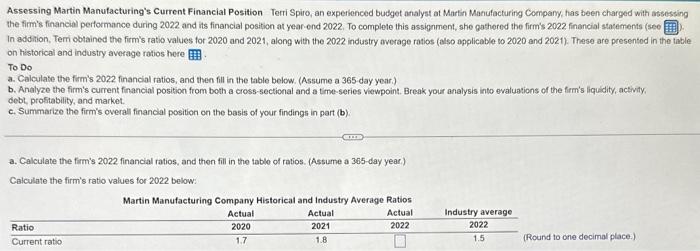

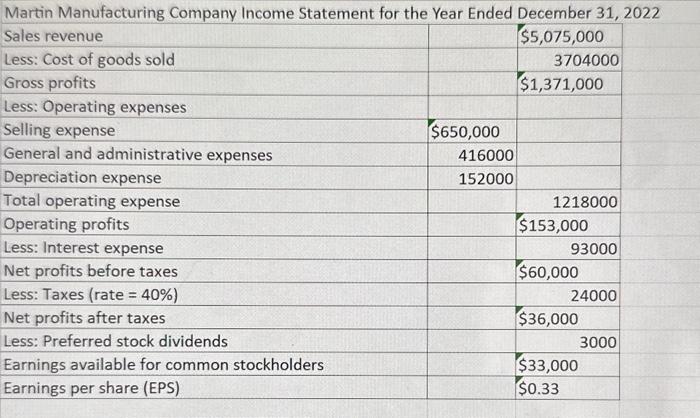

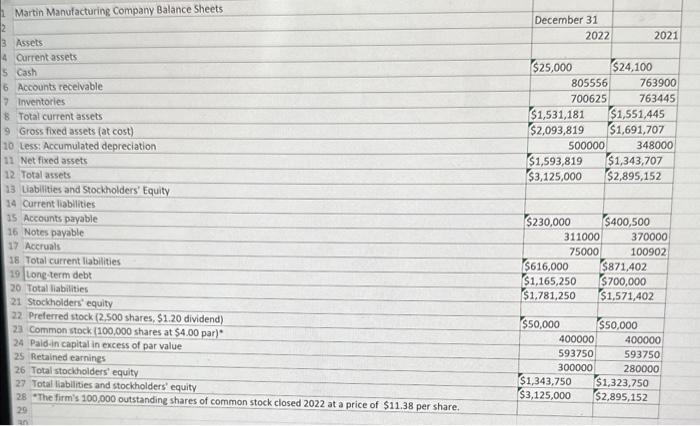

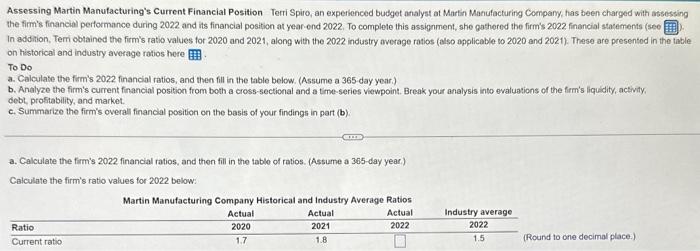

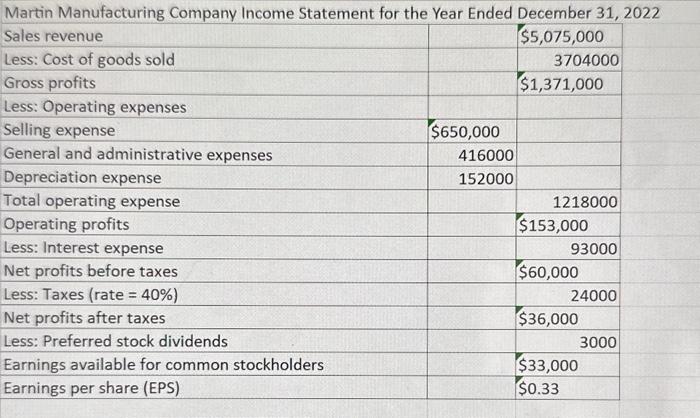

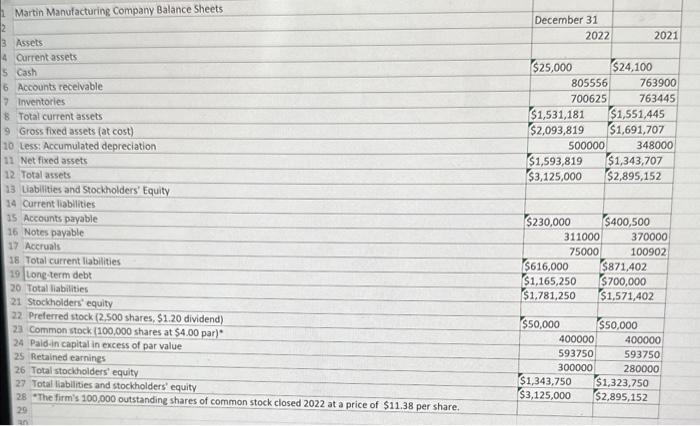

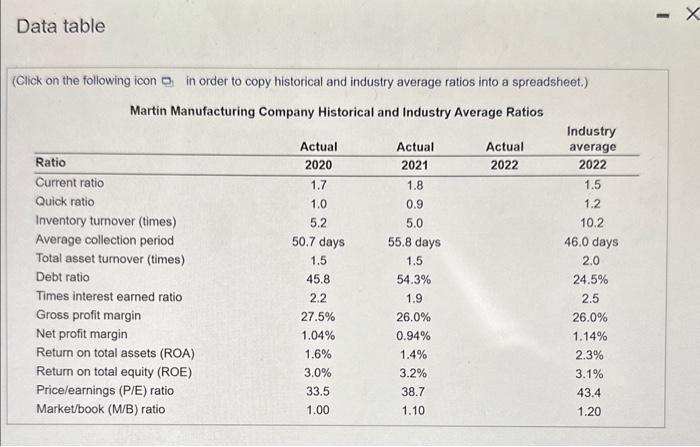

Assessing Martin Manufacturing's Current Financial Position Terri Spiro, an experienced budget analyst at Martin Manufacturitig Company, has been chargod with assessing the firm's financial performance during 2022 and its financial position at year-end 2022 . To complete this assignment, she gathered the firm's 2022 financial statements (see In addition. Tem obtained the firm's ratio values for 2020 and 2021, along with the 2022 industry average ratios (also applicable to 2020 and 2021 ). These are presented in the table on historical and industry average ratios here To Do a. Calculase the firm's 2022 financial ratios, and then fill in the table below. (Assume a 365 -day year.) b. Analyze the firm's current financial position from both a cross-sectional and a time-series viewpoint, Break your analysis into evaluations of the firm's liquidity, activity, debt, prostability, and market. c. Summarize the firm's overall financial position on the basis of your findings in part (b). a. Calculate the firm's 2022 financial ratios, and then fill in the tablo of ratios. (Assume a 365-day year.) Calculate the firm's ratio values for 2022 below: Martin Manufacturing Company Income Statement for the Year Ended December 31, 2022 Martin Manufacturing Company Balance Sheets Assets: Current assets 5 Cash 6 Accounts recelvable 7 Inventories 8. Total current assets 9 Gross fixed assets (at cost) 10 Less: Accumulated depreciation 11 Net fixed assets 12. Total assets 13 Liablities and Stockholders' Equity 14 Current liabilities 15 Accounts payable 16 Notes payable 17 Accruals 18 Total current liabilities 29 Lone.term debt 20 Total liabilities 21 Stockholders' equity 22. Prelerred stock (2.500 shares, $1.20 dividend) 23 Common stock (100,000 shares at $4.00 par) * 24 Paid-in capital in excess of par value 25 Retained earnines 26 Total stockholders' equity 27. Total lablilities and stockholders' equity 28 The firm's 100,000 outstanding shares of common stock closed 2022 at a price of $11.38 per share. Data table (Click on the following icon 