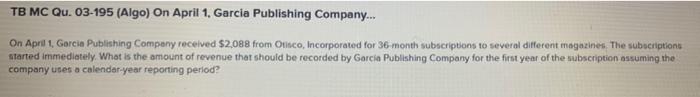

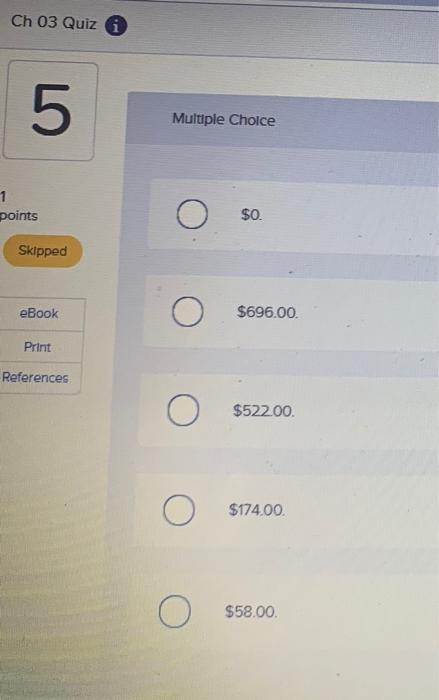

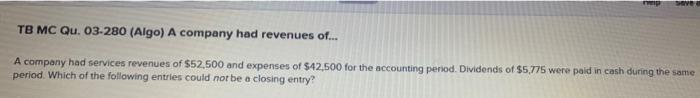

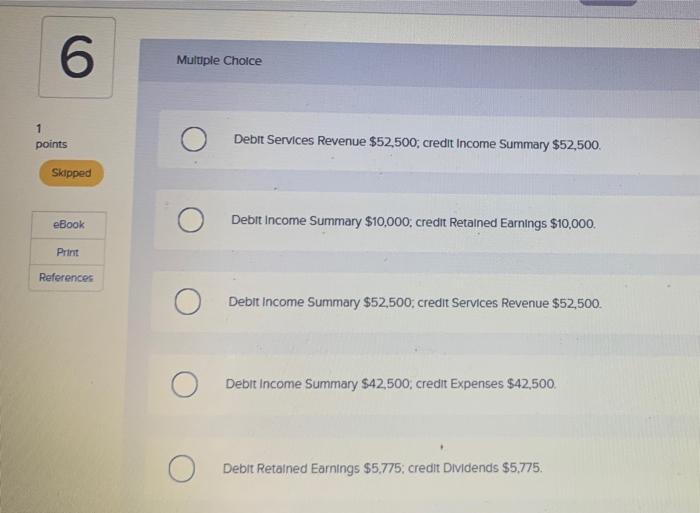

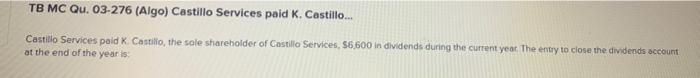

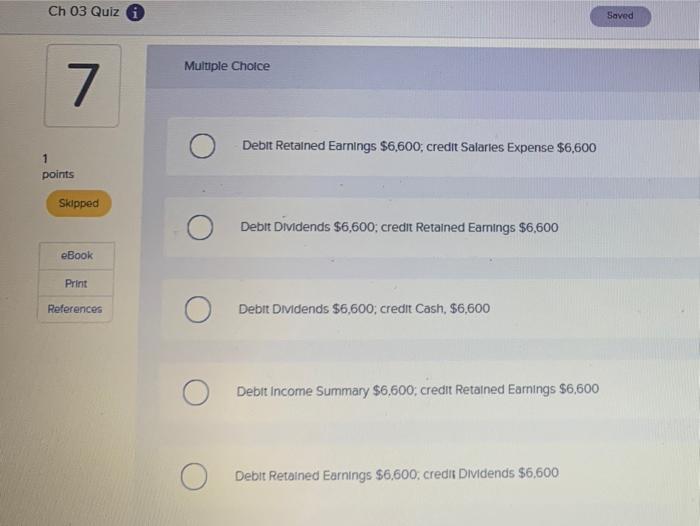

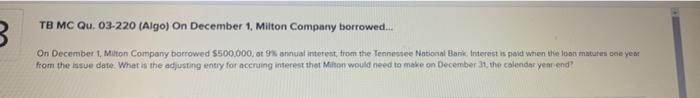

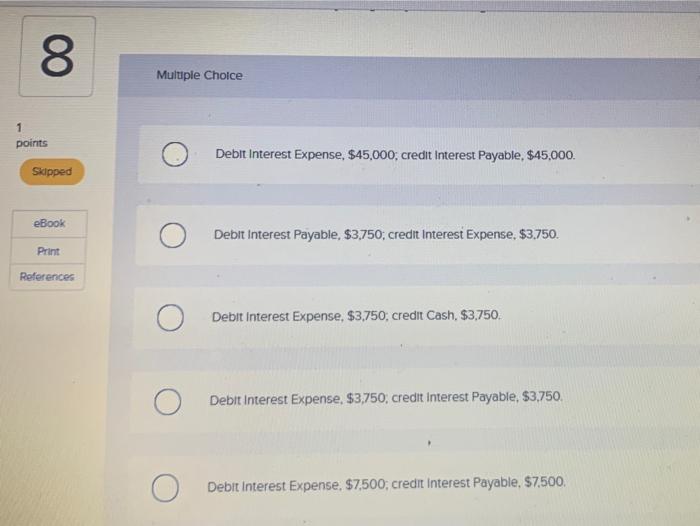

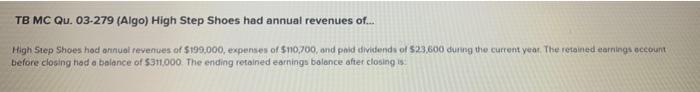

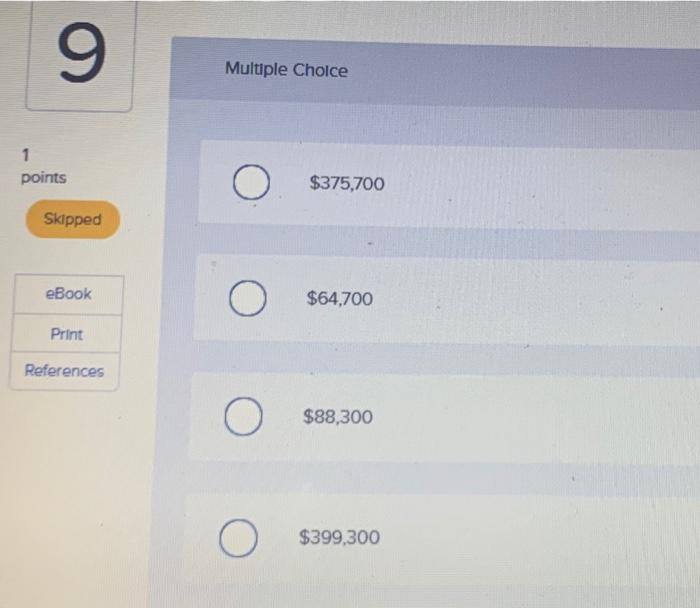

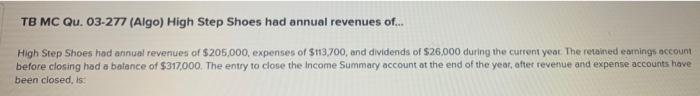

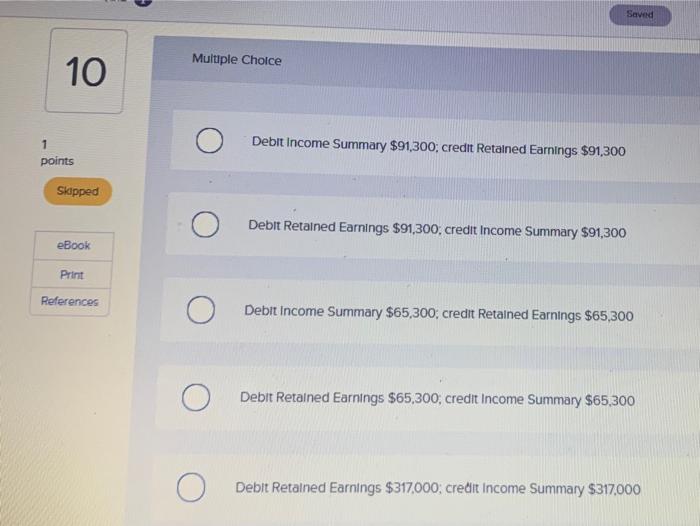

TB MC Qu. 03-195 (Algo) On April 1, Garcia Publishing Company... On April 1, Garcia Publishing Company received $2,088 from Ollsco, Incorporated for 36 month subscriptions to several different magazines. The subscriptions started immediately. What is the amount of revenue that should be recorded by Garcia Publishing Company for the first year of the subscription assuming the company uses a calendar-year reporting period? Ch 03 Quiz i 5 Multiple Choice 1 points O $0. Skipped eBook $696.00. Print References O $522.00 O $174.00 $58.00 p Save TB MC Qu. 03-280 (Algo) A company had revenues of... A company had services revenues of $52,500 and expenses of $42,500 for the accounting period. Dividends of $5.775 were paid in cash during the same period. Which of the following entries could not be a closing entry? 