thanks for the help!!

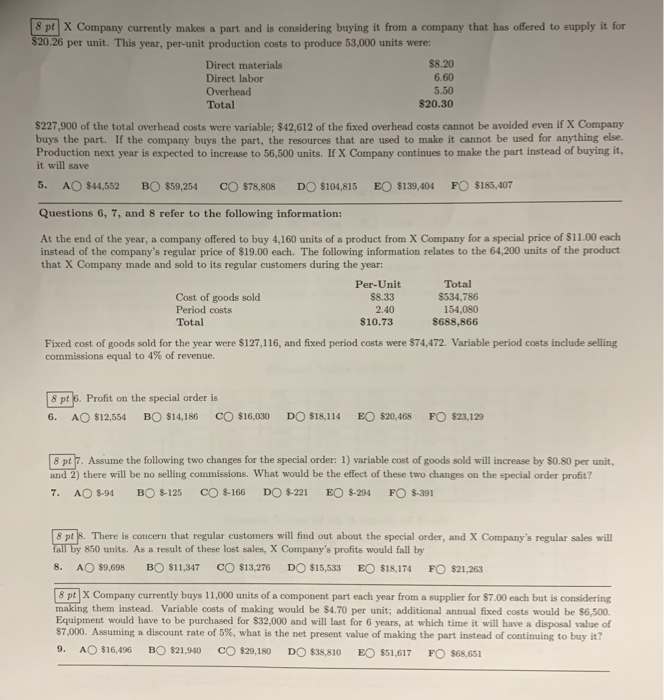

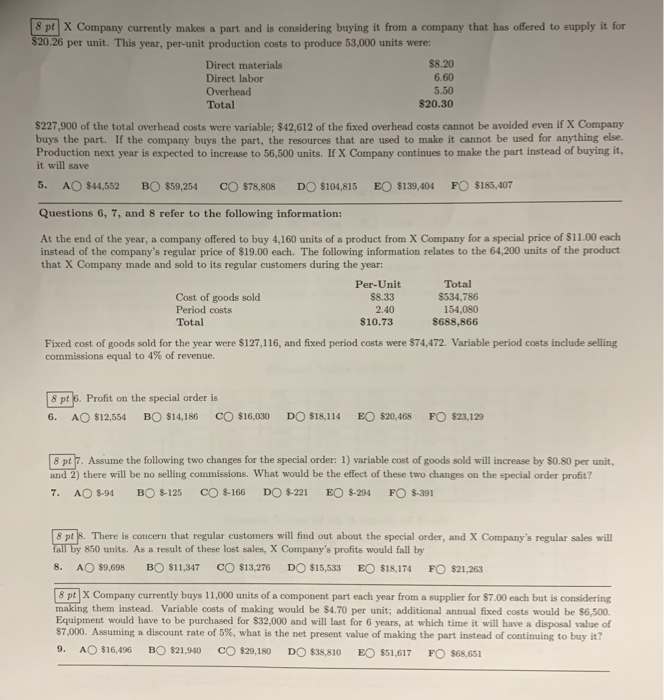

S pt X Company currently makes a part and is considering buying it from a company that has offered to supply it for $20.26 per unit. This year, per-unit production costs to produce 53,000 units were Direct materials Direct labor Overhead Total $8.20 6.60 5.50 $20.30 $227,900 of the total overhead costs were variable: $42,612 of the fixed overhead costs cannot be avoided even if X Company buys the part. If the company buys the part, the resources that are used to make it cannot be used for anything else. Production next year is expected to increase to 56,500 units. If X Company continues to make the part instead of buying it, it will save 5. AOS44,552 BOS59,254 CO$78,808 DO si04,815 EO$139,404 FO sss,407 Questions 6, 7, and 8 refer to the following information: At the end of the year, a company offered to buy 4,160 units of a product from X Company for a special price of $11.00 each instead of the company's regular price of $19.00 each. The following information relates to the 64,200 units of the product that X Company made and sold to its regular customers during the year: Total $534,786 154,080 $688,866 Per-Unit Cost of goods sold Period costs Total $8.33 2.40 $10.73 Fixed cost of goods sold for the year were $127,116, and fixed period costs were $74,472. Variable period costs include selling conmissions equal to 4% of revenue. 8 pt 6. Profit on the special order is 6. AO $12,554 BO $14,186 CO $16,030 DO S18,114 EO $20,468 FO $23,129 8pt7. Assume the following two changes for the special order: 1) variable cost of goods sold will increase by $0.80 per unit and 2) there will be no selling commissions. What would be the effect of these two changes on the special order profit? 7. AO S-94 BO S-125 CO $-166 DO$-221 EO S-294 FO $-391 8 pts. There is concern that regular customers will find out about the special order, and X Company's regular sales wil 850 units. As a result of these lost sales, X Company's profits would fall by 8. $9,698 BO s11,347 cO s13,276 DO $15,533 EO$18,174 FO$21,263 8 pt X Company currently buys 11,000 units of a component part each year from a supplier for $7.00 each but is considering making them instead. Variable costs of making would be $4.70 per unit; additional annual fixed costs would be $6,500. Equipment would have to be purchased for $32,000 and will last for 6 years, at which time it will have a disposal value of $7000. Assuming a discount rate of 5%, what is the net present value of making the part instead of continuing to buy it? 9. AO $16,496 BO $21,940 CO $29,180 DO $38,810 EO $51,617 FO $68,651

thanks for the help!!

thanks for the help!!