Answered step by step

Verified Expert Solution

Question

1 Approved Answer

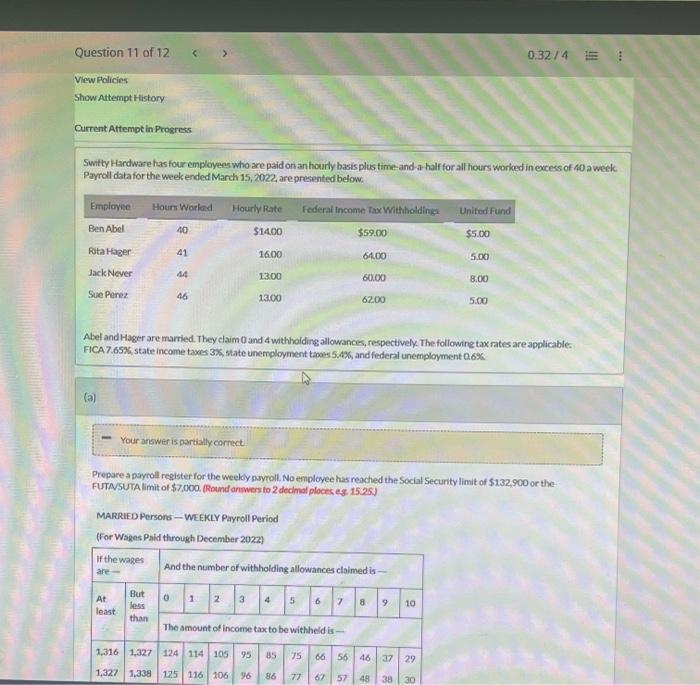

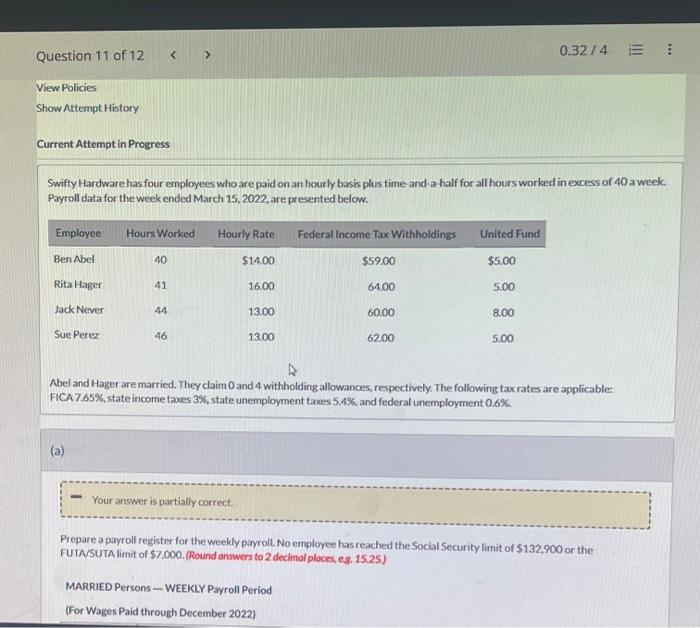

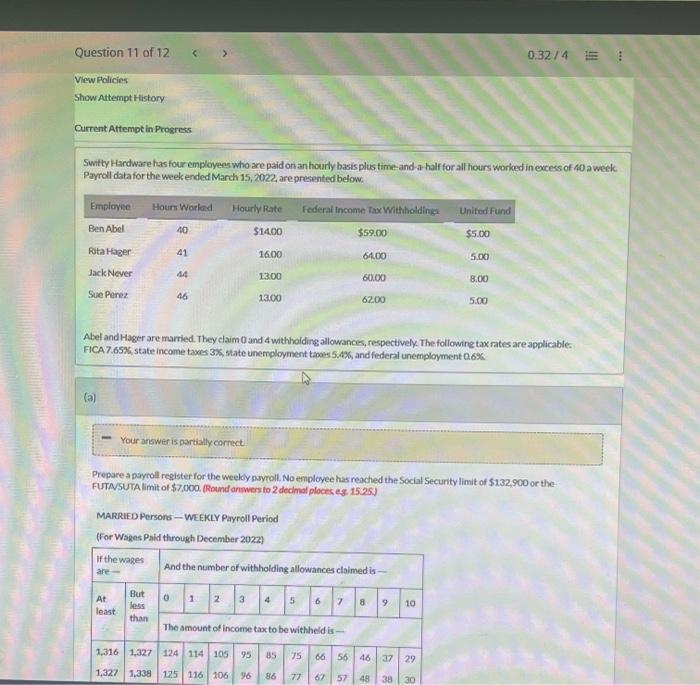

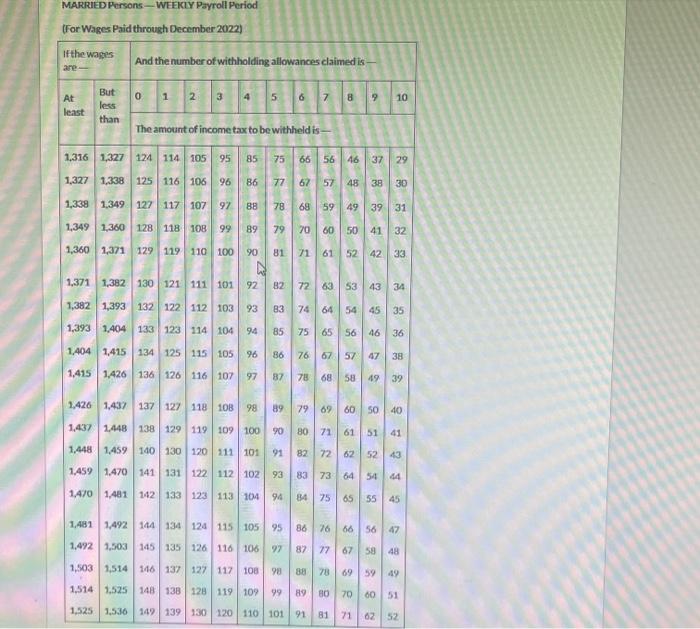

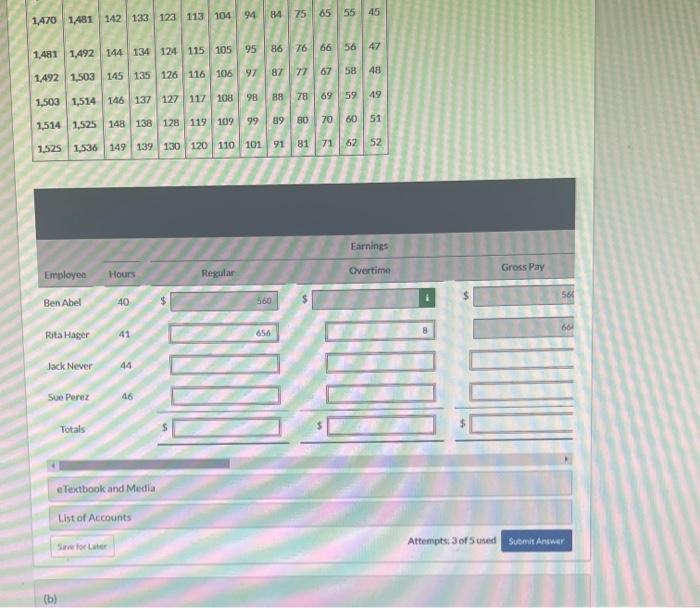