6 Multiple Choice 1 points Debit Services Revenue $52,500, credit Income Summary $52,500. Skipped eBook Debit Income Summary $10,000 credit Retained Earnings $10,000. Print References Debit Income Summary $52,500. credit Services Revenue $52,500. Debit Income Summary $42,500, credit Expenses $42,500 Debit Retained Earnings $5.775credit Dividends $5.775. TB MC Qu. 03-276 (Algo) Castillo Services paid K. Castillo... Castillo Services paid K. Castillo, the sole shareholder of Castillo Services, 56.600 in dividends during the current year. The entry to close the dividends account at the end of the year is Ch 03 Quiz Saved Multiple Choice 7 Debit Retained Earnings $6,600; credit Salaries Expense $6,600 1 points Skipped Debit Dividends $6,600; credit Retained Earings $6,600 eBook Print References Debit Dividends $6,600; credit Cash, $6,600 Debit Income Summary $6.600; credit Retained Earnings $6,600 Debit Retained Earnings $6,600, credit Dividends $6,600 TB MC Qu. 03-220 (Algo) On December 1, Milton Company borrowed. 3 On December 1, Milton Company borrowed $500,000, at 9% annual interest, from the Tennessee National Bank. Interest is paid when the loan matutes coe year from the issue date. What is the adjusting entry for accruing interest that Milton would need to make on December 31, the calendar year end 8 Multiple Choice 1 points Debit Interest Expense, $45,000, credit Interest Payable, $45,000. Skipped eBook Debit interest Payable, $3,750, credit Interest