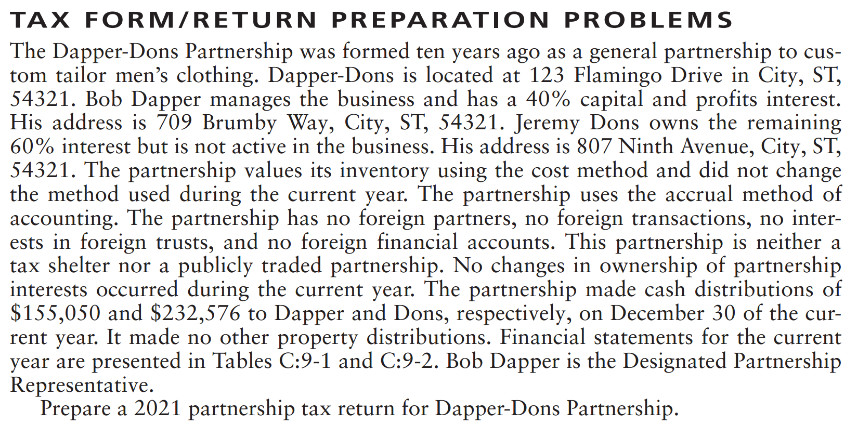

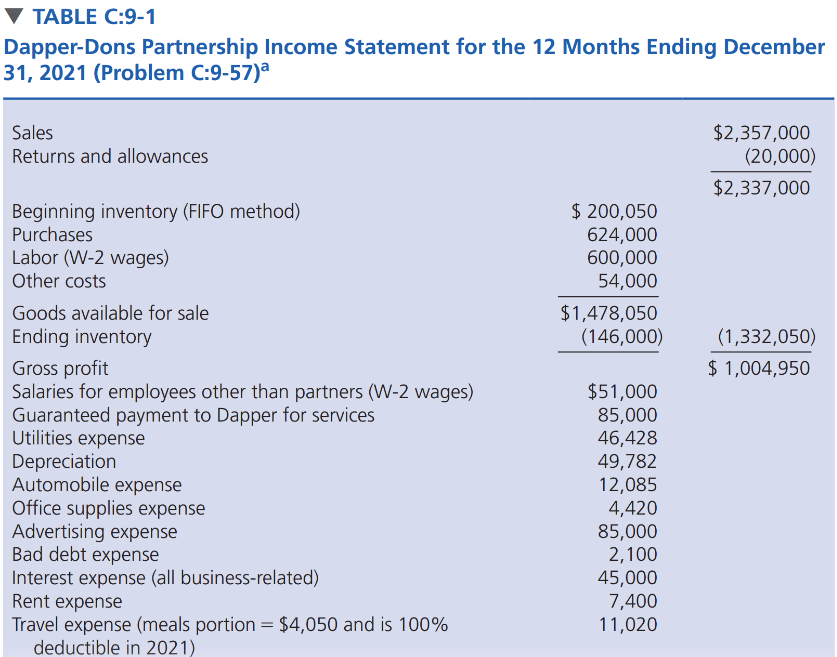

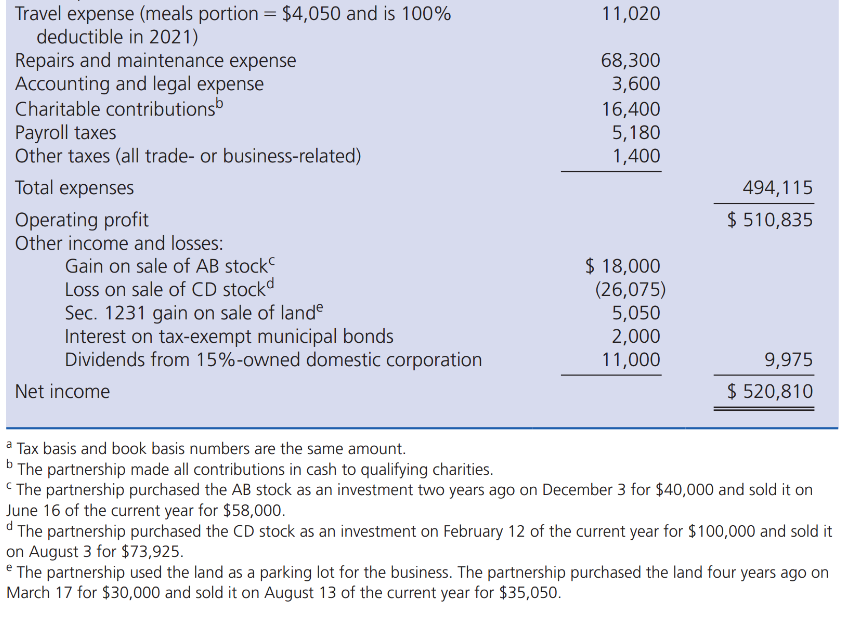

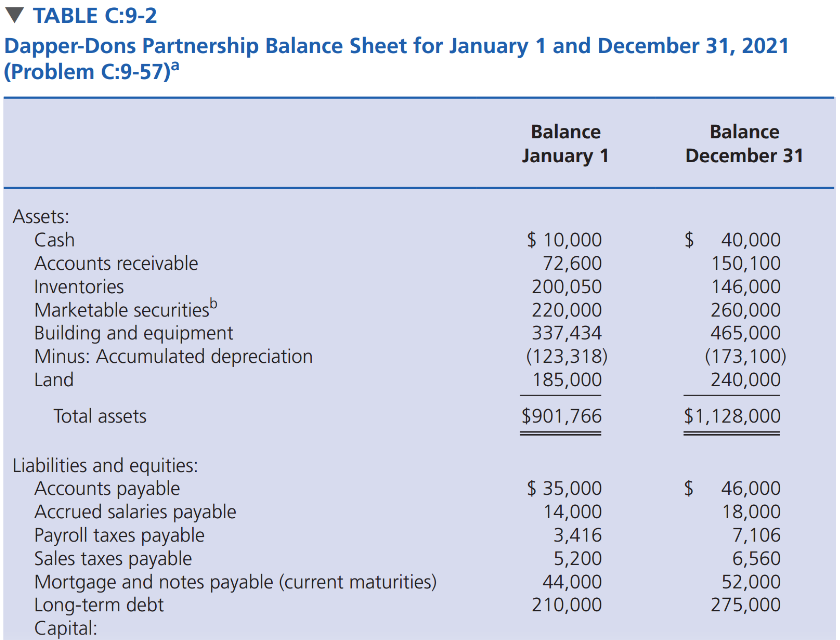

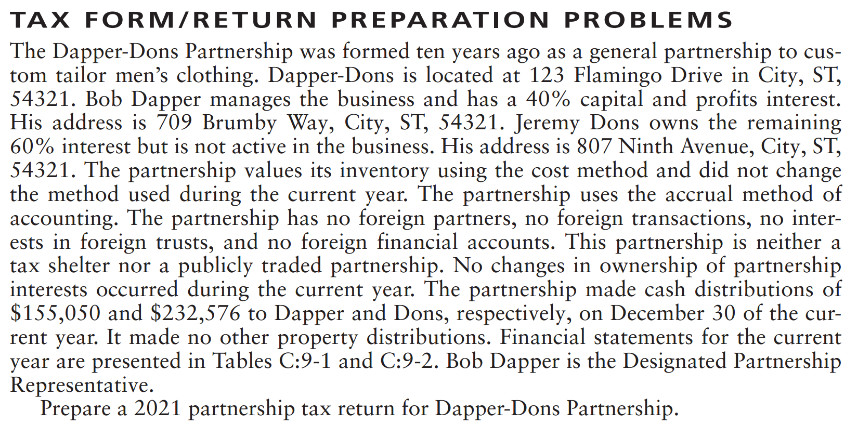

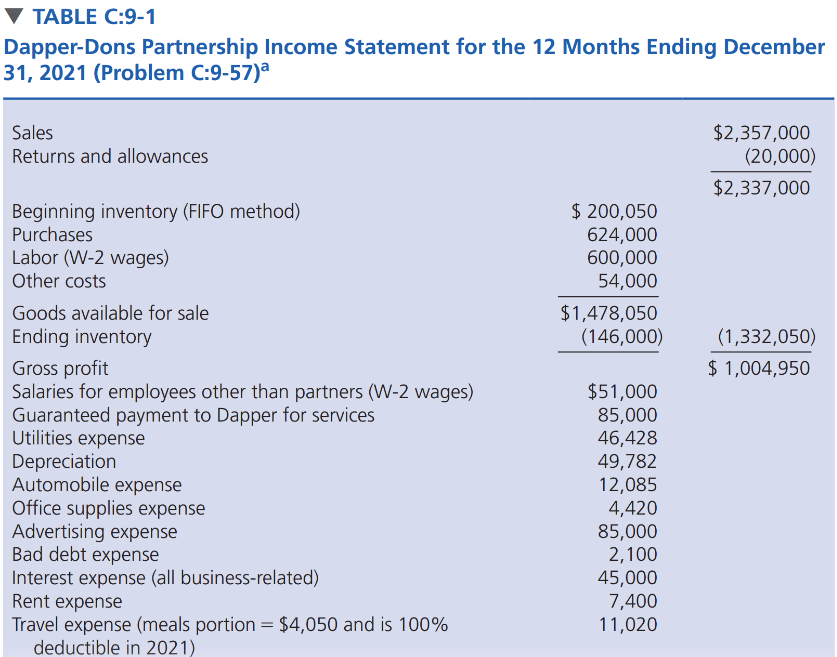

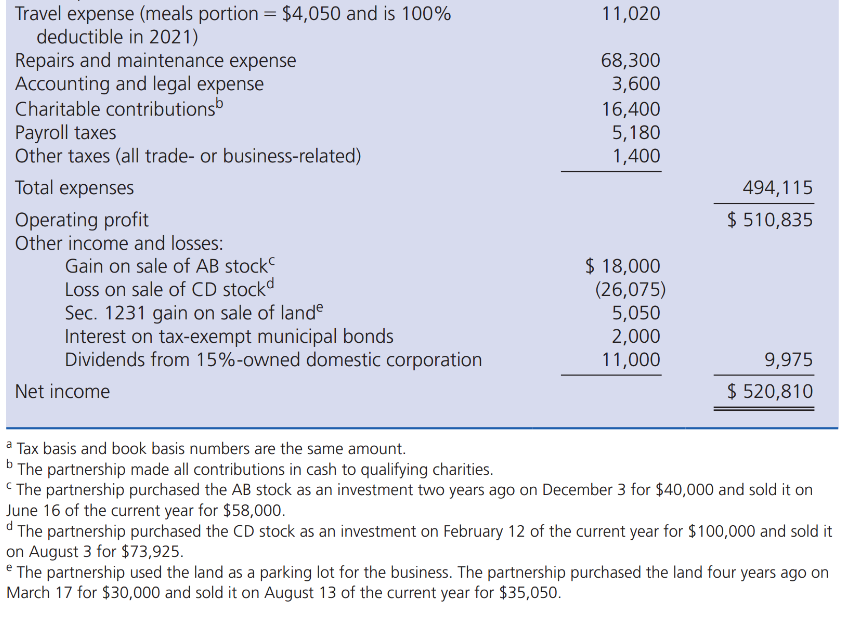

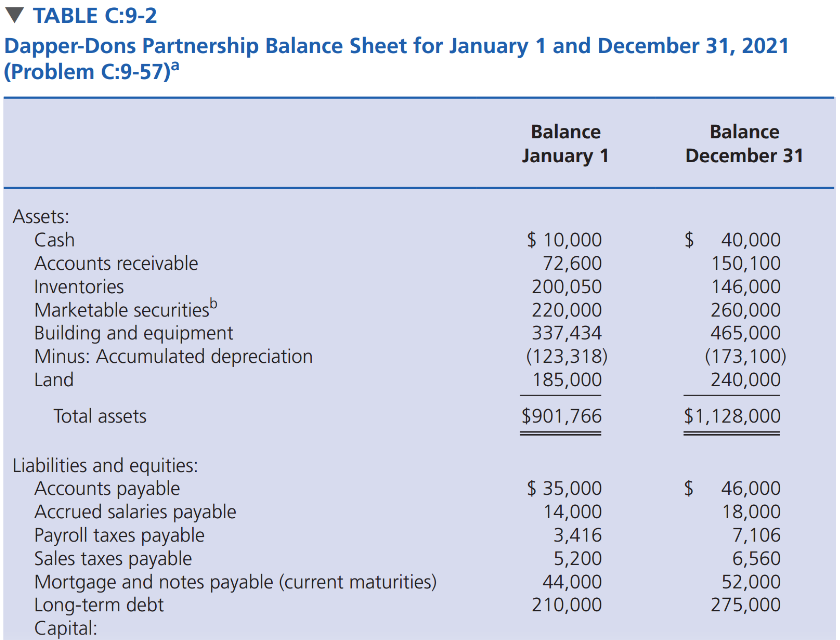

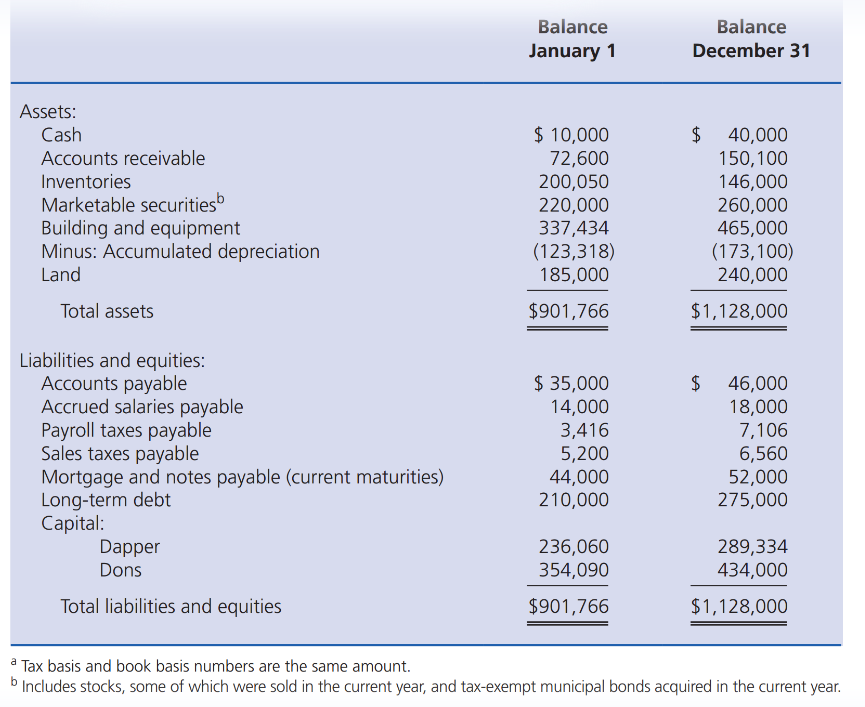

TAX FORM/RETURN PREPARATION PROBLEMS C:9-57 The Dapper-Dons Partnership was formed ten years ago as a general partnership to custom tailor mens clothing. Dapper-Dons is located at 123 Flamingo Drive in City, ST, 54321. Bob Dapper manages the business and has a 40% capital and profits interest. His address is 709 Brumby Way, City, ST, 54321. Jeremy Dons owns the remaining 60% interest but is not active in the business. His address is 807 Ninth Avenue, City, ST, 54321. The partnership values its inventory using the cost method and did not change the method used during the current year. The partnership uses the accrual method of accounting. The partnership has no foreign partners, no foreign transactions, no interests in foreign trusts, and no foreign financial accounts. This partnership is neither a tax shelter nor a publicly traded partnership. No changes in ownership of partnership interests occurred during the current year. The partnership made cash distributions of $155,050 and $232,576 to Dapper and Dons, respectively, on December 30 of the current year. It made no other property distributions. Financial statements for the current year are presented in Tables C:9-1 and C:9-2. Bob Dapper is the Designated Partnership Representative. Prepare a 2021 partnership tax return for Dapper-Dons Partnership.

Forms needed:

- schedule D (form 1065)

- 4797

- 1065 - m1 & m2

- Schedule B-1 (ownership form)

- 1125-A

- K-1 for the 40% partner).