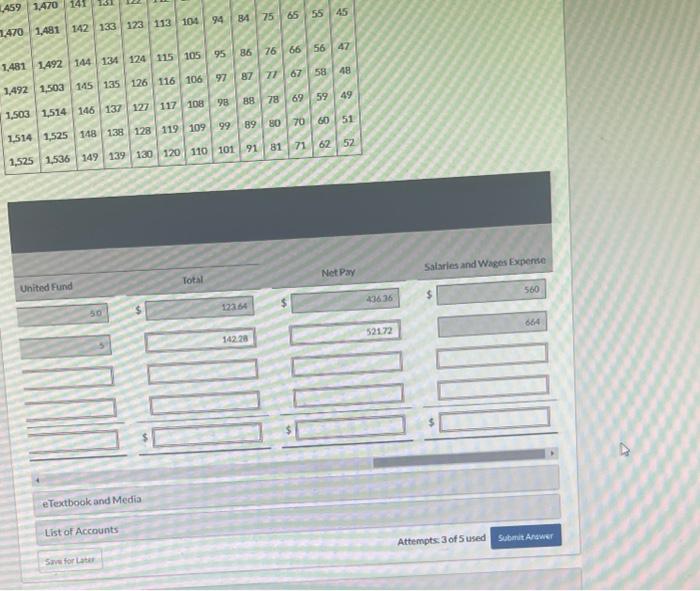

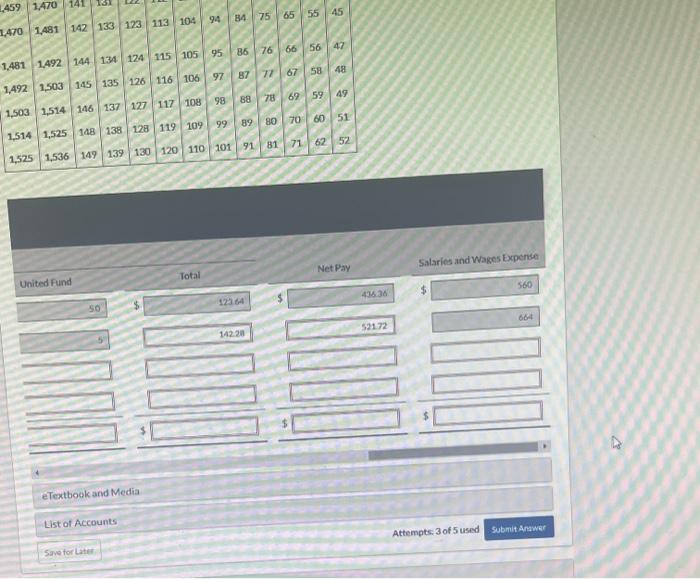

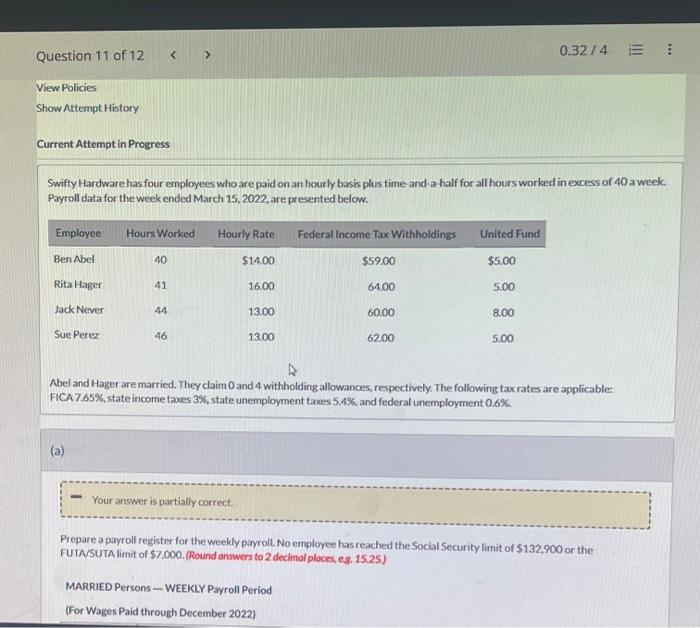

Switty Hardware has four employees who are paid on an hourly basis plus time-and-a- half for all hours worked in excess of 40 a week.

