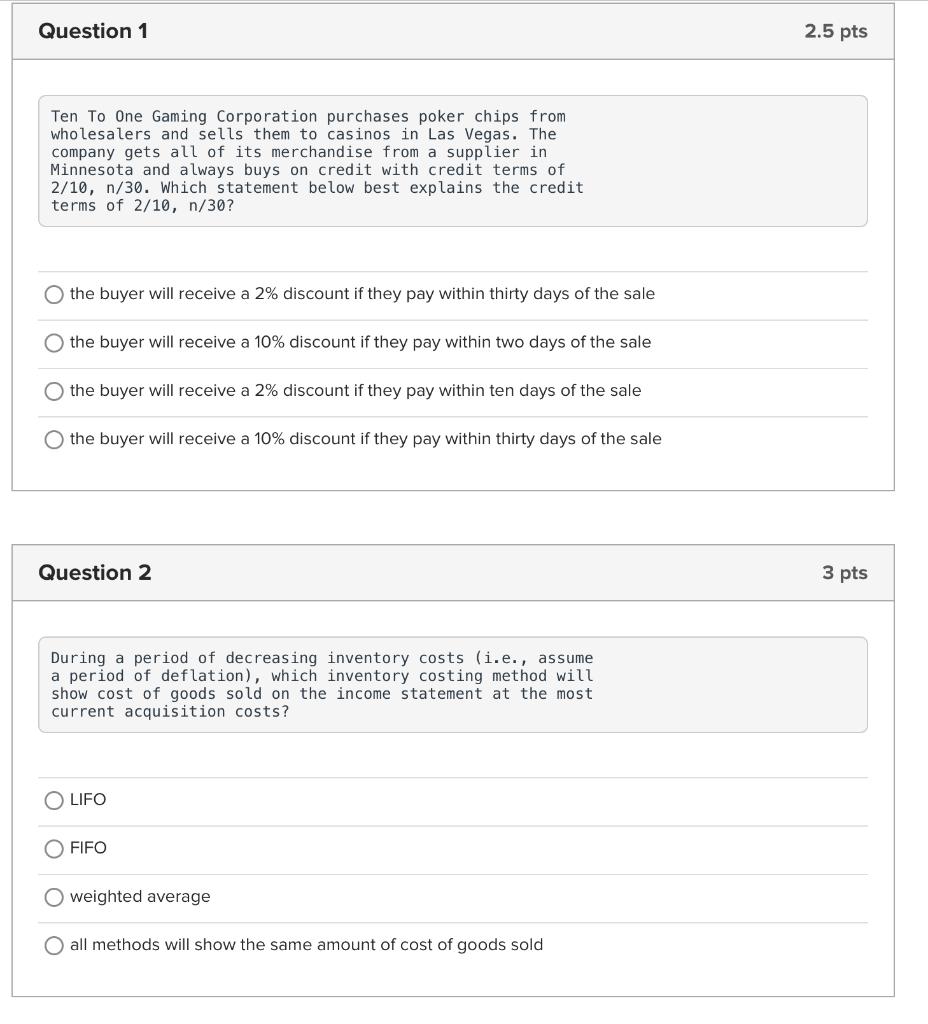

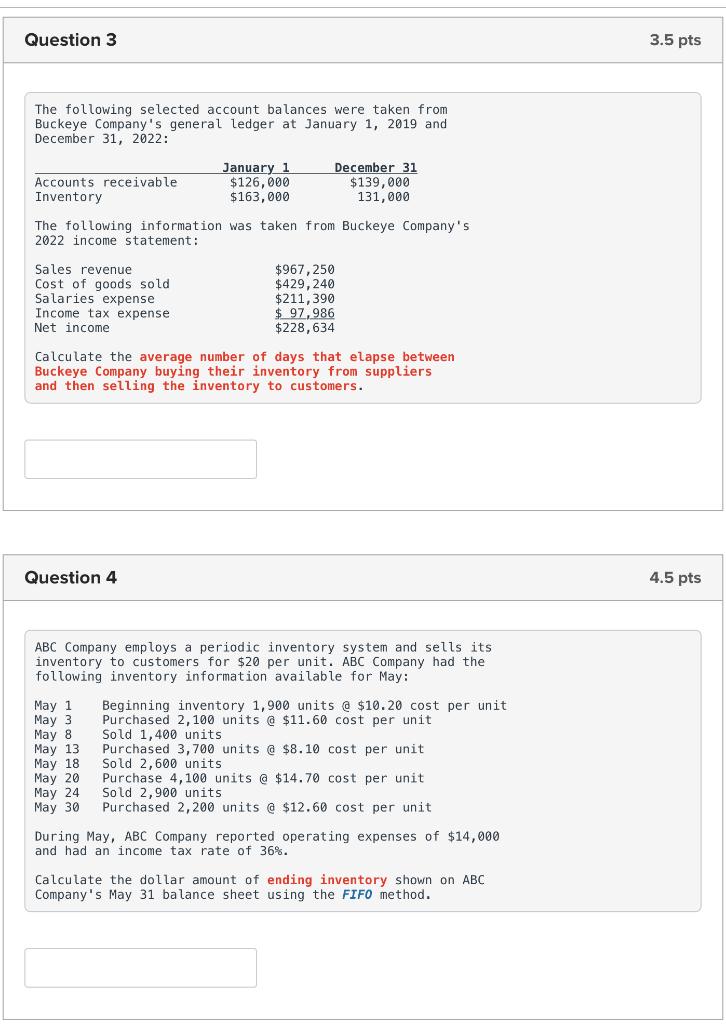

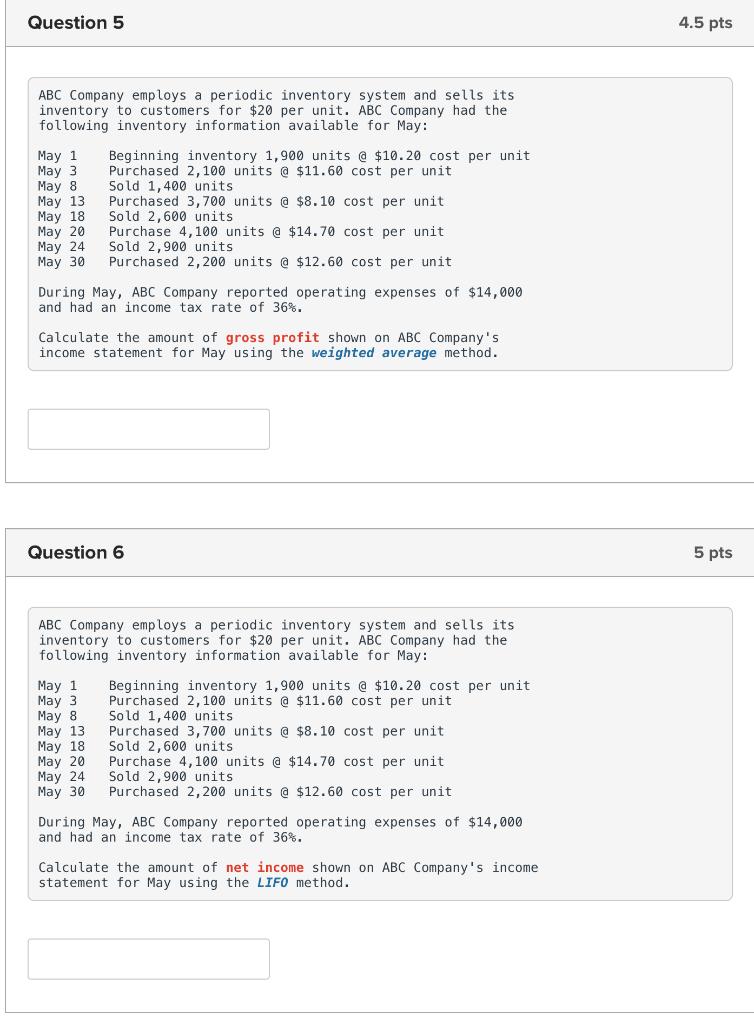

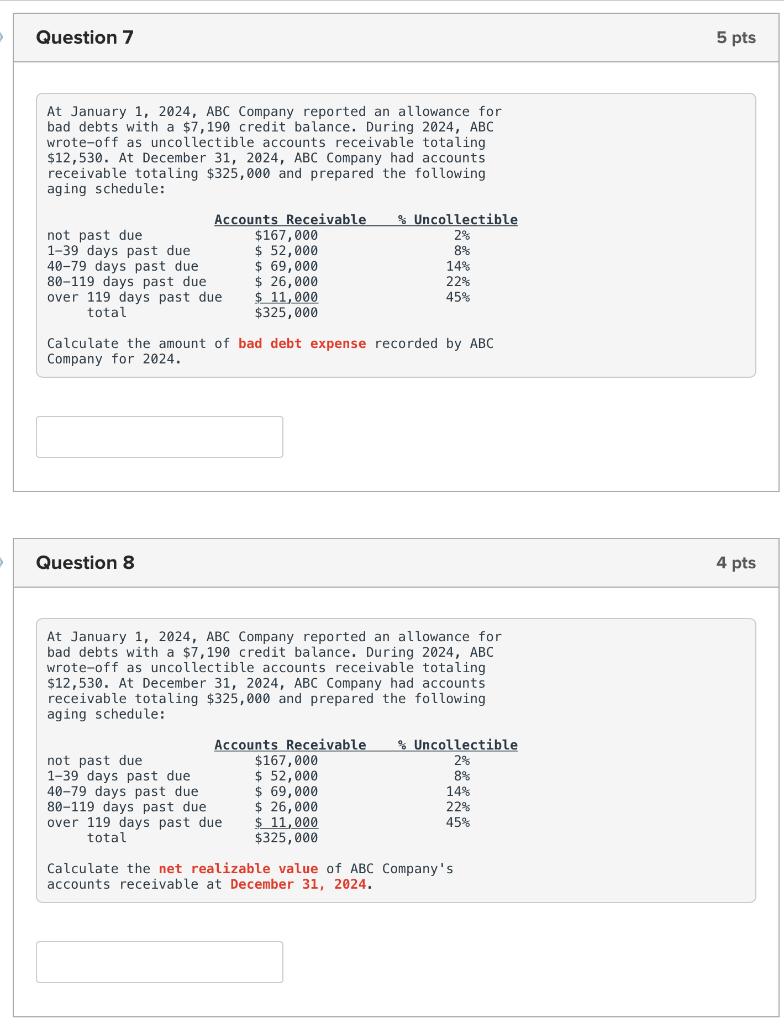

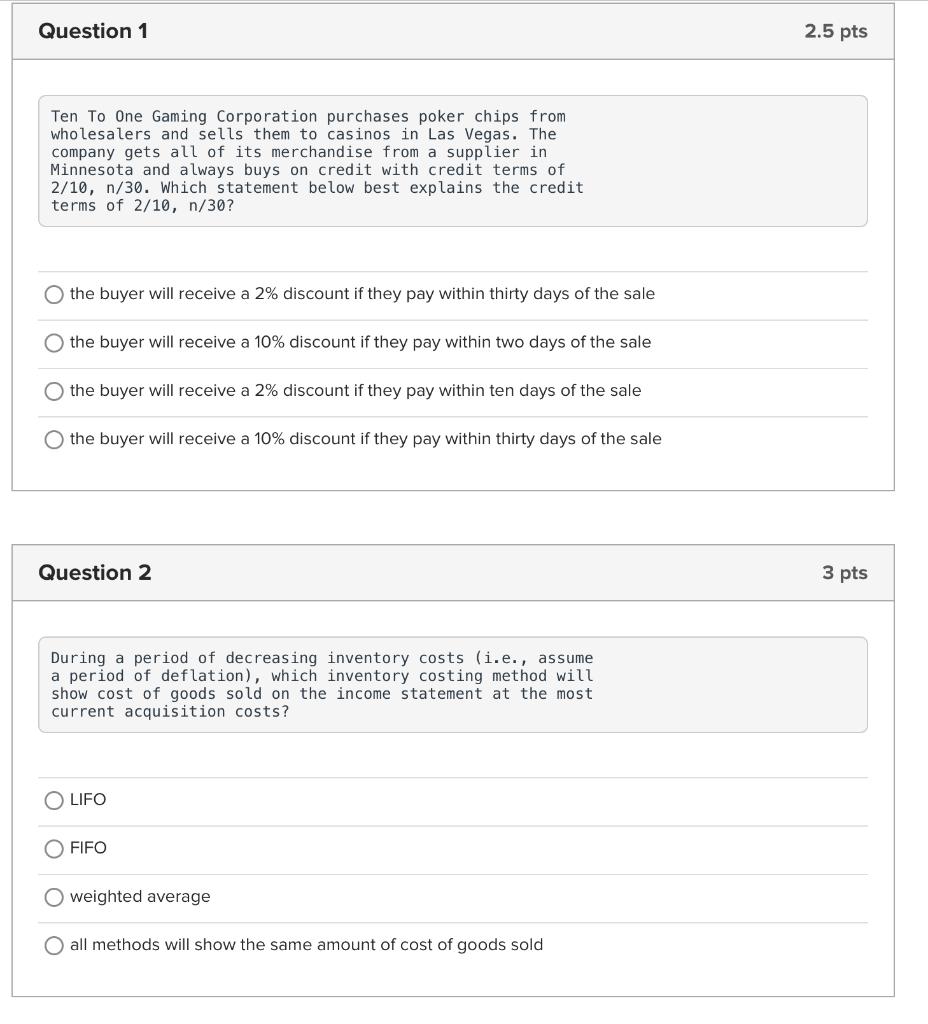

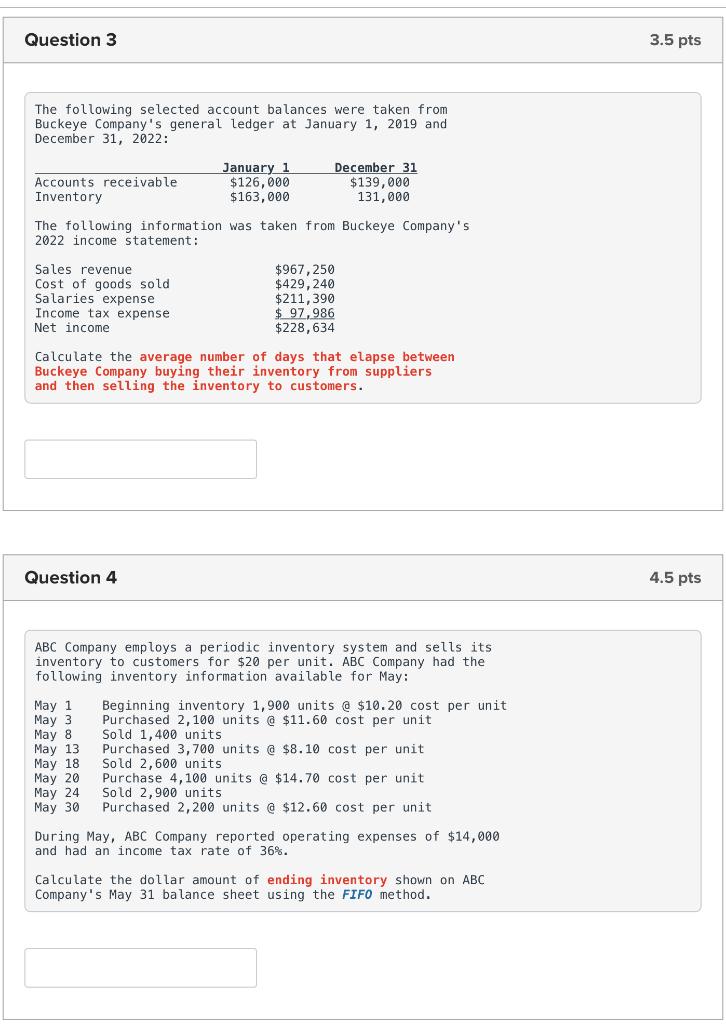

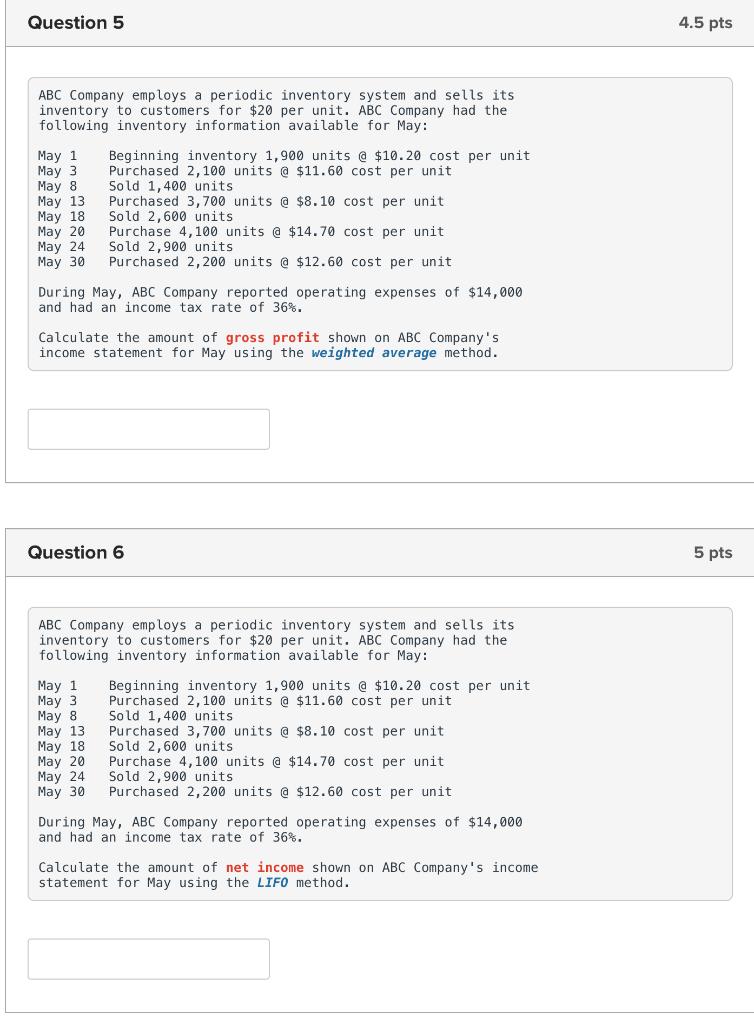

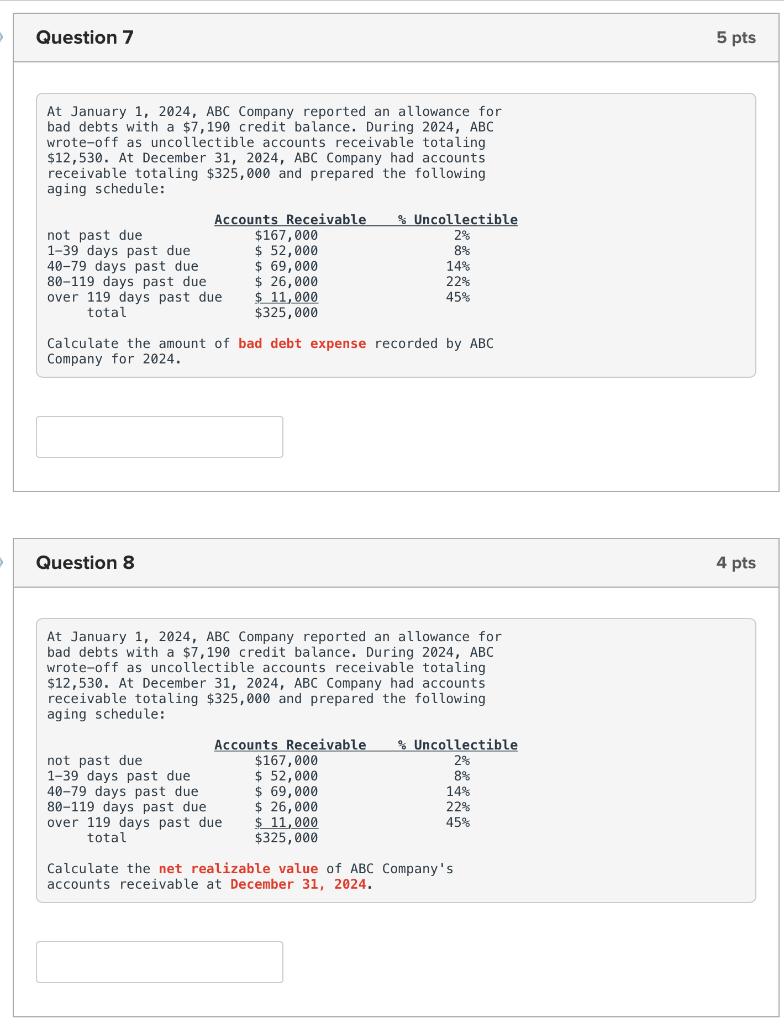

Ten To One Gaming Corporation purchases poker chips from wholesalers and sells them to casinos in Las Vegas. The company gets all of its merchandise from a supplier in Minnesota and always buys on credit with credit terms of 2/10,n/30. Which statement below best explains the credit terms of 2/10,n/30 ? the buyer will receive a 2% discount if they pay within thirty days of the sale the buyer will receive a 10% discount if they