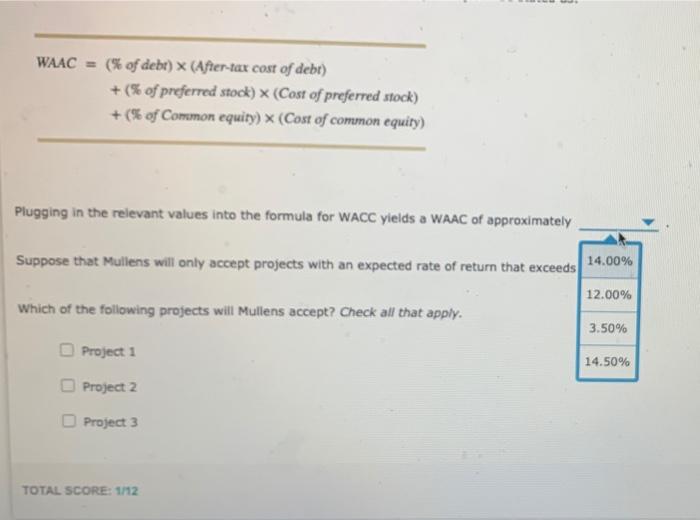

Suppose Mullens Corporation is considering three average-risk projects with the following costs and rates of return; Project Cost Expected Rate of Return 1 $2,500 17.00% 2 $3,000 10.00% 3 $2,750 12.00% Mullens estimates that it can issue debt at a rate of ra = 10.00% and a tax rate of T = 25.00%. It can issue preferred stock that pays a constant dividend of D, = $15.00 per year and at P, = $75.00 per share. Also, its common stock currently sells for P = 540.00 per share. The expected dividend payment of the common stock is Di = $4.00 and the dividend is expected to grow at a constant annual rate of g = 5.00% per year. Mullens' target capital structure consists of we = 70.00% comman stock, wx = 20.00% debt, and w = 10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as Plugging in the values for , and (T) yields an after-tax cost of debt of approximately According to the video, the cost of preferred stock can be stated as Plugging in the values for D, and P, Vields a cost of preferred stock of of approximately Hint: Assume no flotation costs. According to the video, the cost of common stock can be stated as stock of approximately Plugging in the values for Dr. Po and g yields a cost of common Recall that the equation for the weighted average cost of capital (WAAC) can be stated as: WAAC = (5 of debe) x (After-tar cost of debt) + (5 of preferred stock) x (Cost of preferred stock) +(5 of Common equity) (Cost of common equity) Plugging in the relevant values into the formula for WACC yields a WAAC of approximately Suppose that Mullens will only accept projects with an expected rate of return that exceeds the WAAC. Which of the following projects will Mullens accept? Check all that apply. Project 1 Project 2 Project 3 3 $2,750 12.00% Mullens estimates that it can issue debt at a rate of ra = 10.00% and a tax rate of T = 25.00%. It can issue preferred stock that pays a constant dividend of D, = $15.00 per year and at P, = $75.00 per share, Also, its common stock currently sells for P = $40.00 per share. The expected dividend payment of the common stock is Di = 54.00 and the dividend is expected to grow at a constant annual rate of g = 5.00% per year. Mullens' target capital structure consists of W, = 70.00% common stock, wa = 20.00% debt, and w, = 10.00% preferred stock According to the video, the after-tax cost of debt can be stated as . Plugging in the values for rand (T) yields an after-tax cost of debt of approximately 1X (7) According to the video, the cost of preferred stock can be stated as (I-Plugging in the values for D, and P, yields a cost of preferred stock of of approximately 1x (21) Hint: Assume no flotation costs. TEX(+7 According to the video, the cost of common stock can be stated as . Plugging in the values for D. Po, and yields a cost of common stock of approximately Recall that the equation for the weighted average cost of capital (WAAC) can be stated as: WAAC = (" of debe After los cost of debr) +of preferred shack) x (Cost of preferred stock) + of Common equity) (Cost of common equity) Mullens estimates that it can issue debt at a rate of 14 = 10.00% and a tax rate of T = 25.00%. It can issue preferred stock that pays a constant dividend of D, = $15.00 per year and at P, = $75.00 per share, Also, its common stock currently sells for Po = $40.00 per share. The expected dividend payment of the common stock is D. - $4.00 and the dividend is expected to grow at a constant annual rate of g = 5.00% per year. Mullens' target capital structure consists of w, = 70.00% common stock, we = 20.00% debt, and wn = 10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as Plugging in the values for , and (T) yields an after-tax cost of debt of approximately 7.50% preferred stock can be stated as According to the video, stock of of approximate 5.00% Plugging in the values for D, and P, yields a cost of preferred 12.50% Hint: Assume no flotat According to the video, 2.50% common stock can be stated as . Plugging in the values for D. Po, and yields a cost of common stock of approximately Recall that the equation for the weighted average cost of capital (WAAC) can be stated as: WAAC = (of deht) x After tax cost of debr) + (% of preferred stock) x (Cost of preferred stock) + (5 of Common equiry) x (Cost of common equity) 2 $3,000 10.00% 3 $2,750 12.00% Mullens estimates that it can issue debt at a rate of ra = 10.00% and a tax rate of T = 25,00%. It can issue preferred stock that pays a constant dividend of D, = $15.00 per year and at P, = $75.00 per share. Also, its common stock currently sells for Po = 540.00 per share. The expected dividend payment of the common stock is D, -S4,00 and the dividend is expected to grow at a constant annual rate of 8 - 5.00% per year. Mullens' target capital structure consists of w, = 70.00% common stock, w: = 20.00% debt, and w, = 10.00/% preferred stock. According to the video, the after-tax cost of debt can be stated as .. Plugging in the values for rx and (T) yields an after-tax cost of debt of approximately According to the video, the cost of preferred stock can be stated as Plugging in the values for D, and P, yields a cost of preferred stock of of approximately D, XP, Hint: Assume no flotation costs. According to the video, the cost of common stock can be stated as Plugging in the values for D. Po, and yields a cost of common stock of approximately 1D,+P Recall that the equation for the weighted average cost of capital (WAAC) can be stated as: WAAC = (% of debt) x After tar cast of debe) +(of preferred stock) x (Cost of preferred stock) +(5 of Commercity) (Cost of mon equity) AM 3 $2,750 12.00% ullens estimates that it can issue debt at a rate of ra = 10.00% and a tax rate of T = 25.00%. It can issue preferred stock that pays a constant Evidend of D, = $15.00 per year and at P, = $75.00 per share, lso, its common stock currently sells for Po = $40.00 per share. The expected dividend payment of the common stock is Di = $4.00 and the dividend is expected to grow at a constant annual rate of g = 5.00% per year. Hullens' target capital structure consists of w, = 70.00% common stock, wa = 20.00% debt, and w, = 10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as Plugging in the values for rx and (T) ylelds an after-tax cost of debt of approximately According to the video, the cost of preferred stock can be stated as Plugging in the values for D, and P, yields a cost of preferred stock of of approximately 20.00% Hint: Assume no flotation According to the video, the 5.50% mmon stock can be stated as Plugging in the values for D, Po, and 8 yields a cost of common stock of approximately 6.00% 5.00% Recall that the equation to ted average cost of capital (WAAC) can be stated as: WAAC = (of debt) x After tar cost of debi) + (% of preferred stock) x (Cost of preferred stock) + (5 of Common equity) x (Cost of common equity) 10- Video Lesson - The Cost of Capital 1 $2,500 17.00% 2 $3,000 10.00% 3 $2,750 12.00% Mullens estimates that it can issue debt at a rate of 14 = 10.00% and a tax rate of T = 25.00%. It can issue preferred stock that pays a constant dividend of D, = $15.00 per year and at P, = $75.00 per share. Also, its common stock currently sells for P. = $40.00 per share. The expected dividend payment of the common stock is D. = $4.00 and the dividend is expected to grow at a constant annual rate of g = 5.00% per year. Mullens' target capital structure consists of w. = 70.00% common stock, we = 20.00% debt, and wn = 10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as Plugging in the values for 4 and (7) yields an after-tax cost of debt of approximately According to the video, the cost of preferred stock can be stated as Plugging in the values for D, and P, yields a cost of preferred stock of of approximately Hint: Assume no flotation costs. According to the video, the cost of common stock can be stated as Plugging in the values for D. Po, and g yields a cost of common stock of approximately sia + Recall that the equation for the weighted average cost of capital (W + be stated as: de la D 8 WAAC = (5 of debt) x (After-tax cost of der +(5 of preferred stock) x (Cost of preferred stock) + (5 of Communequity (Cost of common equity) Mullens estimates that it can issue debt at a rate of 14 = 10.00% and a tax rate of T = 25,00%. It can issue preferred stock that pays a constant dividend of D, = $15.00 per year and at P, = $75.00 per share, Also, its common stock currently sells for Ps = $40.00 per share. The expected dividend payment of the common stock is Di = 54.00 and the dividend is expected to grow at a constant annual rate of g = 5.00% per year. Mullens' target capital structure consists of w. = 70.00% common stock, wx = 20.00% debt, and w, = 10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as Plugging in the values for rx and (T) yleis an after-tax cost of debt of approximately According to the video, the cost of preferred stock can be stated as stock of of approximately Plugging in the values for D, and P, yields a cost of preferred Hint: Assume na flotation costs Plugging in the values for Di. Po, and 8 yields a cost of common According to the video, the cost of common stock can be stated as stock of approximately 10.00% Recall that the equation ghted average cost of capital (WAAC) can be stated as: 15.00% 40.00% WAAC = (of del cost of dehr + (5 of 30.00% pok) x (Cost of preferred stock) + (5 of common equity) x (Cost of commoneywity) WAAC = (% of debe) x (After-tar cost of debr) +(% of preferred stock) x (Cost of preferred stock) +(% of Common equity) (Cost of common equity) Plugging in the relevant values into the formula for WACC yields a WAAC of approximately Suppose that Mullens will only accept projects with an expected rate of return that exceeds 14.00% 12.00% Which of the following projects will Mullens accept? Check all that apply. 3.50% Project 1 14.50% Project 2 Project 3 TOTAL SCORE: 1112