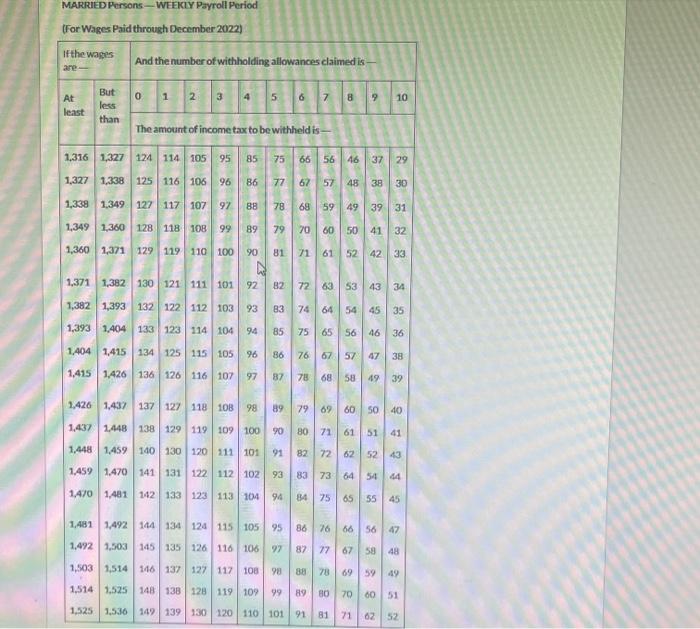

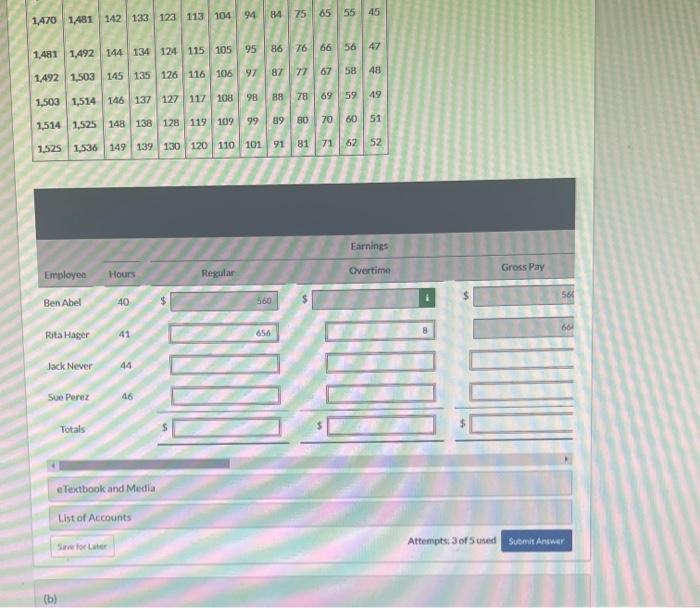

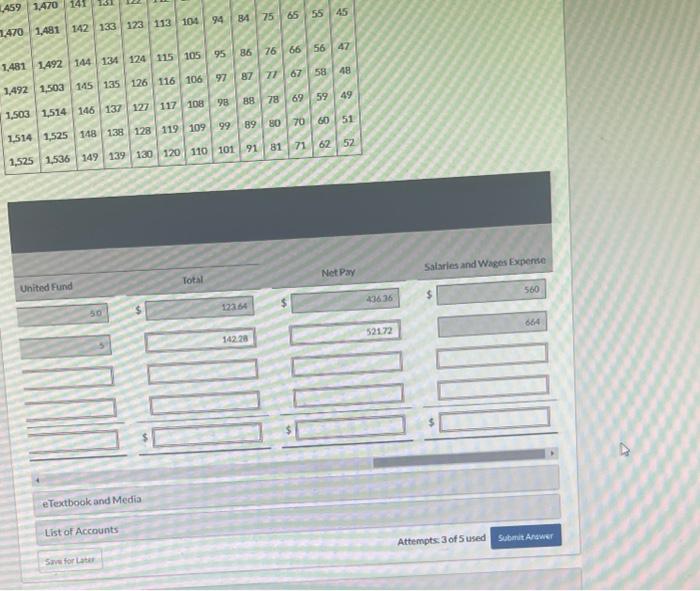

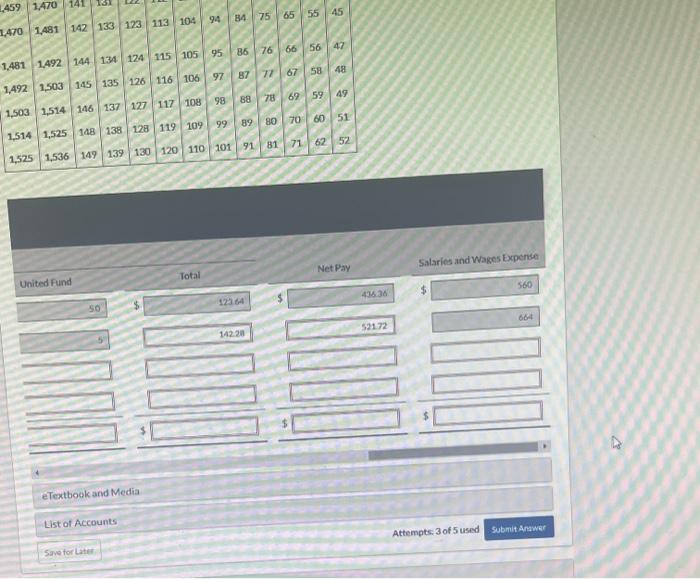

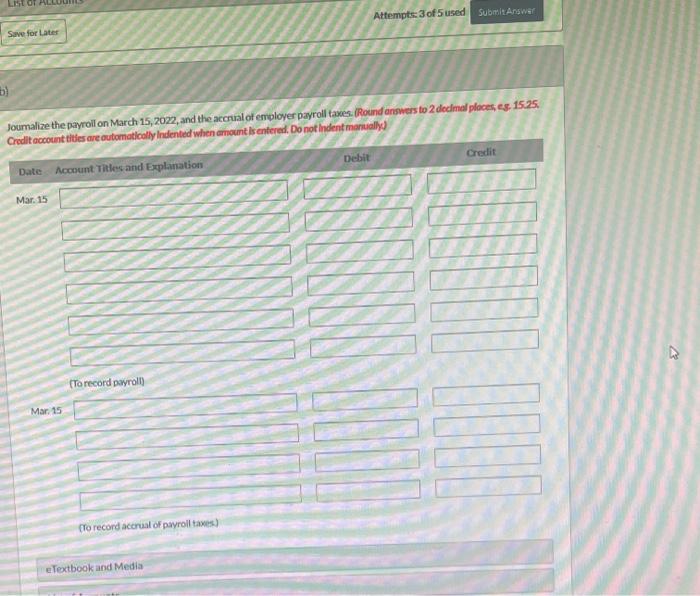

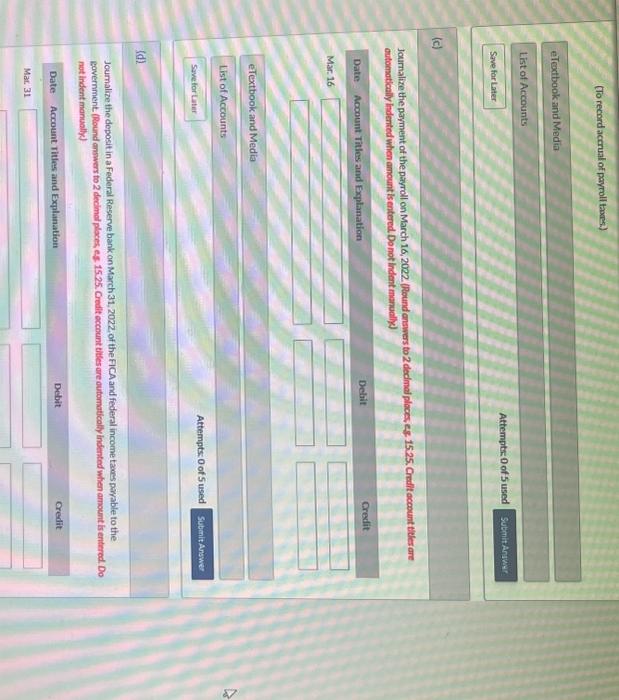

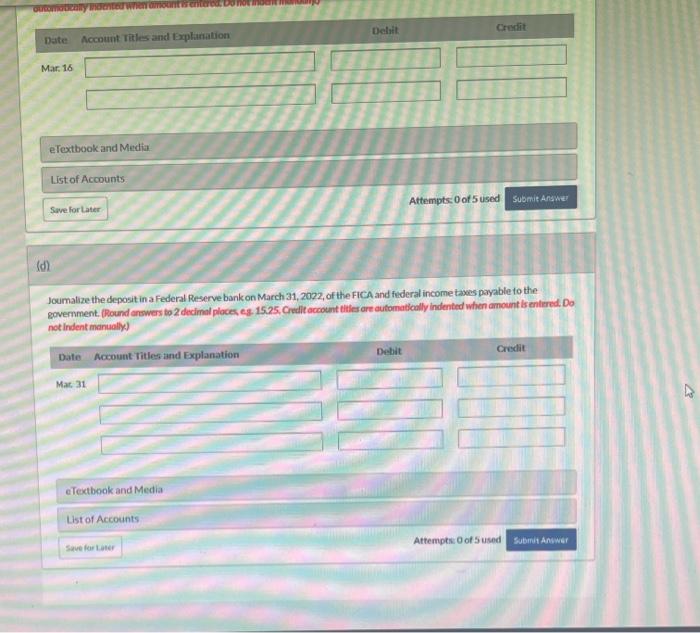

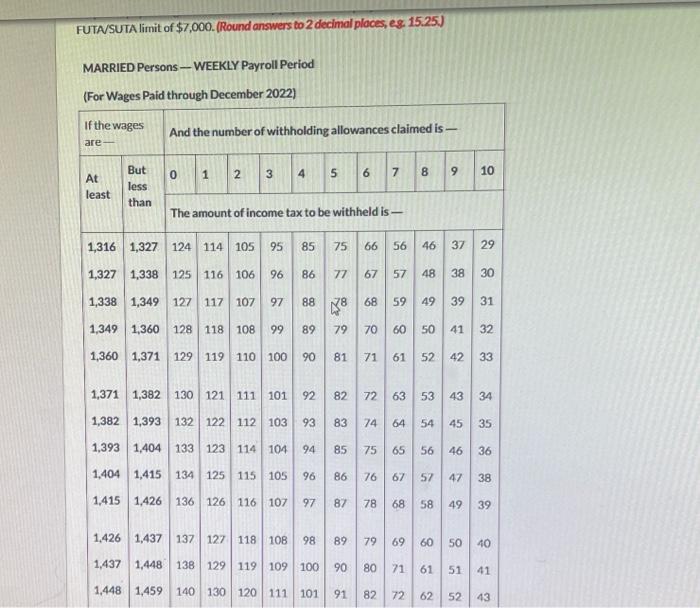

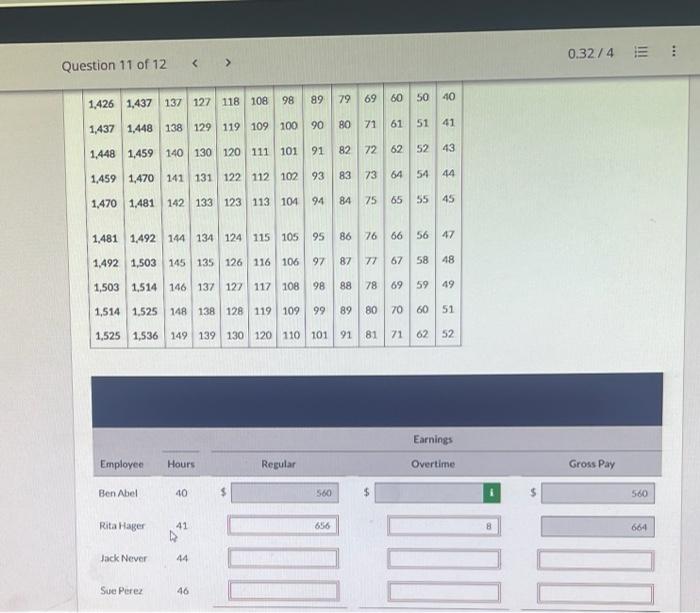

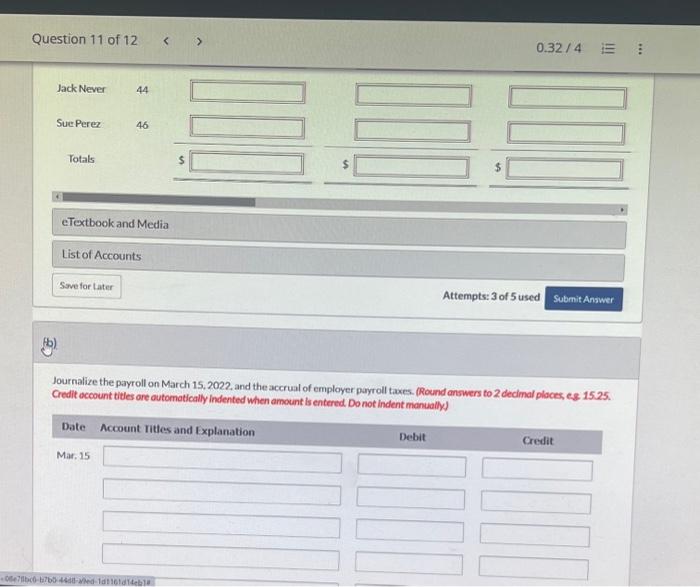

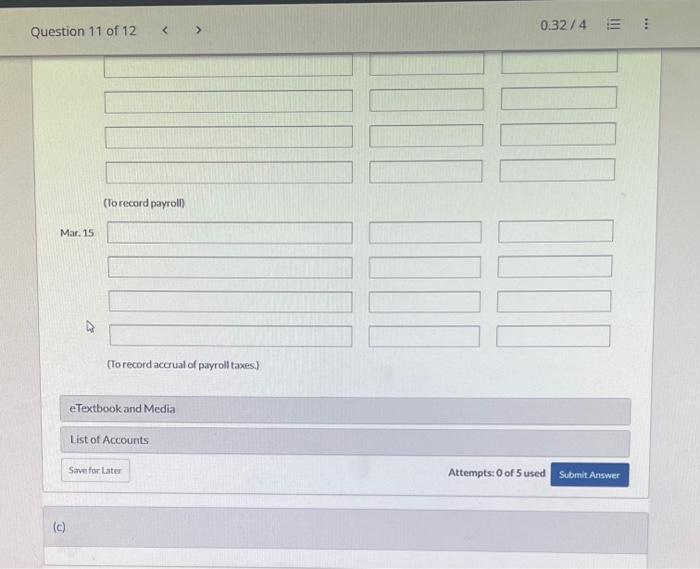

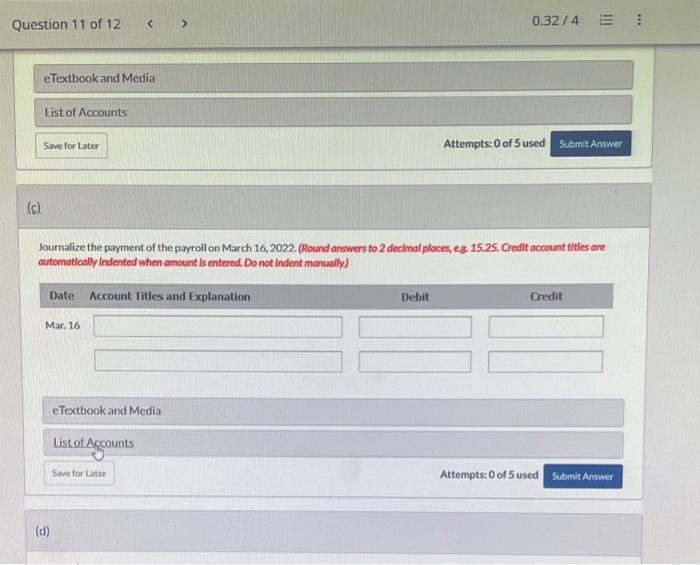

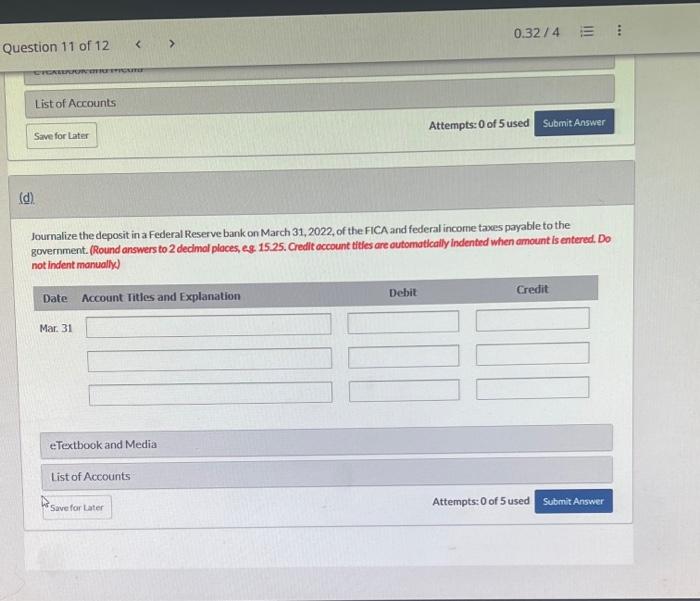

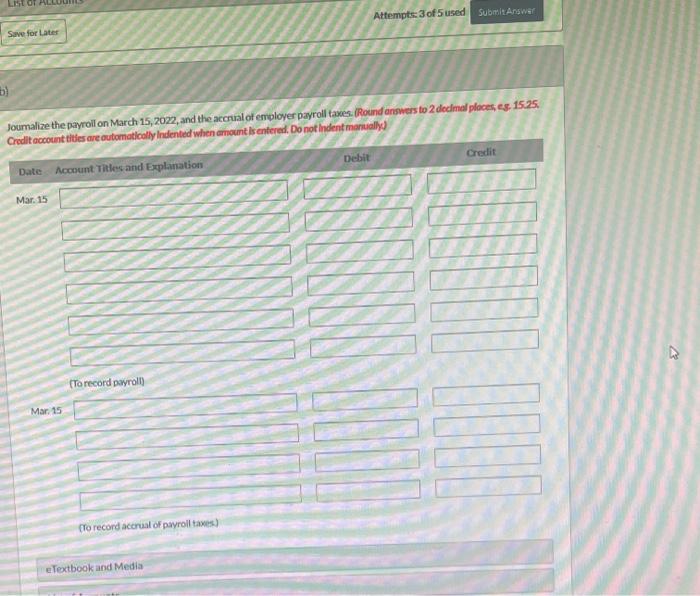

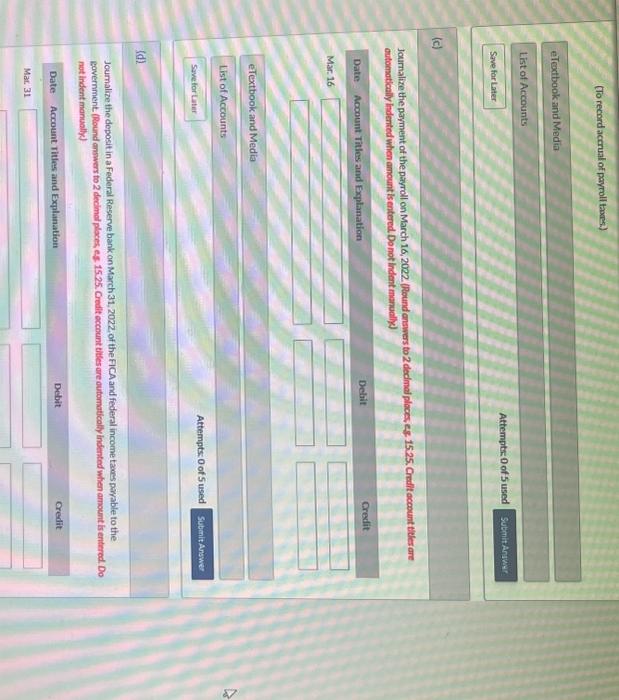

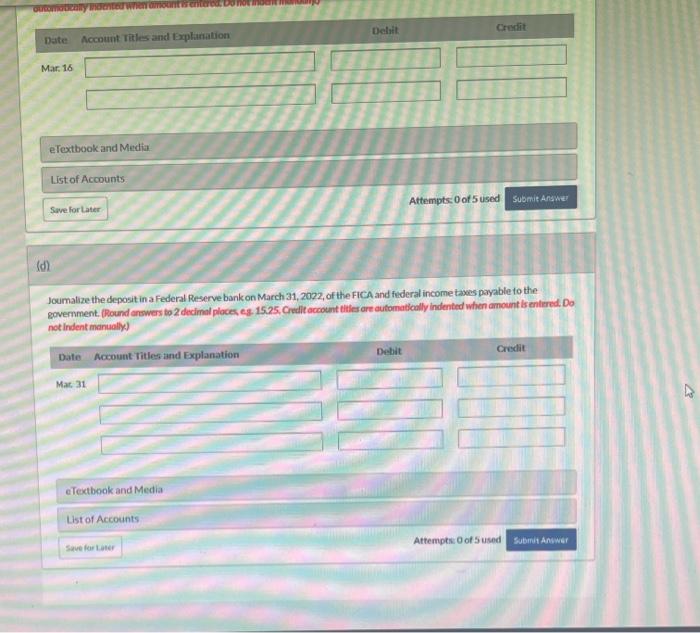

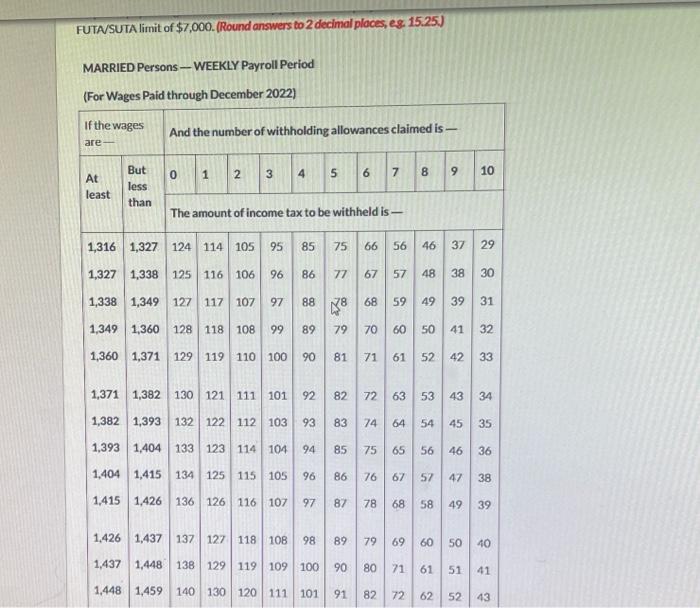

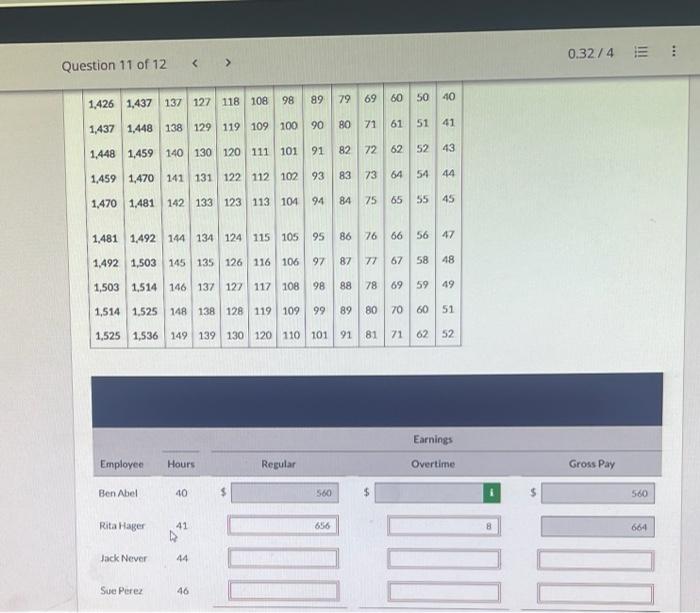

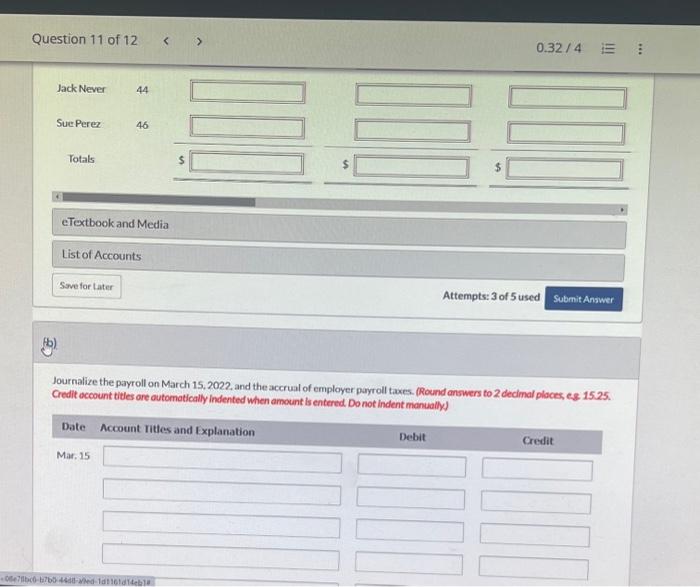

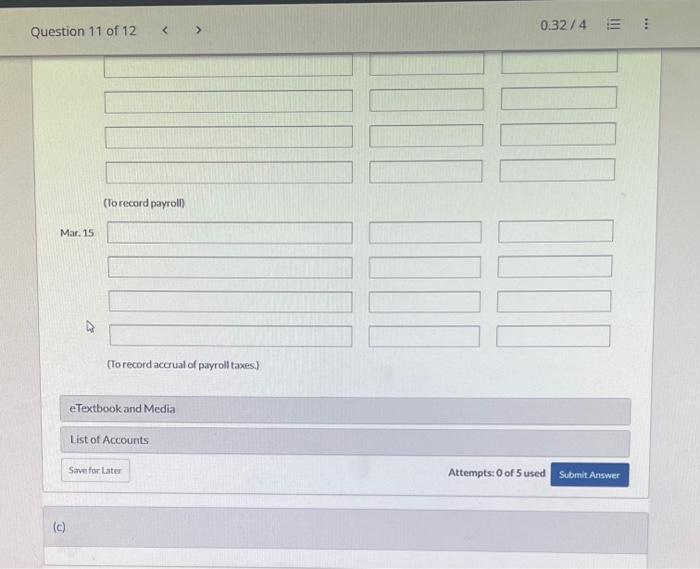

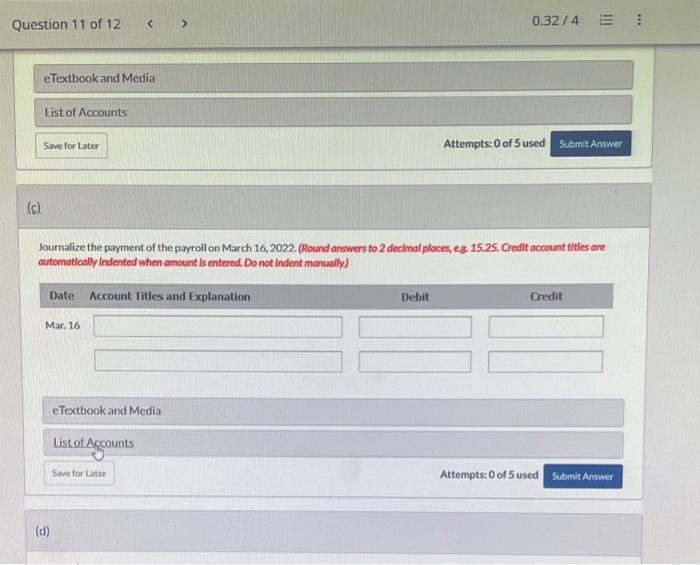

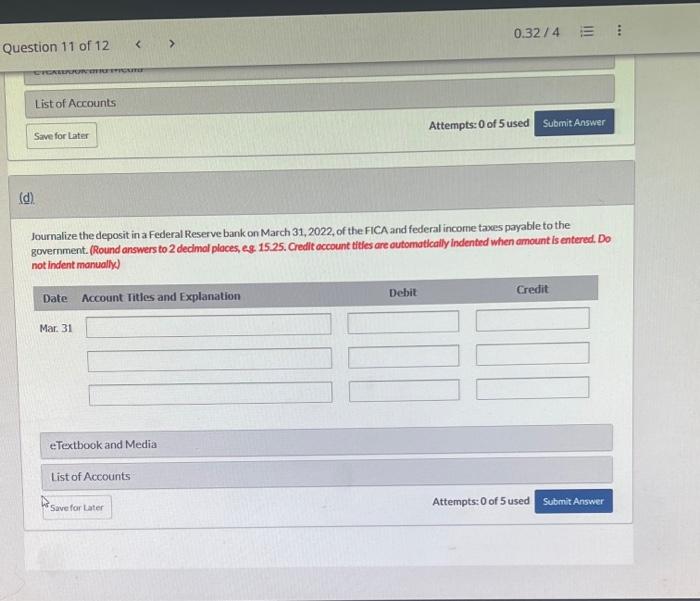

Switty Hardware has four employees who are paid on an hourly basis plus time-and-a- half for all hours worked in excess of 40 a week. Payroll data for the weekended March 15, 2022, arepresented below. Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The followine tax rates are applicable: FICA 7.65K state income taxes 3K, state unemployment taxoss 5.4X, and federal unemployment 0.6%. (a) - Your answer is partially correct. Prepare a payroll register for the weeloy poyroll. No employee has reached the Social Secunty limit of $132,900 or the FUTASUTA limit of $7000. (Round anwers to 2 decimol ploces eg. 15.25) MARRIED Persons - WEEKIY Payroll Period MARRRIED Persons - WEFKIY Payroll Period \begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|l|l|} 1,470 & 1,481 & 142 & 133 & 123 & 113 & 104 & 94 & 84 & 75 & 65 & 55 & 45 \\ 1,481 & 1,492 & 144 & 134 & 124 & 115 & 105 & 95 & 86 & 76 & 66 & 56 & 47 \\ 1,492 & 1,503 & 145 & 135 & 126 & 116 & 106 & 97 & 87 & 77 & 67 & 58 & 48 \\ 1,503 & 1,514 & 146 & 137 & 127 & 117 & 108 & 98 & 88 & 78 & 69 & 59 & 49 \\ 1,514 & 1,525 & 148 & 138 & 128 & 119 & 109 & 99 & 89 & 80 & 70 & 60 & 51 \\ 1,525 & 1,536 & 149 & 139 & 130 & 120 & 110 & 101 & 91 & 81 & 71 & 62 & 52 \\ \hline \end{tabular} (b) United Fund Total NetPay Salarles and Waees Expenset United fund Total NetPaY Salaries and Wages Expersen 50 \$. 