Expense, $3,750. Print References Debit interest Expense, $3,750, credit Cash, $3,750. Debit interest Expense, $3,750, credit Interest Payable, $3,750, Debit Interest Expense, $7,500, credit interest Payable, $7,500. TB MC Qu. 03-279 (Algo) High Step Shoes had annual revenues of... High Step Shoes had annual revenues of $199,000, expenses of $10,700, and paid dividends of 523,600 during the current year. The retained earnings account before closing had a balance of $311.000 The ending retained earnings balance after closing is 9 Multiple Choice 1 points O $375,700 Skipped eBook O $64.700 Print References . $88,300 O $399,300 TB MC Qu. 03-277 (Algo) High Step Shoes had annual revenues of... High Step Shoes had annual revenues of $205,000, expenses of $13,700, and dividends of $26.000 during the current year. The retained earnings account before closing had a balance of $317.000. The entry to close the income Summary account at the end of the year after revenue and expense accounts have been closed, is Saved Multiple Choice 10 Debit Income Summary $91,300, credit Retained Earnings $91,300 points Skipped Debit Retained Earnings $91,300, credit Income Summary $91,300 eBook Print References Debit Income Summary $65,300, credit Retained Earnings $65,300 O Debit Retained Earnings $65,300, credit Income Summary $65,300 Debit Retained Earnings $317.000, credit Income Summary $317.000