Question

Susan (see question 6 above) had a net profit of $95,000 for the tax year. She is married to George, and they have an

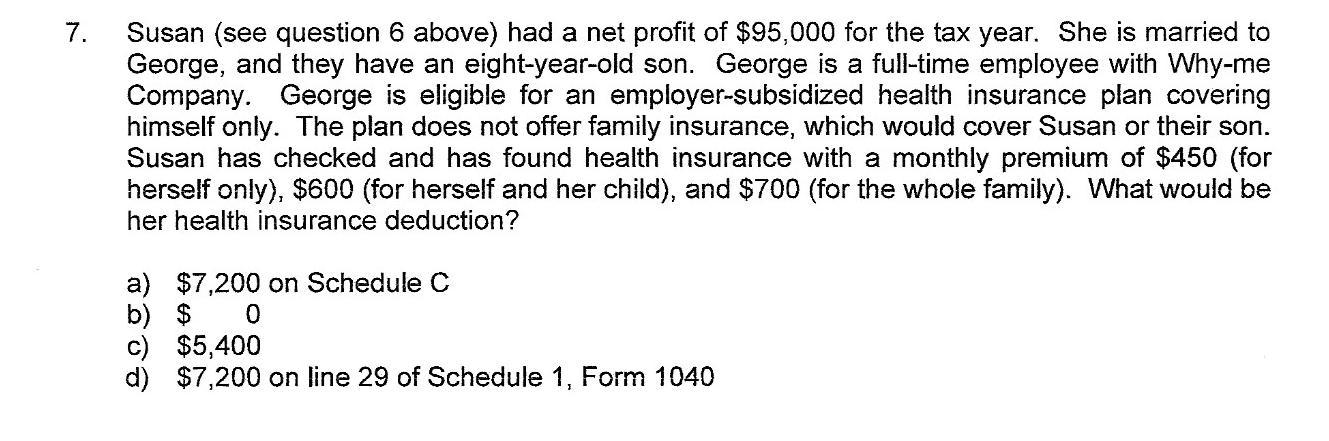

Susan (see question 6 above) had a net profit of $95,000 for the tax year. She is married to George, and they have an eight-year-old son. George is a full-time employee with Why-me Company. George is eligible for an employer-subsidized health insurance plan covering himself only. The plan does not offer family insurance, which would cover Susan or their son. Susan has checked and has found health insurance with a monthly premium of $450 (for herself only), $600 (for herself and her child), and $700 (for the whole family). What would be her health insurance deduction? 7. a) $7,200 on Schedule C b) $ c) $5,400 d) $7,200 on line 29 of Schedule 1, Form 1040

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer option d 7200 on line 29 of schedule IRS Form 1040 is the basic federal income tax form ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Public Finance

Authors: John E. Anderson

2nd edition

978-0538478441, 538478446, 978-1133708360, 1133708366, 978-1111526986

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App