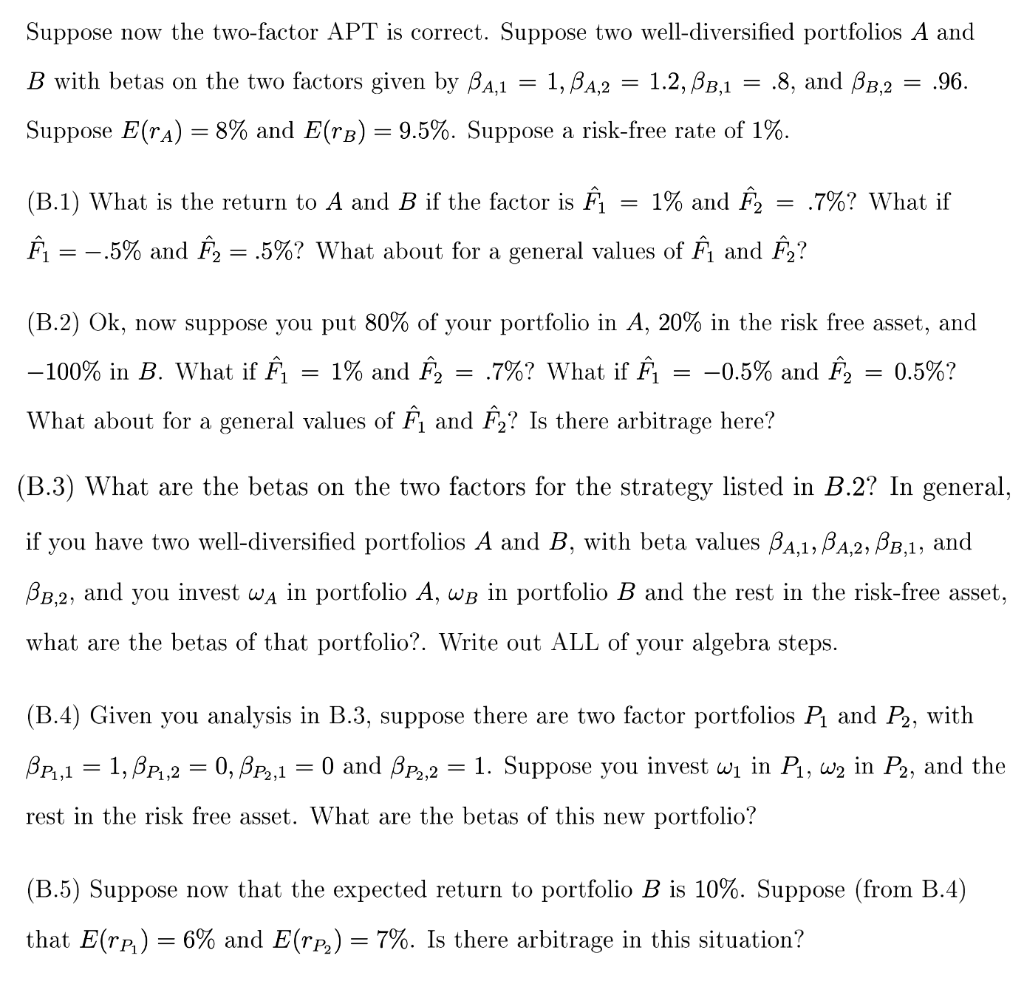

Suppose now the two-factor APT is correct. Suppose two well-diversified portfolios A and B with betas on the two factors given by BA,1 = 1, BA,2 : 1.2,B3,1 .8, and BB,2 .96. Suppose E(ra) = 8% and E(TB) = 9.5%. Suppose a risk-free rate of 1%. = = (B.1) What is the return to A and B if the factor is 1% and = .7%? What if -.5% and 2 =.5%? What about for a general values of and z? =- = (B.2) Ok, now suppose you put 80% of your portfolio in A, 20% in the risk free asset, and -100% in B. What if 1% and .7%? What if = -0.5% and 2 = 0.5%? What about for a general values of and ,? Is there arbitrage here? = (B.3) What are the betas on the two factors for the strategy listed in B.2? In general, if you have two well-diversified portfolios A and B, with beta values BA,1,BA,2, BB,1, and BB,2, and you invest w in portfolio A, wb in portfolio B and the rest in the risk-free asset, what are the betas of that portfolio?. Write out ALL of your algebra steps. (B.4) Given you analysis in B.3, suppose there are two factor portfolios P and P2, with BP1,1 = 1, BP1,2 = 0, BP2,1 1. Suppose you invest wi in P1, W2 in P2, and the rest in the risk free asset. What are the betas of this new portfolio? O and BP2,2 (B.5) Suppose now that the expected return to portfolio B is 10%. Suppose (from B.4) that Erpi) 6% and E(Tp.) = 7%. Is there arbitrage in this situation? Suppose now the two-factor APT is correct. Suppose two well-diversified portfolios A and B with betas on the two factors given by BA,1 = 1, BA,2 : 1.2,B3,1 .8, and BB,2 .96. Suppose E(ra) = 8% and E(TB) = 9.5%. Suppose a risk-free rate of 1%. = = (B.1) What is the return to A and B if the factor is 1% and = .7%? What if -.5% and 2 =.5%? What about for a general values of and z? =- = (B.2) Ok, now suppose you put 80% of your portfolio in A, 20% in the risk free asset, and -100% in B. What if 1% and .7%? What if = -0.5% and 2 = 0.5%? What about for a general values of and ,? Is there arbitrage here? = (B.3) What are the betas on the two factors for the strategy listed in B.2? In general, if you have two well-diversified portfolios A and B, with beta values BA,1,BA,2, BB,1, and BB,2, and you invest w in portfolio A, wb in portfolio B and the rest in the risk-free asset, what are the betas of that portfolio?. Write out ALL of your algebra steps. (B.4) Given you analysis in B.3, suppose there are two factor portfolios P and P2, with BP1,1 = 1, BP1,2 = 0, BP2,1 1. Suppose you invest wi in P1, W2 in P2, and the rest in the risk free asset. What are the betas of this new portfolio? O and BP2,2 (B.5) Suppose now that the expected return to portfolio B is 10%. Suppose (from B.4) that Erpi) 6% and E(Tp.) = 7%. Is there arbitrage in this situation