Tesla is a US-based multinational manufacturer of electric vehicles and renewable energy products. Being a US company, the domestic currency used for valuation is

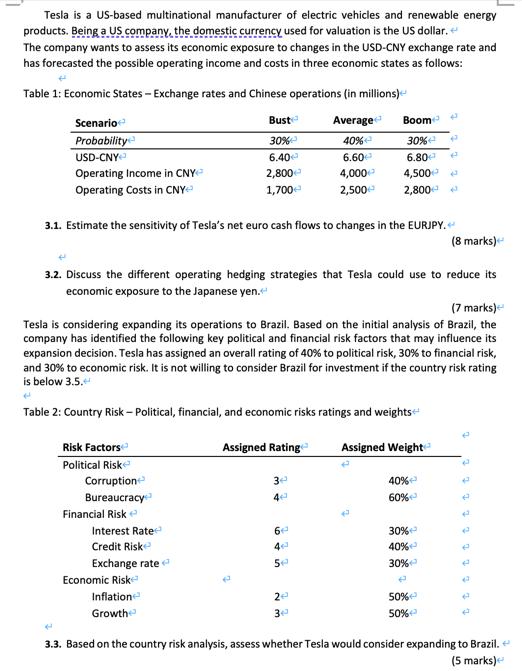

Tesla is a US-based multinational manufacturer of electric vehicles and renewable energy products. Being a US company, the domestic currency used for valuation is the US dollar. + The company wants to assess its economic exposure to changes in the USD-CNY exchange rate and has forecasted the possible operating income and costs in three economic states as follows: Table 1: Economic States - Exchange rates and Chinese operations (in millions) Average 40% 6.60 Scenario Probability USD-CNY Operating Income in CNY Operating Costs in CNY 3.1. Estimate the sensitivity of Tesla's net euro cash flows to changes in the EURJPY. Risk Factors Political Risk Corruption Bureaucracy Financial Risk Interest Rate Credit Riske 3.2. Discuss the different operating hedging strategies that Tesla could use to reduce its economic exposure to the Japanese yen. Exchange rate Buste 30% 6.40 2,800 1,700 (7 marks) Tesla is considering expanding its operations to Brazil. Based on the initial analysis of Brazil, the company has identified the following key political and financial risk factors that may influence its expansion decision. Tesla has assigned an overall rating of 40% to political risk, 30% to financial risk, and 30% to economic risk. It is not willing to consider Brazil for investment if the country risk rating is below 3.5. Table 2: Country Risk - Political, financial, and economic risks ratings and weights+ Economic Risk Inflation Growth Assigned Rating 3.3. Based on the country risk analysis, asse 3 4 4,000 2,500 6 Boome 30% 6.80 4,500 2,800 4 5 20 34 Assigned Weight 40% 60% 30% 40% 30% 2 2 50% 50% (8 marks) 2 42 e e e 2 e assess whether Tesla would consider expanding to Brazil. (5 marks)

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

31 Estimate the sensitivity of Teslas net euro cash flows to changes in the EURJPY To estimate the sensitivity of Teslas net euro cash flows to changes in the EURJPY exchange rate we need to calculate ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started