pay within two days of the sale the buyer will receive a 2% discount if they pay within ten days of the sale the buyer will receive a 10% discount if they pay within thirty days of the sale Question 2 3 pts During a period of decreasing inventory costs (i.e., assume a period of deflation), which inventory costing method will show cost of goods sold on the income statement at the most current acquisition costs? LIFO FIFO weighted average all methods will show the same amount of cost of goods sold The following selected account balances were taken from Buckeye Company's general ledger at January 1, 2019 and December 31, 2022: The following information was taken from Buckeye Company's 2022 income statement: Calculate the average number of days that elapse between Buckeye Company buying their inventory from suppliers and then selling the inventory to customers. Question 4 ABC Company employs a periodic inventory system and sells its inventory to customers for $20 per unit. ABC Company had the following inventory information available for May: May 1 Beginning inventory 1,900 units @ $10.20 cost per unit May 3 Purchased 2,100 units @ $11.60 cost per unit May 8 Sold 1,400 units May 13 Purchased 3,700 units a $8.10 cost per unit May 18 Sold 2,600 units May 20 Purchase 4,100 units @ $14.70 cost per unit May 24 Sold 2,900 units May 30 Purchased 2,200 units @ $12.60 cost per unit During May, ABC Company reported operating expenses of $14,000 and had an income tax rate of 36%. Calculate the dollar amount of ending inventory