12364 \( 5 \longdiv { 5 6 0 } \) 5 14221 5,5172 eTextbock and Media List of Accounts Sive for Later Joumalize the payroil on March 15, 2022, and the accrual of employer payroll taxes. (Rosind answers to 2 docimel ploces, es. 15.25. Cuadibarrount tities are outomatiodly indented when wrount ls entered. Do not indent marually) (To record acrrual of payroll taxes.) Jcurnalize the payment of the payrdil on March 16, 2022. (Round answers to 2 declmai ploces, 28,1525 . Credit account tleler are outociatically indentod when amount is entered. Do not indent manualy eTextbook and Media List of Accounts Attempts 0 of 5 used (d). Joumalize the deposit in a Federal Reserve bank on March 31, 2022, of the FICA and federal income tawes payable to the povernment. (Round answers to 2 decimal places, es 15.25. Credit occount tilles are outomaticolfy indented when amount is entered. Do not indent manually J Joumalize the deposit in a Federal Reserve bank on March 31, 2022, of the FICA and federal income taxos payable to the government. (Round answers to 2 decirnal ploces eg. 15.25. Credit acoount titter are automatically indented when ainount is entered. Do not indent manually) View Policies Show Attempt History Current Attempt in Progress Swifty Hardware has four employees who are paid on an hourly basis plus time-and-a half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2022, are presented below. Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3% state unemployment taxes 5.4%, and federal unemployment 0.6%. MARRIED Persons - WEEKLY Payroll Period Question 11 of 12 0.32/4 \begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|l|l|} \hline 1,426 & 1,437 & 137 & 127 & 118 & 108 & 98 & 89 & 79 & 69 & 60 & 50 & 40 \\ 1,437 & 1,448 & 138 & 129 & 119 & 109 & 100 & 90 & 80 & 71 & 61 & 51 & 41 \\ 1,448 & 1,459 & 140 & 130 & 120 & 111 & 101 & 91 & 82 & 72 & 62 & 52 & 43 \\ 1,459 & 1,470 & 141 & 131 & 122 & 112 & 102 & 93 & 83 & 73 & 64 & 54 & 44 \\ 1,470 & 1,481 & 142 & 133 & 123 & 113 & 104 & 94 & 84 & 75 & 65 & 55 & 45 \\ 1,481 & 1,492 & 144 & 134 & 124 & 115 & 105 & 95 & 86 & 76 & 66 & 56 & 47 \\ 1,492 & 1,503 & 145 & 135 & 126 & 116 & 106 & 97 & 87 & 77 & 67 & 58 & 48 \\ 1,503 & 1,514 & 146 & 137 & 127 & 