Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank u!have a nice day! Question9 Network Pty Ltd is an unlisted company and manufactures computer systems. The company has recently reassessed their capital budgeting

Thank u!have a nice day!

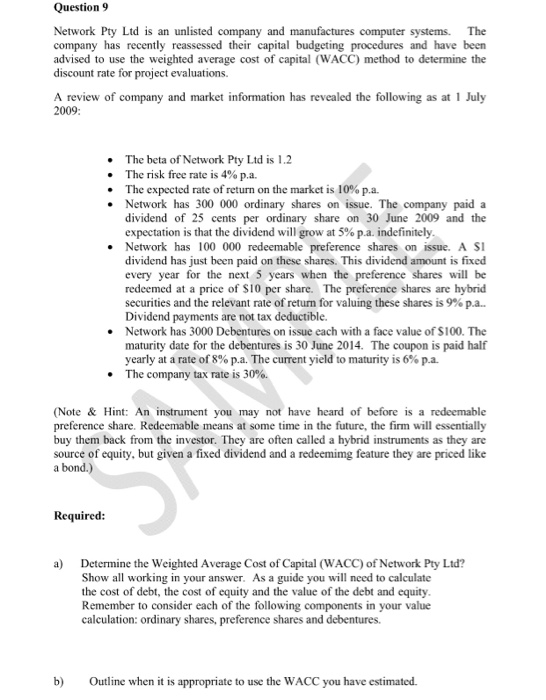

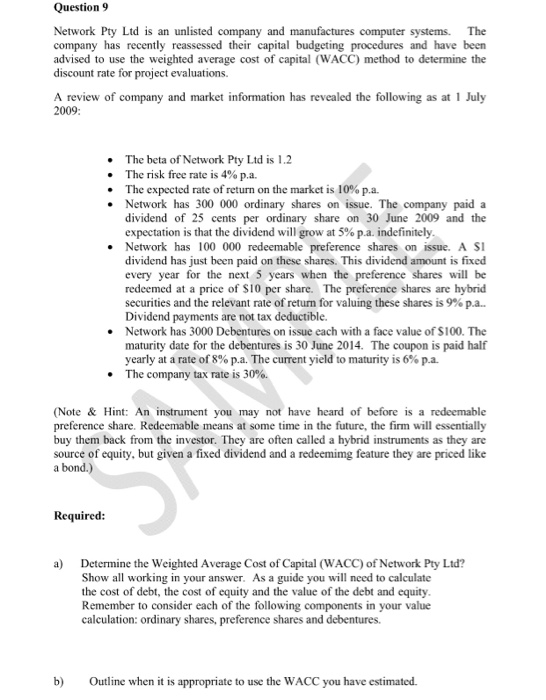

Question9 Network Pty Ltd is an unlisted company and manufactures computer systems. The company has recently reassessed their capital budgeting procedures and have beern advised to use the weighted average cost of capital (WACC) method to determine the discount rate for project evaluations. A review of company and market information has revealed the following as at 1 July 2009: The beta of Network Pty Ltd is 1.2 The risk free rate is 4% p.a. . . The expected rate of return on the market is 10% pa. . Network has 300 000 ordinary shares on issue. The company paid a dividend of 25 cents per ordinary share on 30 June 2009 and the expectation is that the dividend will grow at 5% p.a. indefinitely . Network has 100 000 redeemable preference shares on issue. A Si dividend has just been paid on these shares. This dividend amount is fixed every year for the next 5 years when the preference shares will be redeemed at a price of S10 per share. The preference shares are hybrid securities and the relevant rate of retum for valuing these shares is 9% pa.. Dividend payments are not tax deductible. Network has 3000 Debentures on issue each with a face value of $100. The maturity date for the debentures is 30 June 2014. The coupon is paid half yearly at a rate of 8% pa The cument yield to maturity is 6% pa The company tax rate is 30%. . (Note & Hint: An instrument you may not have heard of before is a redeemable preference share. Redeemable means at some time in the future, the firm will essentially buy them back from the investor. They are often called a hybrid instruments as they are source of equity, but given a fixed dividend and a redeemimg feature they are priced like a bond.) Required a) Determine the Weighted Average Cost of Capital (WACC) of Network Pty Ltd? Show all working in your answer. As a guide you will need to calculate the cost of debt, the cost of equity and the value of the debt and equity Remember to consider each of the following components in your value calculation: ordinary shares, preference shares and debentures. b Outline when it is appropriate to use the WACC you have estimated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started