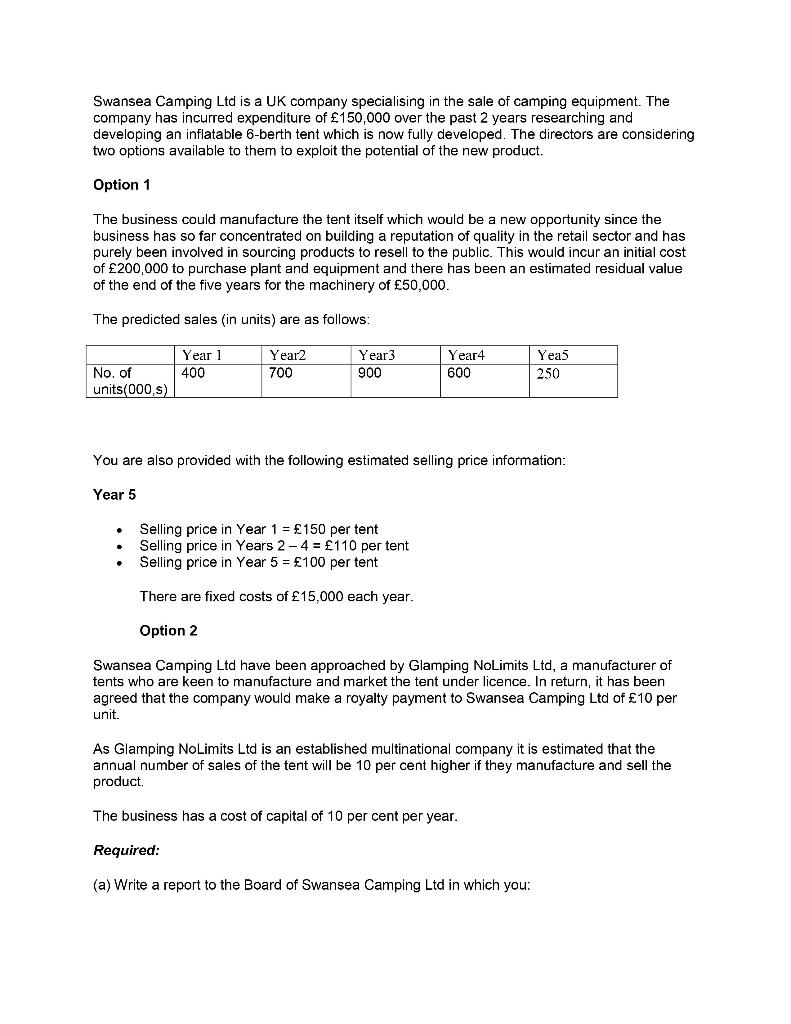

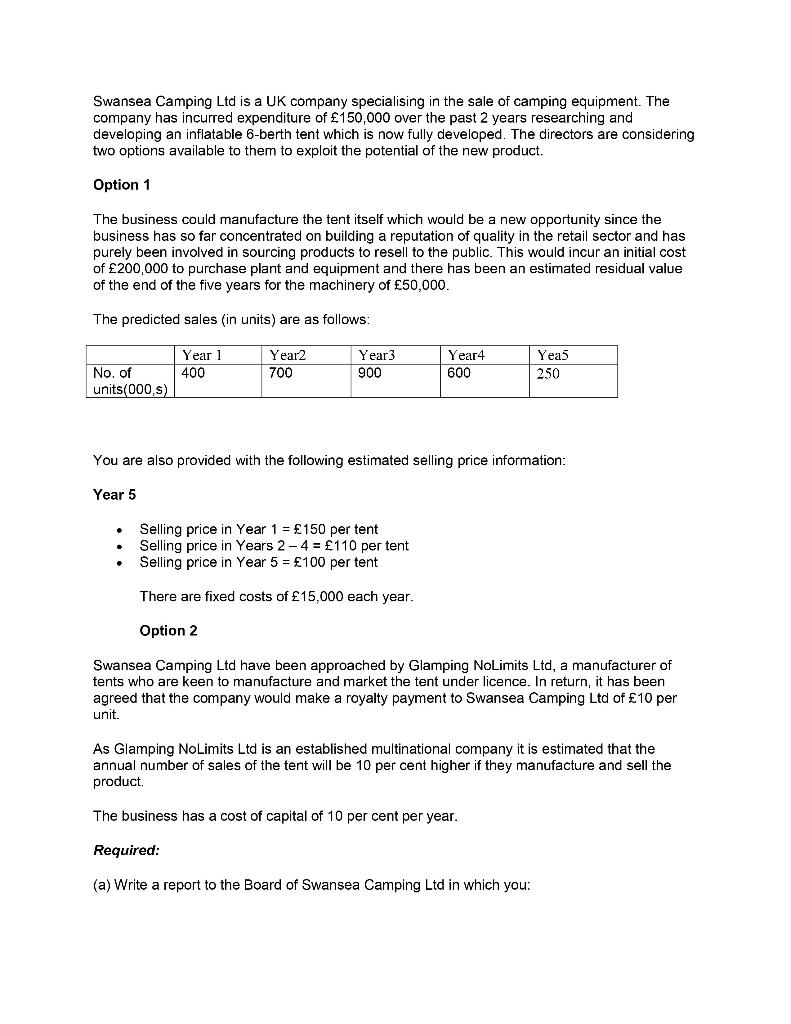

Swansea Camping Ltd is a UK company specialising in the sale of camping equipment. The company has incurred expenditure of 150,000 over the past 2 years researching and developing an inflatable 6-berth tent which is now fully developed. The directors are considering two options available to them to exploit the potential of the new product. Option 1 The business could manufacture the tent itself which would be a new opportunity since the business has so far concentrated on building a reputation of quality in the retail sector and has purely been involved sourcing products to resell to the public. This would incur an initial cost of 200,000 to purchase plant and equipment and there has been an estimated residual value of the end of the five years for the machinery of 50,000. The predicted sales (in units) are as follows: Year 1 400 Year2 700 Year 3 900 Year4 600 Yea5 250 No. of units(000,s) You are also provided with the following estimated selling price information: Year 5 . Selling price in Year 1 = 150 per tent Selling price in Years 2-4 = 110 per tent Selling price in Year 5 = 100 per tent There are fixed costs of 15,000 each year. Option 2 Swansea Camping Ltd have been approached by Glamping NoLimits Ltd, a manufacturer of tents who are keen to manufacture and market the tent under licence. In return, it has been agreed that the company would make a royalty payment to Swansea Camping Ltd of 10 per unit. As Glamping NoLimits Ltd is an established multinational company it is estimated that the annual number of sales of the tent will be 10 per cent higher if they manufacture and sell the product The business has a cost of capital of 10 per cent per year. Required: (a) Write a report to the Board of Swansea Camping Ltd in which you: 1. (i) Calculate the net present value of each of the options available to Swansea Camping Ltd. Include tables showing your calculations in full. (15 marks) 2. (i) Identify and discuss any other factors that Swansea Camping Ltd should consider before arriving at a decision. (3 marks) 3. (ii) State, with reasons, what you consider to be the most suitable option. (2 marks) (b) In groups you are required to prepare a 5-minute PowerPoint presentation for the Board in which you explain: Why the net present value method of investment appraisal is considered to be theoretically superior to other methods that are found in practice. (5 marks) [Total: 25 marks]