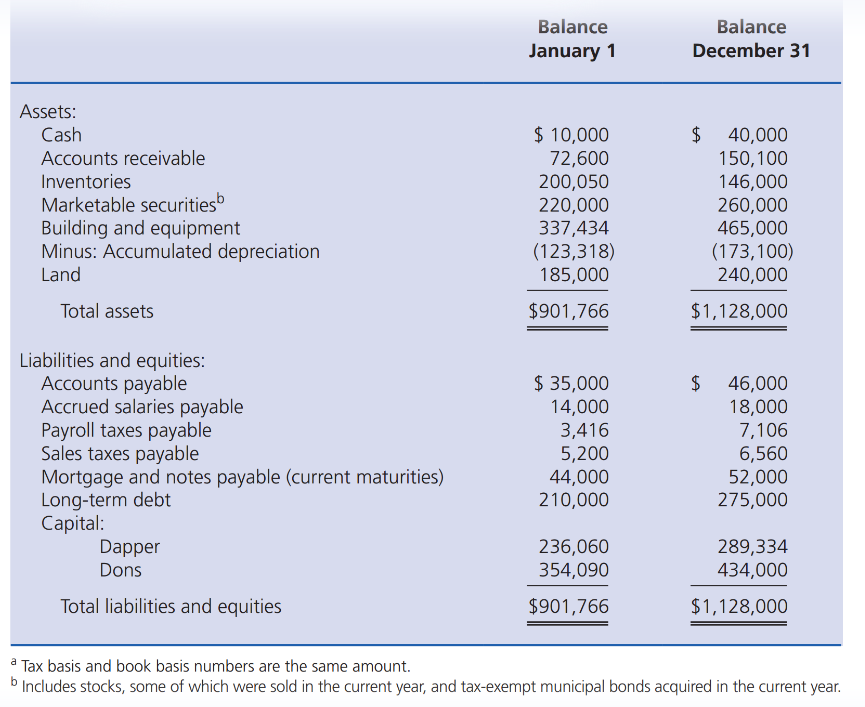

TAX FORM /RETURN PREPARATION PROBLEMS The Dapper-Dons Partnership was formed ten years ago as a general partnership to custom tailor men's clothing. Dapper-Dons is located at 123 Flamingo Drive in City, ST, 54321. Bob Dapper manages the business and has a 40% capital and profits interest. His address is 709 Brumby Way, City, ST, 54321. Jeremy Dons owns the remaining 60% interest but is not active in the business. His address is 807 Ninth Avenue, City, ST, 54321. The partnership values its inventory using the cost method and did not change the method used during the current year. The partnership uses the accrual method of accounting. The partnership has no foreign partners, no foreign transactions, no interests in foreign trusts, and no foreign financial accounts. This partnership is neither a tax shelter nor a publicly traded partnership. No changes in ownership of partnership interests occurred during the current year. The partnership made cash distributions of $155,050 and $232,576 to Dapper and Dons, respectively, on December 30 of the current year. It made no other property distributions. Financial statements for the current year are presented in Tables C:9-1 and C:9-2. Bob Dapper is the Designated Partnership Representative. Prepare a 2021 partnership tax return for Dapper-Dons Partnership. TABLE C:9-1 Dapper-Dons Partnership Income Statement for the 12 Months Ending December 31 20>1 (Prnhlem r957)a 2 Tax basis and book basis numbers are the same amount. The partnership made all contributions in cash to qualifying charities. c The partnership purchased the AB stock as an investment two years ago on December 3 for $40,000 and sold it on June 16 of the current year for $58,000. d The partnership purchased the CD stock as an investment on February 12 of the current year for $100,000 and sold it on August 3 for $73,925. e The partnership used the land as a parking lot for the business. The partnership purchased the land four years ago on March 17 for $30,000 and sold it on August 13 of the current year for $35,050. TABLE C:9-2 Dapper-Dons Partnership Balance Sheet for January 1 and December 31, 2021 lax nasis allu nuuk nasis muminels ale mie salle allvuill. b Includes stocks, some of which were sold in the current year, and tax-exempt municipal bonds acquired in the current year. TAX FORM /RETURN PREPARATION PROBLEMS The Dapper-Dons Partnership was formed ten years ago as a general partnership to custom tailor men's clothing. Dapper-Dons is located at 123 Flamingo Drive in City, ST, 54321. Bob Dapper manages the business and has a 40% capital and profits interest. His address is 709 Brumby Way, City, ST, 54321. Jeremy Dons owns the remaining 60% interest but is not active in the business. His address is 807 Ninth Avenue, City, ST, 54321. The partnership values its inventory using the cost method and did not change the method used during the current year. The partnership uses the accrual method of accounting. The partnership has no foreign partners, no foreign transactions, no interests in foreign trusts, and no foreign financial accounts. This partnership is neither a tax shelter nor a publicly traded partnership. No changes in ownership of partnership interests occurred during the current year. The partnership made cash distributions of $155,050 and $232,576 to Dapper and Dons, respectively, on December 30 of the current year. It made no other property distributions. Financial statements for the current year are presented in Tables C:9-1 and C:9-2. Bob Dapper is the Designated Partnership Representative. Prepare a 2021 partnership tax return for Dapper-Dons Partnership. TABLE C:9-1 Dapper-Dons Partnership Income Statement for the 12 Months Ending December 31 20>1 (Prnhlem r957)a 2 Tax basis and book basis numbers are the same amount. The partnership made all contributions in cash to qualifying charities. c The partnership purchased the AB stock as an investment two years ago on December 3 for $40,000 and sold it on June 16 of the current year for $58,000. d The partnership purchased the CD stock as an investment on February 12 of the current year for $100,000 and sold it on August 3 for $73,925. e The partnership used the land as a parking lot for the business. The partnership purchased the land four years ago on March 17 for $30,000 and sold it on August 13 of the current year for $35,050. TABLE C:9-2 Dapper-Dons Partnership Balance Sheet for January 1 and December 31, 2021 lax nasis allu nuuk nasis muminels ale mie salle allvuill. b Includes stocks, some of which were sold in the current year, and tax-exempt municipal bonds acquired in the current year