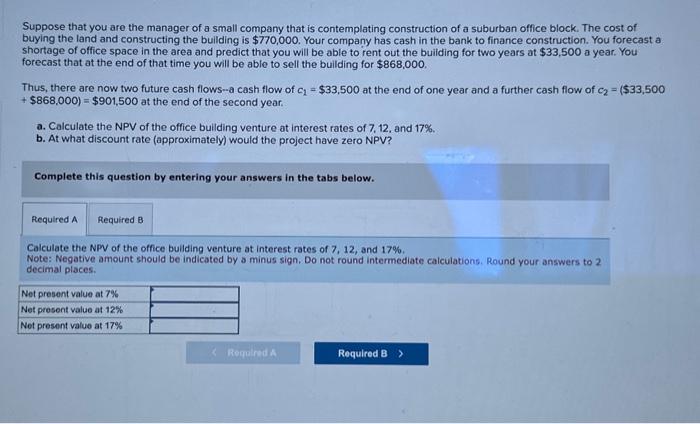

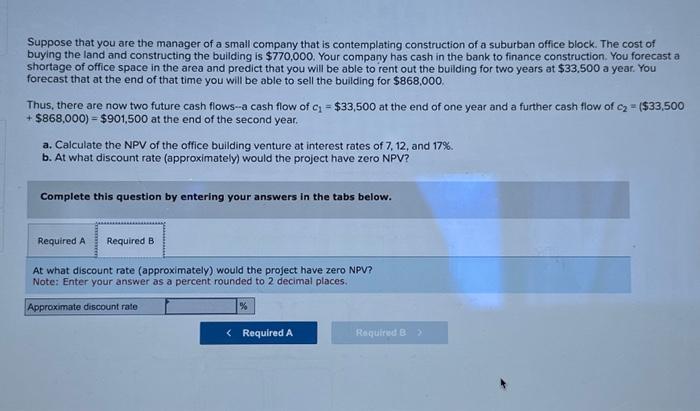

Suppose that you are the manager of a small company that is contemplating construction of a suburban office block. The cost of buying the land and constructing the building is $770,000. Your company has cash in the bank to finance construction. You forecast a shortage of office space in the area and predict that you will be able to rent out the building for two years at $33,500 a year. You forecast that at the end of that time you will be able to sell the building for $868,000. Thus, there are now two future cash flows - a cash flow of c1=$33,500 at the end of one year and a further cash flow of c2=($33,500 +$868,000)=$901,500 at the end of the second year. a. Calculate the NPV of the office building venture at interest rates of 7, 12, and 17%. b. At what discount rate (approximately) would the project have zero NPV? Complete this question by entering your answers in the tabs below. Calculate the NPV of the office building venture at interest rates of 7,12 , and 17%. Note: Negative amount should be indicated by a minus sign, Do not round intermediate calculations. Round your answers to 2 decimal places. Suppose that you are the manager of a small company that is contemplating construction of a suburban office block. The cost of buying the land and constructing the building is $770,000. Your company has cash in the bank to finance construction. You forecast a shortage of office space in the area and predict that you will be able to rent out the buliding for two years at $33,500 a year. You forecast that at the end of that time you will be able to sell the building for $868,000. Thus, there are now two future cash flows - a cash flow of c1=$33,500 at the end of one year and a further cash flow of c2=1$33,500 +$868,000)=$901,500 at the end of the second year. a. Calculate the NPV of the office building venture at interest rates of 7,12 , and 17%. b. At what discount rate (approximately) would the project have zero NPV? Complete this question by entering your answers in the tabs below. At what discount rate (approximately) would the project have zero NPV? Note: Enter your answer as a percent rounded to 2 decimal places