Answered step by step

Verified Expert Solution

Question

1 Approved Answer

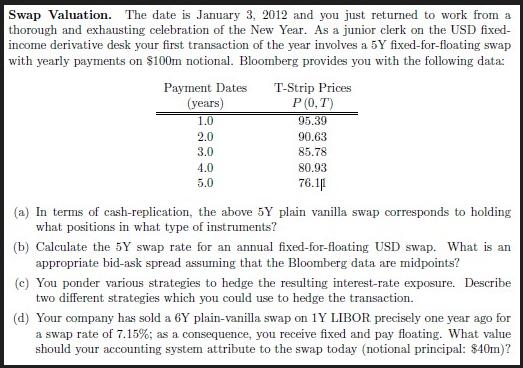

Swap Valuation. The date is January 3, 2012 and you just returned to work from a thorough and exhausting celebration of the New Year.

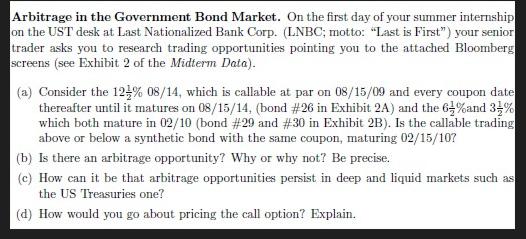

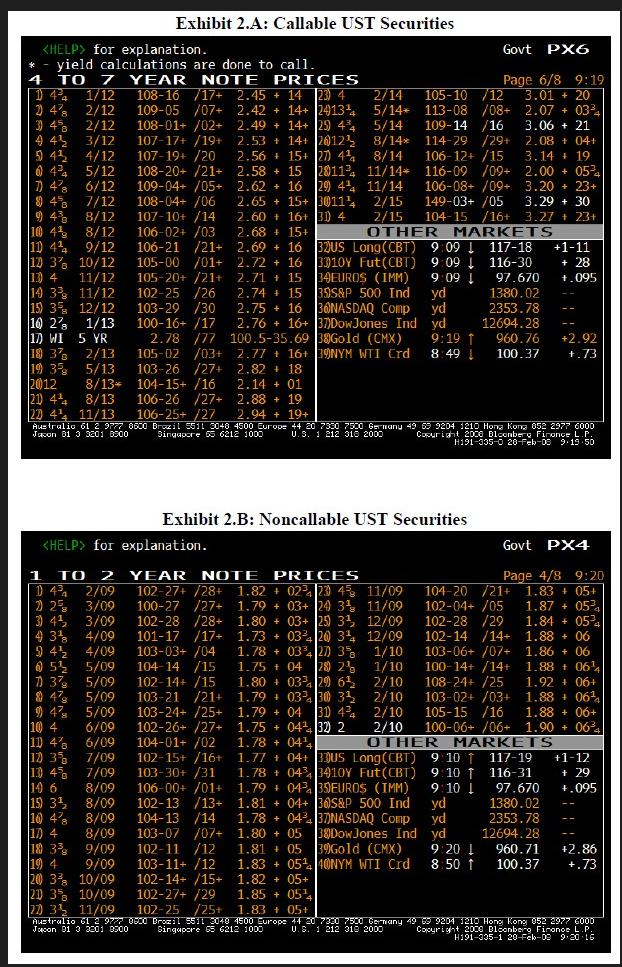

Swap Valuation. The date is January 3, 2012 and you just returned to work from a thorough and exhausting celebration of the New Year. As a junior clerk on the USD fixed- income derivative desk your first transaction of the year involves a 5Y fixed-for-floating swap with yearly payments on $100m notional. Bloomberg provides you with the following data: Payment Dates (years) 1.0 2.0 3.0 4.0 5.0 T-Strip Prices P (0,T) 95.39 90.63 85.78 80.93 76.11 (a) In terms of cash-replication, the above 5Y plain vanilla swap corresponds to holding what positions in what type of instruments? (b) Calculate the 5Y swap rate for an annual fixed-for-floating USD swap. What is an appropriate bid-ask spread assuming that the Bloomberg data are midpoints? (c) You ponder various strategies to hedge the resulting interest-rate exposure. Describe two different strategies which you could use to hedge the transaction. (d) Your company has sold a 6Y plain-vanilla swap on 1Y LIBOR precisely one year ago for a swap rate of 7.15%; as a consequence, you receive fixed and pay floating. What value should your accounting system attribute to the swap today (notional principal: $40m)? Arbitrage in the Government Bond Market. On the first day of your summer internship on the UST desk at Last Nationalized Bank Corp. (LNBC; motto: "Last is First") your senior trader asks you to research trading opportunities pointing you to the attached Bloomberg screens (see Exhibit 2 of the Midterm Data). (a) Consider the 12% 08/14, which is callable at par on 08/15/09 and every coupon date thereafter until it matures on 08/15/14, (bond #26 in Exhibit 2A) and the 63% and 3% which both mature in 02/10 (bond #29 and #30 in Exhibit 2B). Is the callable trading above or below a synthetic bond with the same coupon, maturing 02/15/107 (b) Is there an arbitrage opportunity? Why or why not? Be precise. (c) How can it be that arbitrage opportunities persist in deep and liquid markets such as the US Treasuries one? (d) How would you go about pricing the call option? Explain. for explanation. yield calculations are done to call. 4 TO 1434 1/12 2) 48 2/12 34% 2/12 4 43 5 43 0 4 7) 4% 7 YEAR NOTE PRICES 108-16 /17+ 2.45 + 14 23) 4 109-05 /07+ 2.42 14+ 2413 108-01+/02+ 2.49 + 14+ 25) 434 2.53 14+ 2012 2.56+15+27) 4 2.58+ 15 2011 2.62 + 16 29 4 2.65+15+ 30114 2.60+ 16+30) 4 2.68 +15+ 2.69 + 16 2.72 +16 2.71 15 2.74 15 2.75 + 16 2.76 + 16+ 3/12 4/12 84% 9) 4% 10 4 8/12 10) 44 9/12 12 3% 10/12 13 4 11/12 14 3 11/12 5/12 6/12 7/12 8/12 15) 3 10 27 17 WI 5 YR 84% 947 12/12 1/13 10 4 18 3% 2/13 5/13 19) 35 2012 21) 424 8/13* 8/13 22 44 11/13 Exhibit 2.A: Callable UST Securities 4/09 5/09 5/09 5/09 5/09 107-17+ /19+ 107-19+ /20 108-20+ /21+ for explanation. 