0 in order to copy historical and industry average ratios into a spreadsheet.) Martin Manufacturing Company Historical and Industry Average Ratios Assessing Martin Manufacturing's Current Financial Position Terri Spiro, an experienced budget analyst at Martin Manufacturitig Company, has been chargod with assessing the firm's financial performance during 2022 and its financial position at year-end 2022 . To complete this assignment, she gathered the firm's 2022 financial statements (see In addition. Tem obtained the firm's ratio values for 2020 and 2021, along with the 2022 industry average ratios (also applicable to 2020 and 2021 ). These are presented in the table on historical and industry average ratios here To Do a. Calculase the firm's 2022 financial ratios, and then fill in the table below. (Assume a 365 -day year.) b. Analyze the firm's current financial position from both a cross-sectional and a time-series viewpoint, Break your analysis into evaluations of the firm's liquidity, activity, debt, prostability, and market. c. Summarize the firm's overall financial position on the basis of your findings in part (b). a. Calculate the firm's 2022 financial ratios, and then fill in the tablo of ratios. (Assume a 365-day year.) Calculate the firm's ratio values for 2022 below: Martin Manufacturing Company Income Statement for the Year Ended December 31, 2022 Martin Manufacturing Company Balance Sheets Assets: Current assets 5 Cash 6 Accounts recelvable 7 Inventories 8. Total current assets 9 Gross fixed assets (at cost) 10 Less: Accumulated depreciation 11 Net fixed assets 12. Total assets 13 Liablities and Stockholders' Equity 14 Current liabilities 15 Accounts payable 16 Notes payable 17 Accruals 18 Total current liabilities 29 Lone.term debt 20 Total liabilities 21 Stockholders' equity 22. Prelerred stock (2.500 shares, $1.20 dividend) 23 Common stock (100,000 shares at $4.00 par) * 24 Paid-in capital in excess of par value 25 Retained earnines 26 Total stockholders' equity 27. Total lablilities and stockholders' equity 28 The firm's 100,000 outstanding shares of common stock closed 2022 at a price of $11.38 per share. Data table (Click on the following icon 0 in order to copy historical and industry average ratios into a spreadsheet.) Martin Manufacturing Company Historical and Industry Average Ratios