Question

Text from the first page, incase you have trouble reading it--- Flash-Forward to the year 2050: Due to advancements in technology, the J-Watch and J-TV

Text from the first page, incase you have trouble reading it---

Flash-Forward to the year 2050: Due to advancements in technology, the J-Watch and J-TV have become obsolete products, as Snap Inc.s Specs have become the latest must have product. As sales are dropping, Japple is looking into developing several new products to increase revenues and drive growth.

Their most promising idea is the J-Porter, a watch which allows teleportation to anywhere in the world. The company is currently developing the prototype and trying to identify how expensive manufacturing a single product will be. As of

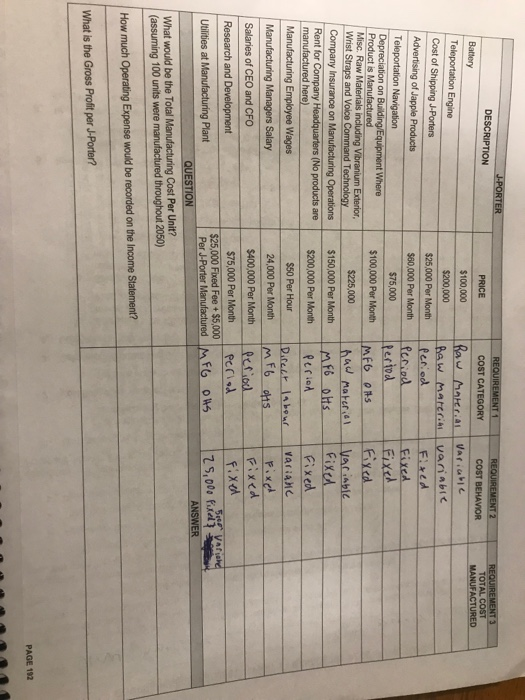

now, they know the following (or estimate): Sell the J-Porter for five times (5x) the cost to manufacture a single unit. Additionally, the company estimates it will take 50 hours to manufacture one J-Porter. The prices identified should be considered Per Unit unless otherwise stated in the table below. Plan on manufacturing 100 J-Porters during 2050 (will manufacture across all twelve months).

Japple has hired your consulting firm to help them further understand Managerial Accounting Topics and how they will apply to the J- Porter and J-Home. Throughout your consultation, you will provide input on the following areas (requirements):

Manufacturing vs. Nonmanufacturing Costs o For each of the cost shown, identify which category best applies: Raw Materials (RM), Direct Labor (DL),

Manufacturing Overhead (MOH) or Period Costs (PC).

Cost Behaviors: Variable, Fixed and Mixed

o For each of the cost shown, identify which cost behavior best applies: Variable, Fixed or Mixed

Calculating Manufacturing Cost and Gross Profit (Hint: See key information provided above)

Cost-Volume-Profit Analysis

o Scenario#1and#2:Asyoubeginyourworkwiththecontributionmarginincomestatement,JapplesCEOwantedto remind your firm that not all manufacturing costs are considered variable costs for the company. Additionally, Scenario #1 is considered the Best Case and Scenario #2 the Worst Case for the company.

o Scenario #2: After further consideration of their costs, Japple believes that is manufacturing cost are going to be substantially higher than previously thought. However, potential customers have indicated they are unwilling to pay more than $2,500,000 per unit. Here are the new revised worst case estimates from the company:

Manufacture and Sell 100 Units Variable Costs = Four times (4x) higher than Scenario #1 Sales Price = $2,500,000 per Unit Fixed Costs = $5,500,000 lower than Scenario #1

Break-Even and Desired Operating Income Targets o Using Scenario #2 from the Cost-Volume-Profit Analysis, the company wants to know how many units it must sell to

Break-Even and how many it must sell to have an operating income of $150,000,000

New Product Proposal: As part of your consulting practice, you have a team who recommends new products to your clients. As such, what new product would you recommend Japple consider adding to their catalog of inventory?

Need help finding the goal manufacturing cost and answers to the bottom 3 questions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started