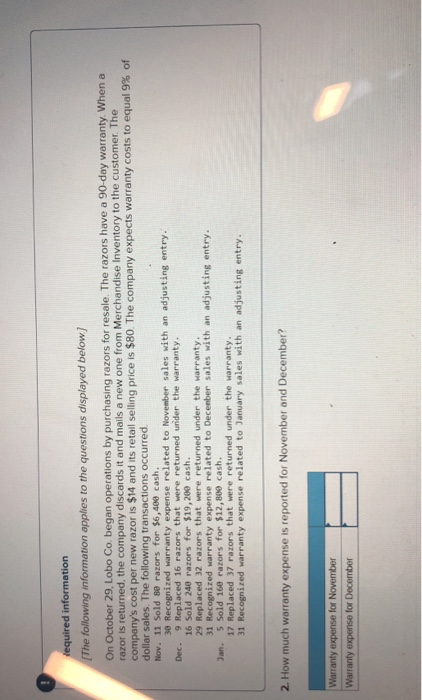

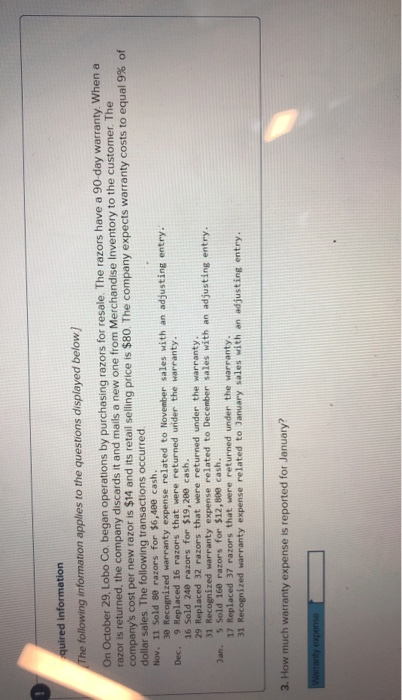

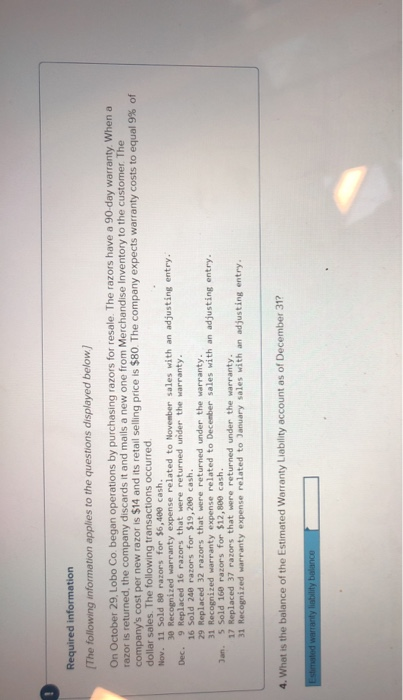

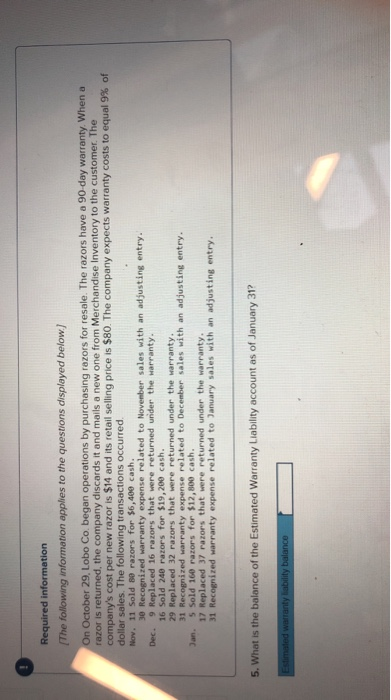

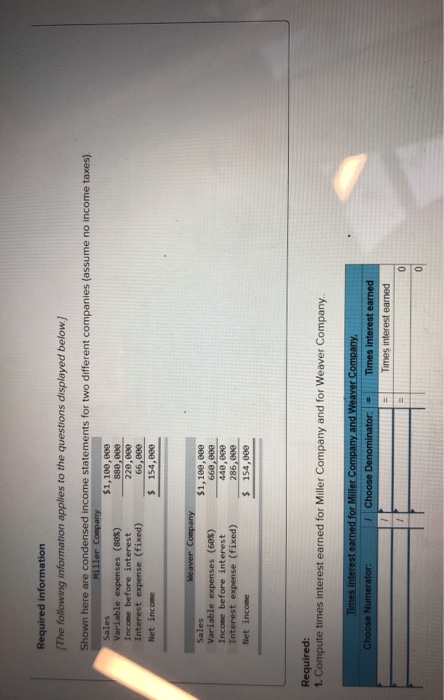

Tequired information The following information applies to the questions displayed below] On October 29, Lobo Co. began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $14 and its retail selling price is $80. The company expects warranty costs to equal 9% of dollar sales. The following transactions occurred. Nov. 11 Sold 89 razors for $6,400 cash. 30 Recognized warranty expense related to November sales with an adjusting entry. Dec. 9 Replaced 16 razors that were returned urider the warranty. 16 Sold 240 razors for $19,200 cash. 29 Replaced 32 razors that were returned under the warranty. 31 Recognized warranty expense related to December sales with an adjusting entry. Jan. 5 Sold 160 razors for $12,800 cash. 17 Replaced 37 razors that were returned under the warranty. 31 Recognized warranty expense related to January sales with an adjusting entry. 2. How much warranty expense is reported for November and December? Warranty expense for November Warranty expense for December quired information The following information applies to the questions displayed below! On October 29, Lobo Co began operations by purchasing razors for resale. The razors have a 90-day warranty. When a rozor is returned the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $14 and its retail selling price is $80. The company expects warranty costs to equal 9% of dollar sales. The following transactions occurred Nov. 11 Sold 89 razors for $6,400 cash. 30 Recognized warranty expense related to November sales with an adjusting entry. Dec. 9 Replaced 16 razors that were returned wrider the warranty. 16 Sold 240 razors for $19, 280 cash. 29 Replaced 32 razors that were returned under the warranty. 31 Recognized warranty expense related to December sales with an adjusting entry. Jan. 5 sold 160 razors for $12,800 cash. 17 Replaced 37 razors that were returned under the warranty. 31 Recognized warranty expense related to January sales with an adjusting entry. 3. How much warranty expense is reported for January? W anty expense Required information The following information applies to the questions displayed below) On October 29, Lobo Co began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $14 and its retail selling price is $80. The company expects warranty costs to equal 9% of dollar sales. The following transactions occurred Nov. 11 Sold 30 razors for $6,400 cash. 30 Recognized warranty expense related to November sales with an adjusting entry. Dec. 9 Replaced 16 rarors that were returned under the warranty. 