117 & 108 & 98 & 88 & 78 & 69 & 59 & 49 \\ 1,514 & 1,525 & 148 & 138 & 128 & 119 & 109 & 99 & 89 & 80 & 70 & 60 & 51 \\ 1,525 & 1,536 & 149 & 139 & 130 & 120 & 110 & 101 & 91 & 81 & 71 & 62 & 52 \\ \hline \end{tabular} Jack Never 44 SuePerez 46 Journalize the payroll on March 15.2022, and the accrual of employer payroll taxes. (Round answers to 2 decimal ploces, eg. 15.25. Credit account titles are outomatically indented when amount is entered Do not indent manually) Question 11 of 12 0.32/4 (Torecord payroll) Mar, 15 (To record accrual of payroll taxes) eTextbook and Media List of Accounts Save for Later Attempts: 0 of 5 used Submit Answer (c) Journalize the payment of the payroll on March 16, 2022. (Round answers to 2 decimal places, eg. 15.25, Credit occount titles are automatically indented when amount is entered. Do not indent manually) Journalize the deposit in a Federal Reserve bank on March 31, 2022, of the FiCA and federal income taoss payable to the government. (Round answers to 2 decimal places, eg. 15.25. Credit occount titles are outomatically indented when amount is entered. Do not indent manual (J

