Question

Suppose that the current limit order book of Tencent shares are as follows: Bid/Ask Price Size Ask 456.00 200 Ask 455.90 700 Ask 455.80

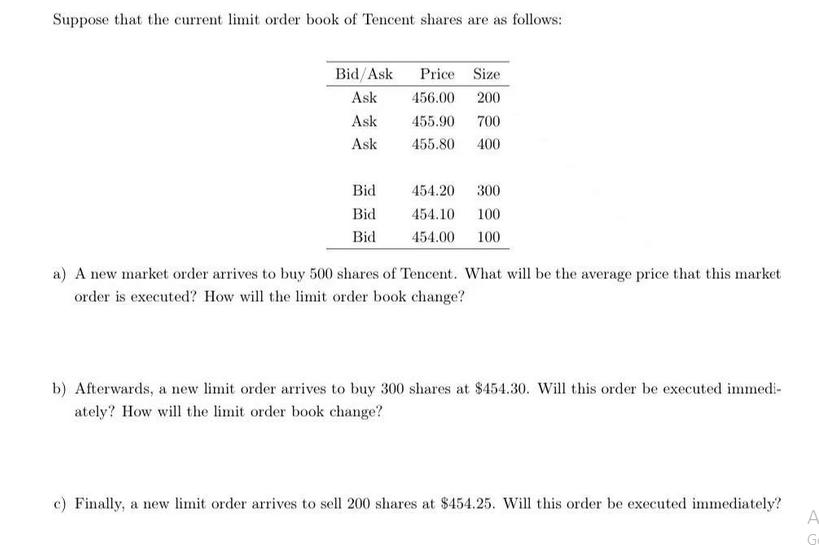

Suppose that the current limit order book of Tencent shares are as follows: Bid/Ask Price Size Ask 456.00 200 Ask 455.90 700 Ask 455.80 400 Bid 454.20 300 Bid 454.10 100 Bid 454.00 100 a) A new market order arrives to buy 500 shares of Tencent. What will be the average price that this market order is executed? How will the limit order book change? b) Afterwards, a new limit order arrives to buy 300 shares at $454.30. Will this order be executed immedi- ately? How will the limit order book change? c) Finally, a new limit order arrives to sell 200 shares at $454.25. Will this order be executed immediately?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Global Investments

Authors: Bruno Solnik, Dennis McLeavey

6th edition

321527704, 978-0321527707

Students also viewed these Business Communication questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App