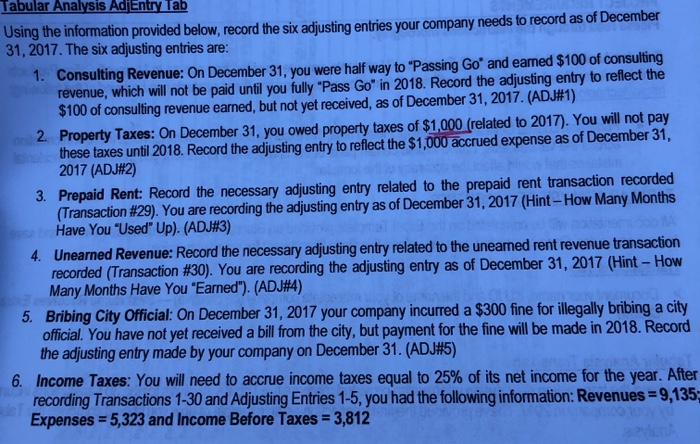

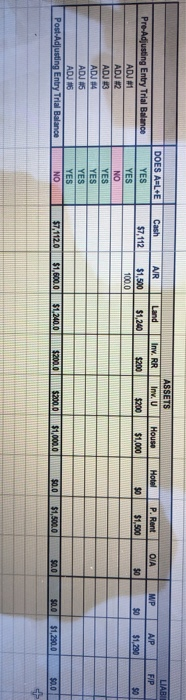

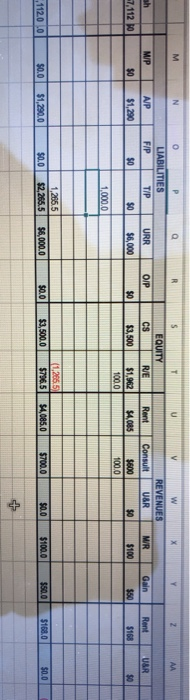

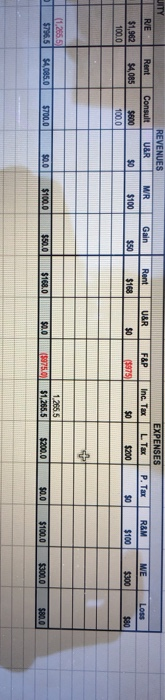

Tabular Analysis AdjEntry Tab Using the information provided below, record the six adjusting entries your company needs to record as of December 31, 2017. The six adjusting entries are: 1. Consulting Revenue: On December 31, you were half way to "Passing Go' and earned $100 of consulting revenue, which will not be paid until you fully "Pass Go" in 2018. Record the adjusting entry to reflect the $100 of consulting revenue earned, but not yet received, as of December 31, 2017. (ADJ#1) 2. Property Taxes: On December 31, you owed property taxes of $1,000 (related to 2017). You will not pay these taxes until 2018. Record the adjusting entry to reflect the $1,000 accrued expense as of December 31, 2017 (ADJ#2) 3. Prepaid Rent: Record the necessary adjusting entry related to the prepaid rent transaction recorded (Transaction #29). You are recording the adjusting entry as of December 31, 2017 (Hint - How Many Months Have You "Used Up). (ADJ#3) 4. Unearned Revenue: Record the necessary adjusting entry related to the uneamed rent revenue transaction recorded (Transaction #30). You are recording the adjusting entry as of December 31, 2017 (Hint - How Many Months Have You "Earned"). (ADJ#4) 5. Bribing City Official: On December 31, 2017 your company incurred a $300 fine for illegally bribing a city official. You have not yet received a bill from the city, but payment for the fine will be made in 2018. Record the adjusting entry made by your company on December 31. (ADJ#5) 6. Income Taxes: You will need to accrue income taxes equal to 25% of its net income for the year. After recording Transactions 1-30 and Adjusting Entries 1-5, you had the following information: Revenues = 9,135,- Expenses = 5,323 and Income Before Taxes = 3,812 Cash AR ASSETS I. ] House Hotel OIA MP Land $1,240 Inv, RR $200 LIABIE FIP $7,112 P. Rent $1.500 AP $1.299 $1,500 100.0 $200 $1,000 99 $0 $0 so Pre-Adjusting Entry Trial Balance ADJ #1 ADJ #2 ADJES ADJ 84 ADJ 16 ADJ 16 Post-Adjusting Entry Trial Balance DOES A LE YES YES NO YES YES YES YES NO $7.112.0 $1,500.0 $1,240.0 $200.0 $200.0 $1,000.0 $0.0 $1,500.0 $0.0 $0.0 $1,290.0 $0.0 M R un U w X z M EQUITY FIP O/IP LIABILITIES TIP $0 sh 7,112 0 AP $1,290 CS UAR URR $6,000 RE Rent $4,085 REVENUES U&R SO MIR $100 Gain $50 Rent $168 $0 Consult $600 100.0 SO $0 $3,500 $1,962 100.0 $0 1,000.0 1,286.5 $2,265.5 (1.206.5 $796.5 112.00 $0.0 $1,290.0 $0.0 $6,000.0 $0.0 $3,500.0 $4,085.0 $700.0 $0.0 $100.0 $50.0 $168.0 $0.0 UITY RE Rent MR Gain Rent U&R F&P REVENUES Consult UER $500 $0 100.0 R&M EXPENSES L. Tax $200 ME Loss $1,962 100.0 Inc. Tax $0 $1,085 P. Tax 90 $100 $50 $168 $0 ($975) $100 $300 $80 (1.265.5 $796.5 $4,085.0 $700.0 $0.0 $100.0 $50.0 1.265.5 $1,265.5 $168.0 $0.0 (5975.0) $200.0 $0.0 $100.0 $300.0 $80.0