shown on ABC Company's May 31 balance sheet using the FIFO method. ABC Company employs a periodic inventory system and sells its inventory to customers for $20 per unit. ABC Company had the following inventory information available for May: May 1 Beginning inventory 1,900 units @ $10.20 cost per unit May 3 Purchased 2,100 units @ $11.60 cost per unit May 8 Sold 1,400 units May 13 Purchased 3,700 units @ $8.10 cost per unit May 18 Sold 2,600 units May 20 Purchase 4,100 units @ $14.70 cost per unit May 24 Sold 2,900 units May 30 Purchased 2,200 units @ $12.60 cost per unit During May, ABC Company reported operating expenses of $14,000 and had an income tax rate of 36%. Calculate the amount of gross profit shown on ABC Company's income statement for May using the weighted average method. Question 6 ABC Company employs a periodic inventory system and sells its inventory to customers for $20 per unit. ABC Company had the following inventory information available for May: May 1 Beginning inventory 1,900 units @ $10.20 cost per unit May 3 Purchased 2,100 units @ $11.60 cost per unit May 8 Sold 1,400 units May 13 Purchased 3,700 units @ $8.10 cost per unit May 18 Sold 2,600 units May 20 Purchase 4,100 units e $14.70 cost per unit May 24 Sold 2,900 units May 30 Purchased 2,200 units @ $12.60 cost per unit During May, ABC Company reported operating expenses of $14,000 and had an income tax rate of 36%. Calculate the amount of net income shown on ABC Company's income statement for May using the LIFO method. At January 1,2024, ABC Company reported an allowance for bad debts with a $7,190 credit balance. During 2024, ABC wrote-off as uncollectible accounts receivable totaling $12,530. At December 31, 2024, ABC Company had accounts receivable totaling $325,000 and prepared the following aging schedule: Calculate the amount of bad debt expense recorded by ABC Company for 2024 . Question 8 At January 1, 2024, ABC Company reported an allowance for bad debts with a $7,190 credit balance. During 2024, ABC wrote-off as uncollectible accounts receivable totaling $12,530. At December 31,2024 , ABC Company had accounts receivable totaling $325,000 and prepared the following aging schedule: Calculate the net realizable value of ABC Company's accounts receivable at December 31, 2024