Switty Hardware has four employees who are paid on an hourly basis plus time-and-a- half for all hours worked in excess of 40 a week. Payroll data for the weekended March 15, 2022, arepresented below. Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The followine tax rates are applicable: FICA 7.65K state income taxes 3K, state unemployment taxoss 5.4X, and federal unemployment 0.6%. (a) - Your answer is partially correct. Prepare a payroll register for the weeloy poyroll. No employee has reached the Social Secunty limit of $132,900 or the FUTASUTA limit of $7000. (Round anwers to 2 decimol ploces eg. 15.25) MARRIED Persons - WEEKIY Payroll Period MARRRIED Persons - WEFKIY Payroll Period \begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|l|l|} 1,470 & 1,481 & 142 & 133 & 123 & 113 & 104 & 94 & 84 & 75 & 65 & 55 & 45 \\ 1,481 & 1,492 & 144 & 134 & 124 & 115 & 105 & 95 & 86 & 76 & 66 & 56 & 47 \\ 1,492 & 1,503 & 145 & 135 & 126 & 116 & 106 & 97 & 87 & 77 & 67 & 58 & 48 \\ 1,503 & 1,514 & 146 & 137 & 127 & 117 & 108 & 98 & 88 & 78 & 69 & 59 & 49 \\ 1,514 & 1,525 & 148 & 138 & 128 & 119 & 109 & 99 & 89 & 80 & 70 & 60 & 51 \\ 1,525 & 1,536 & 149 & 139 & 130 & 120 & 110 & 101 & 91 & 81 & 71 & 62 & 52 \\ \hline \end{tabular} (b) United Fund Total NetPay Salarles and Waees Expenset United fund Total NetPaY Salaries and Wages Expersen 50 \$. 12364 \( 5 \longdiv { 5 6 0 } \) 5 14221 5,5172 eTextbock and Media List of Accounts Sive for Later Joumalize the payroil on March 15, 2022, and the accrual of employer payroll taxes. (Rosind answers to 2 docimel ploces, es. 15.25. Cuadibarrount tities are outomatiodly indented when wrount ls entered. Do not indent marually) (To record acrrual of payroll taxes.) Jcurnalize the payment of the payrdil on March 16, 2022. (Round answers to 2 declmai ploces, 28,1525 . Credit account tleler are outociatically indentod when amount is entered. Do not indent manualy eTextbook and Media List of Accounts Attempts 0 of 5 used (d). Joumalize the deposit in a Federal Reserve bank on March 31, 2022, of the FICA and federal income tawes payable to the povernment. (Round answers to 2 decimal places, es 15.25. Credit occount tilles are outomaticolfy indented when amount is entered. Do not indent manually J Joumalize the deposit in a Federal Reserve bank on March 31, 2022, of the FICA and federal income taxos payable to the government. (Round answers to 2 decirnal ploces eg. 15.25. Credit acoount titter are automatically indented when ainount is entered. Do not indent manually) View Policies Show Attempt History Current Attempt in Progress Swifty Hardware has four employees who are paid on an hourly basis plus time-and-a half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2022, are presented below. Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3% state unemployment taxes 5.4%, and federal unemployment 0.6%. MARRIED Persons - WEEKLY Payroll Period Question 11 of 12 0.32/4 \begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|l|l|} \hline 1,426 & 1,437 & 137 & 127 & 118 & 108 & 98 & 89 & 79 & 69 & 60 & 50 & 40 \\ 1,437 & 1,448 & 138 & 129 & 119 & 109 & 100 & 90 & 80 & 71 & 61 & 51 & 41 \\ 1,448 & 1,459 & 140 & 130 & 120 & 111 & 101 & 91 & 82 & 72 & 62 & 52 & 43 \\ 1,459 & 1,470 & 141 & 131 & 122 & 112 & 102 & 93 & 83 & 73 & 64 & 54 & 44 \\ 1,470 & 1,481 & 142 & 133 & 123 & 113 & 104 & 94 & 84 & 75 & 65 & 55 & 45 \\ 1,481 & 1,492 & 144 & 134 & 124 & 115 & 105 & 95 & 86 & 76 & 66 & 56 & 47 \\ 1,492 & 1,503 & 145 & 135 & 126 & 116 & 106 & 97 & 87 & 77 & 67 & 58 & 48 \\ 1,503 & 1,514 & 146 & 137 & 127 & 117 & 108 & 98 & 88 & 78 & 69 & 59 & 49 \\ 1,514 & 1,525 & 148 & 138 & 128 & 119 & 109 & 99 & 89 & 80 & 70 & 60 & 51 \\ 1,525 & 1,536 & 149 & 139 & 130 & 120 & 110 & 101 & 91 & 81 & 71 & 62 & 52 \\ \hline \end{tabular} Jack Never 44 SuePerez 46 Journalize the payroll on March 15.2022, and the accrual of employer payroll taxes. (Round answers to 2 decimal ploces, eg. 15.25. Credit account titles are outomatically indented when amount is entered Do not indent manually) Question 11 of 12 0.32/4 (Torecord payroll) Mar, 15 (To record accrual of payroll taxes) eTextbook and Media List of Accounts Save for Later Attempts: 0 of 5 used Submit Answer (c) Journalize the payment of the payroll on March 16, 2022. (Round answers to 2 decimal places, eg. 15.25, Credit occount titles are automatically indented when amount is entered. Do not indent manually) Journalize the deposit in a Federal Reserve bank on March 31, 2022, of the FiCA and federal income taoss payable to the government. (Round answers to 2 decimal places, eg. 15.25. Credit occount titles are outomatically indented when amount is entered. Do not indent manual (J

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started