1 TO 2 1) 43 2/09 7) 25 3/09 3) 4/1/2 3/09 4) 3% 4/09 94//2 53 71) 37 6/09 11 4% 6/09 17) 3% 7/09 10 45 7/09 14 6 8/09 15) 3 8/09 10 4 8/09 17) 4 8/09 109-04+ /05+ 108-04+ /06 107-10+ /14 106-02+ /03 106-21 /21+ 105-00 /01+ 105-20+ /21+ 102-25 /26 103-29 /30 100-16+ /17 2.78 /77 105-02 /03+ 103-26 /27+ 104-15+ /16 106-26 /27+ 106-25+/27 2.14 + 01 2.88 + 19 2.94 + 19+ Australio 61 2 9777 8600 Brazil 5511 3040 4500 Europe 44 20 7330 7500 Germany 49 69 9204 1210 Hong Kong 852 2977 6000 Japon 01 3 3201 0900 Singapore 55 6212 1000 U.S. 1 212 318 2000 Copyright 2000 Bloomberg Finance L.P. H191-335-0 20-Feb-08 9-19-50 103-21 /21+ 103-24+ /25+ 102-26+ /27+ 104-01+/02 102-15+ /16+ 103-30+ /31 106-00+ /01+ 102-13 /13+ 104-13/14 Page 6/8 9:19 3.01 + 20 2.07 033 3.06+ 21 2.08 + 04+ 3.14 19 2.00+ 0574 3.20 +23+ 3.29 + 30 104-15 /16+ 3.27 + 23+ OTHER MARKETS 117-18 +1-11 116-30 + 28 97.670 +.095 1380.02 2353.78 12694.28 103-07 /07+ 102-11 /12 103-11+ /12 2/14 105-10/12 113-08 /08+ 5/14* 5/14 109-14 /16 114-29 /29+ 106-12+ /15 116-09 /09+ 106-08+ /09+ 149-03+/05 8/14* 8/14 11/14 11/14 102-14+ /15+ 102-27+ /29 2/15 2/15 9:09 32US Long(CBT) 9:09 3310Y Fut(CBT) 34EUROS (IMM) 35S&P 500 Ind 9:09 30NASDAQ Comp 37)DowJones Ind Exhibit 2.B: Noncallable UST Securities YEAR NOTE PRICES 102-27+ /28+ 1.82 + 02 23 45 11/09 100-27 /27+ 1.79 +03+ 24 3 102-28 /28+ 1.80 +03+ 25 3 101-17 /17+ 1.73 + 034 20 34 103-03+ /04 1.78 + 03427) 35 104-14 /15 1.75 04 280 2 1.80 033 29 6 1.79 03 30 3 1.79+04 31 44 1.75 + 04 32) 2 1.78 + 04 102-14+ /15 1.77 +04+ 30US Long (CBT) 1.78 + 04343410Y Fut (CBT) 1.79 0434 35 EUROS (IMM) 1.81 +04+ 30S&P 500 Ind 1.78044 37)NASDAQ Comp 1.80 +05 1.81 05 1.83 + 05 1.82 +05+ 100.5-35.69 38Gold (CMX) 2.77 + 16+39NYM WTI Crd 2.82 18 yd yd yd Govt PX6 38Dow Jones Ind 39Gold (CMX) 40NYM WTI Crd 9:19 960.76 8:49 100.37 104-20 /21+ 102-04+/05 102-28 /29 102-14 /14+ 103-06+ /07+ 100-14+ /14+ 108-24+ /25 103-02+ /03+ 9 10 1 9:10 9:10 1 Govt PX4 Page 4/8 9:20 1.83 +05+ 1.87 + 054 1.84 + 054 1.88 + 06 1.86 + 06 1.88 + 064 1.92 +06+ 1.88 064 11/09 12/09 12/09 1/10 1/10 2/10 2/10 2/10 105-15 /16 2/10 100-06+ /06+ 1.90 +064 OTHER MARKETS 1.88 +06+ +2.92 +.73 117-19 116-31 97.670 1380.02 2353.78 12694.28 +1-12 + 29 +.095 yd yd yd 9:20 1 960.71 +2.86 8.50 1 100.37 +.73 18 3 9/09 19 4 9/09 20 3 10/09 20 35 10/09 1.85+ 054 27) 3 11/09 102-25 /25+ 1.83 + 05+ Australio 61 2 9777 9500 Brozil 5511 3040 1500 Europe 44 20 7330 7500 Germany 49 69 9204 1210 Hong Kong 052 2977 6000 Japon 91 3 3201 9500 Singapore 65 6212 1000 U.S. 1 319 2000 H191-335-1 28-Feb-02 9.20

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a In terms of cashreplication the above 5Y plain vanilla swap corresponds to holding the following p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started