Answered step by step

Verified Expert Solution

Question

1 Approved Answer

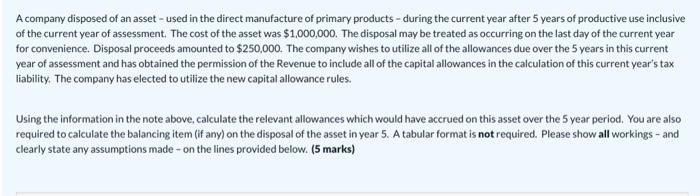

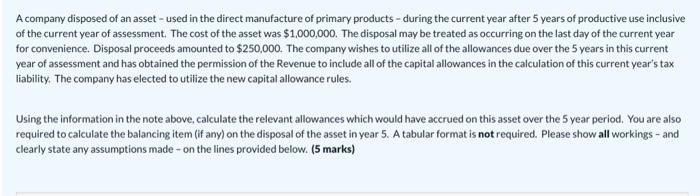

taxation A company disposed of an asset - used in the direct manufacture of primary products - during the current year after 5 years of

taxation

A company disposed of an asset - used in the direct manufacture of primary products - during the current year after 5 years of productive use inclusive of the current year of assessment. The cost of the asset was $1,000,000. The disposal may be treated as occurring on the last day of the current year for convenience. Disposal proceeds amounted to $250,000. The company wishes to utilize all of the allowances due over the 5 years in this current year of assessment and has obtained the permission of the Revenue to include all of the capital allowances in the calculation of this current year's tax liability. The company has elected to utilize the new capital allowance rules. Using the information in the note above, calculate the relevant allowances which would have accrued on this asset over the 5 year period. You are also required to calculate the balancing item (if any) on the disposal of the asset in year 5. A tabular format is not required. Please show all workings - and clearly state any assumptions made - on the lines provided below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started