Question

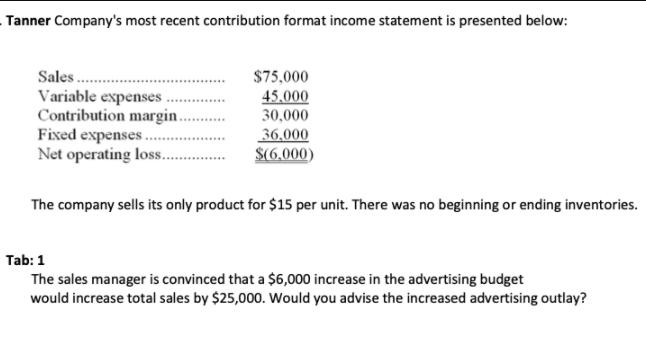

Tanner Company's most recent contribution format income statement is presented below: Sales. Variable expenses. Contribution margin. Fixed expenses. Net operating loss. $75,000 45.000 30,000

Tanner Company's most recent contribution format income statement is presented below: Sales. Variable expenses. Contribution margin. Fixed expenses. Net operating loss. $75,000 45.000 30,000 36,000 $(6.000) The company sells its only product for $15 per unit. There was no beginning or ending inventories. Tab: 1 The sales manager is convinced that a $6,000 increase in the advertising budget would increase total sales by $25,000. Would you advise the increased advertising outlay?

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A Total units sold 7500015 5000 Variable cost per unit 450005000 9 per unit Breakeven point is the l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Ray Garrison, Theresa Libby, Alan Webb

9th canadian edition

1259269477, 978-1259269479, 978-1259024900

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App