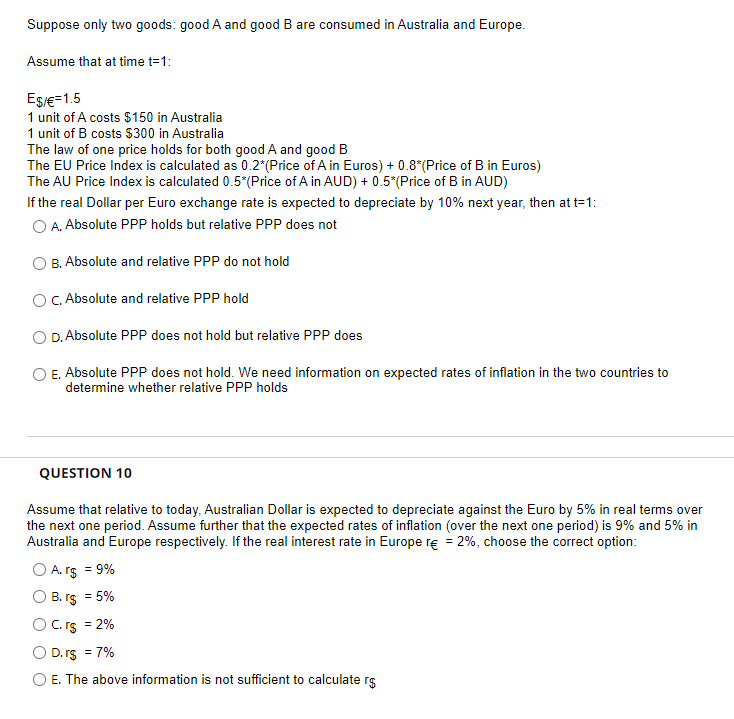

Suppose only two goods: good A and good B are consumed in Australia and Europe. Assume that at time t=1: E$/ 1.5 1 unit of A costs $150 in Australia 1 unit of B costs $300 in Australia The law of one price holds for both good A and good B The EU Price Index is calculated as 0.2*(Price of A in Euros) + 0.8*(Price of B in Euros) The AU Price Index is calculated 0.5*(Price of A in AUD) + 0.5*(Price of B in AUD) If the real Dollar per Euro exchange rate is expected to depreciate by 10% next year, then at t=1: O A. Absolute PPP holds but relative PPP does not B. Absolute and relative PPP do not hold O C. Absolute and relative PPP hold O D. Absolute PPP does not hold but relative PPP does E. Absolute PPP does not hold. We need information on expected rates of inflation in the two countries to determine whether relative PPP holds QUESTION 10 Assume that relative to today, Australian Dollar is expected to depreciate against the Euro by 5% in real terms over the next one period. Assume further that the expected rates of inflation (over the next one period) is 9% and 5% in Australia and Europe respectively. If the real interest rate in Europe r = 2%, choose the correct option: O A. r$ = 9% B. rs = 5% O C. rs = 2% O D.r$ = 7% O E. The above information is not sufficient to calculate r$ Suppose only two goods: good A and good B are consumed in Australia and Europe. Assume that at time t=1: E$/ 1.5 1 unit of A costs $150 in Australia 1 unit of B costs $300 in Australia The law of one price holds for both good A and good B The EU Price Index is calculated as 0.2*(Price of A in Euros) + 0.8*(Price of B in Euros) The AU Price Index is calculated 0.5*(Price of A in AUD) + 0.5*(Price of B in AUD) If the real Dollar per Euro exchange rate is expected to depreciate by 10% next year, then at t=1: O A. Absolute PPP holds but relative PPP does not B. Absolute and relative PPP do not hold O C. Absolute and relative PPP hold O D. Absolute PPP does not hold but relative PPP does E. Absolute PPP does not hold. We need information on expected rates of inflation in the two countries to determine whether relative PPP holds QUESTION 10 Assume that relative to today, Australian Dollar is expected to depreciate against the Euro by 5% in real terms over the next one period. Assume further that the expected rates of inflation (over the next one period) is 9% and 5% in Australia and Europe respectively. If the real interest rate in Europe r = 2%, choose the correct option: O A. r$ = 9% B. rs = 5% O C. rs = 2% O D.r$ = 7% O E. The above information is not sufficient to calculate r$