Question

Target Case (Static) [LO16-2, 16-3, 16-5, 16-8, 16-9] Target Corporation prepares its financial statements according to U.S. GAAP. Targets financial statements and disclosure notes for

Target Case (Static) [LO16-2, 16-3, 16-5, 16-8, 16-9] Target Corporation prepares its financial statements according to U.S. GAAP. Targets financial statements and disclosure notes for the year ended February 1, 2020, are available here. This material also is available under the Investor Relations link at the companys website (www.target.com).

Targets Note 18 indicates that We recognized a net tax benefit of $36 million and $372 million in 2018 and 2017, respectively, primarily because we remeasured our net deferred tax liabilities using the new lower U.S. corporate tax rate. What was the effect of the tax rate change on 2018 net income?

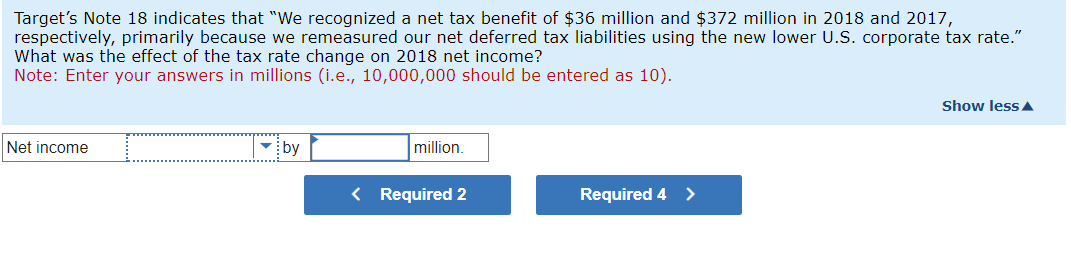

Target's Note 18 indicates that "We recognized a net tax benefit of $36 million and $372 million in 2018 and 2017 , respectively, primarily because we remeasured our net deferred tax liabilities using the new lower U.S. corporate tax rate." What was the effect of the tax rate change on 2018 net income? Note: Enter your answers in millions (i.e., 10,000,000 should be entered as 10 )

Target's Note 18 indicates that "We recognized a net tax benefit of $36 million and $372 million in 2018 and 2017 , respectively, primarily because we remeasured our net deferred tax liabilities using the new lower U.S. corporate tax rate." What was the effect of the tax rate change on 2018 net income? Note: Enter your answers in millions (i.e., 10,000,000 should be entered as 10 ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started