Question

Temple pays out 50% of net income as dividends and has a 20% tax rate. Managers at Temple Brewery are interested in estimating the market

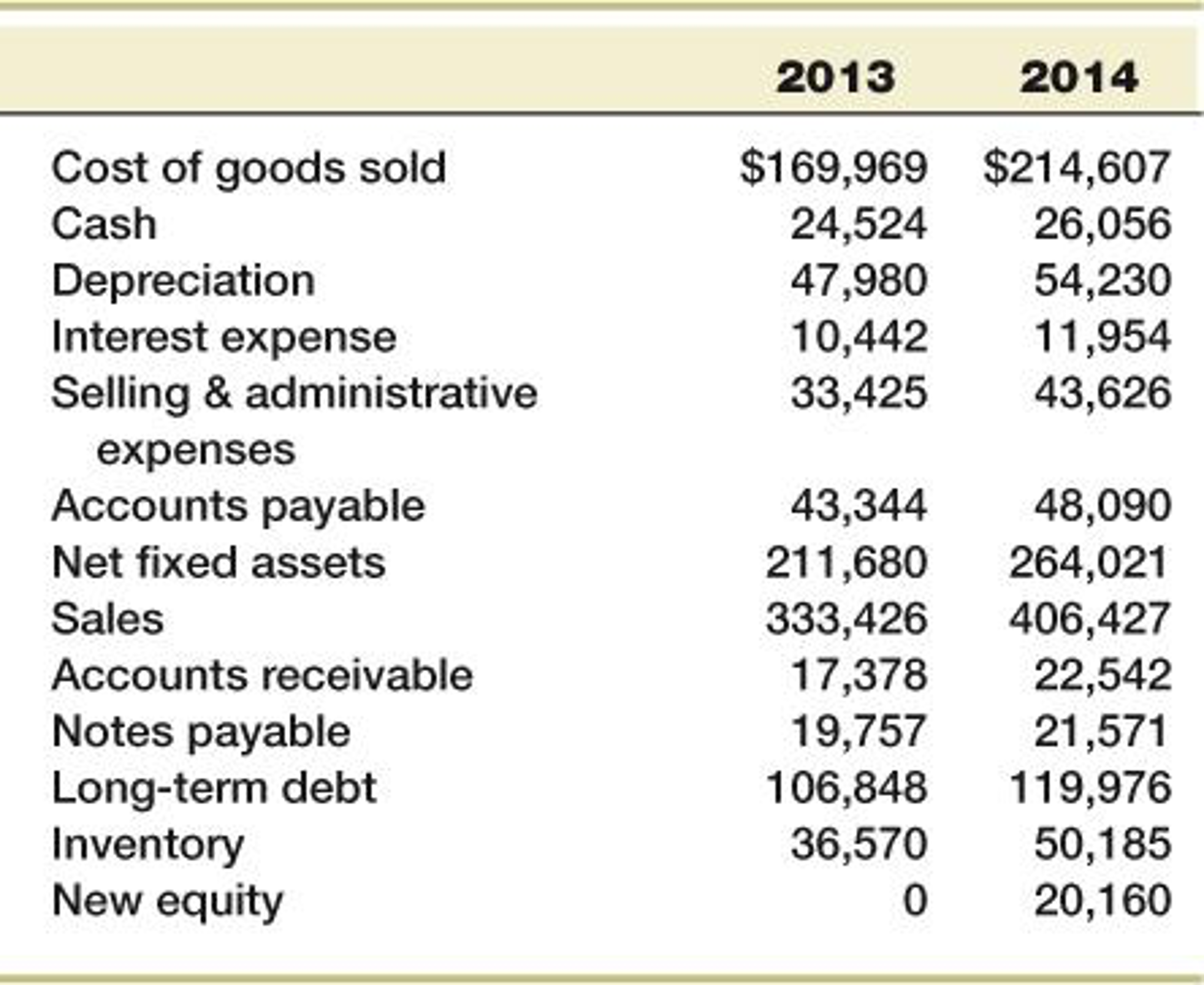

Temple pays out 50% of net income as dividends and has a 20% tax rate.

Managers at Temple Brewery are interested in estimating the market value of the firms equity. They have asked to make this estimate based on the EV/EBITDA multiple of the Alcoholic beverage industry found at: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/vebitda.html

Assume that the market value of long-term debt equals its book value.

You have been asked to create pro-forma statements to assist in planning for the upcoming year 2015. Temple Brewerys CEO would like you to assume that growth in sales is expected to remain equal to the growth experienced from 2013 to 2014. Interest expenses are assumed to remain constant; the tax rate and the dividend payout rate will also remain constant. For simplicity, costs, depreciation, other expenses, current assets, and accounts payable increase spontaneously with sales. The growth in sales will result in a fixed asset investment of $50,000 since the firm is operating at nearly 100% capacity.

a. Build the pro forma income statement and balance sheet.

b. How much is external funding needed?

c. Would you prefer to assume that the company will grow at the sustainable or internal

growth rate as another scenario to compare it against the growth rate you used? Why or why not? What is the difference in assumptions between using the sustainable and internal growth rates?

d. Would you suggest a change in dividend policy to cover EFN? Why or why not? Justify e. Would a change in dividend policy have an impact on the value of the firm? Why or why

not? Justify

e. If you are asked to further analyze to performance of Temple Brewery, what specific suggestions would you make to the CEO? Provide 5 recommendations and justify how these recommendations are relevant.

2013 2014 Cost of goods sold Cash Depreciation Interest expense Selling & administrative $169,969 $214,607 24,52426,056 54,230 11,954 33,42543,626 47,980 10,442 expenses Accounts payable Net fixed assets Sales Accounts receivable Notes payable Long-term debt Inventory New equity 43,344 48,090 211,680 264,021 333,426 406,427 17,378 22,54;2 21,571 106,848 119,976 36,570 50,185 20,160 19,757 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started