Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tayfun is just admitted to a 2-year program at a community college and he considers taking a loan from a bank in order to

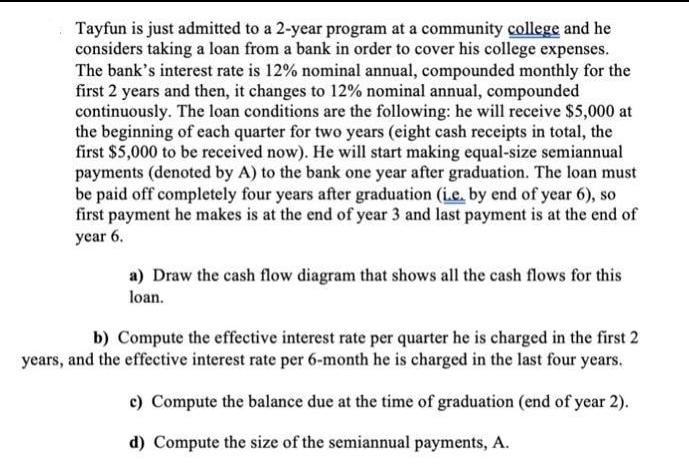

Tayfun is just admitted to a 2-year program at a community college and he considers taking a loan from a bank in order to cover his college expenses. The bank's interest rate is 12% nominal annual, compounded monthly for the first 2 years and then, it changes to 12% nominal annual, compounded continuously. The loan conditions are the following: he will receive $5,000 at the beginning of each quarter for two years (eight cash receipts in total, the first $5,000 to be received now). He will start making equal-size semiannual payments (denoted by A) to the bank one year after graduation. The loan must be paid off completely four years after graduation (i.e. by end of year 6), so first payment he makes is at the end of year 3 and last payment is at the end of year 6. a) Draw the cash flow diagram that shows all the cash flows for this loan. b) Compute the effective interest rate per quarter he is charged in the first 2 years, and the effective interest rate per 6-month he is charged in the last four years. c) Compute the balance due at the time of graduation (end of year 2). d) Compute the size of the semiannual payments, A.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started