16 Sold 240 razors for $19,200 cash. 29 Replaced 32 razors that were returned under the warranty. 31 Recognized warranty expense related to December sales with an adjusting entry. Jan 5 Sold 160 rators for $12,500 cash. 17 Replaced 37 razors that were returned under the warranty. 31 Recognized warranty expense related to January sales with an adjusting entry. 4. What is the balance of the Estimated Warranty Liability account as of December 31? Estimated warranty liability balance Required information The following information applies to the questions displayed below) On October 29, Lobo Co began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $14 and its retail selling price is $80. The company expects Warranty costs to equal 9% of dollar sales. The following transactions occurred Nov. 11 Sold 80 razors for $6,400 cash. 30 Recognized warranty expense related to November sales with an adjusting entry. Dec. 9 Replaced 16 razors that were returned under the warranty. 16 Sold 240 razors for $19,200 cash. 29 Replaced 32 razors that were returned under the warranty. 31 Recognized warranty expense related to December sales with an adjusting entry. Jan. 5 Sold 160 razors for $12,800 cash. 17 Replaced 37 razors that were returned under the warranty. 31 Recognized warranty expense related to January sales with an adjusting entry. 5. What is the balance of the Estimated Warranty Liability account as of January 31? Estimated warranty liability balance Required information The following information applies to the questions displayed below.) Shown here are condensed income statements for two different companies (assume no income taxes) Miller Company Sales $1,100.039 Variable expenses (80%) 880,000 Income before interest 220,000 Interest expense (fixed) 66,009 Net income $ 154,000 Weaver Company Sales Variable expenses (60%) Income before interest Interest expense (fixed) Net income $1,188,888 660, eee 440,00 286,089 $ 154,000 Required: 1. Compute times interest earned for Miller Company and for Weaver Company Times interest earned for Miller Company and Weaver Company Choose Numerator: Choose Denominator = Times interest earned Times interest earned