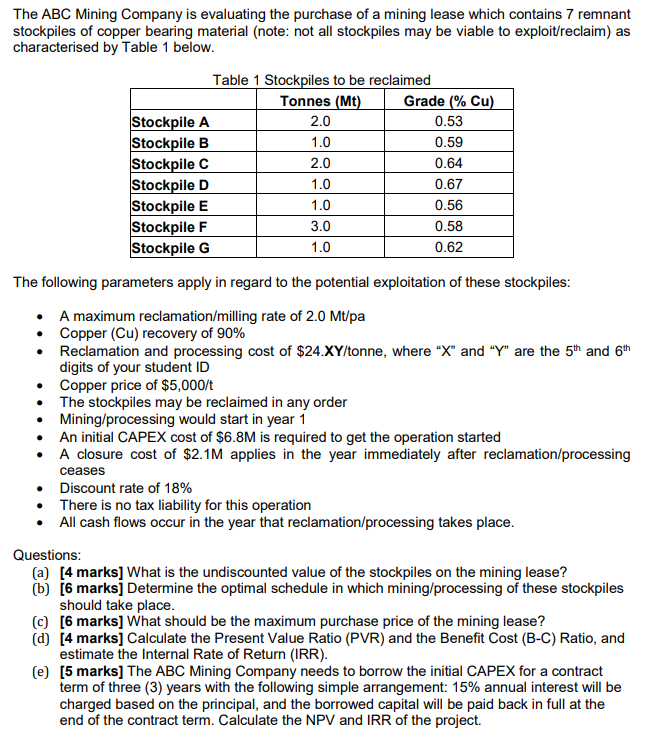

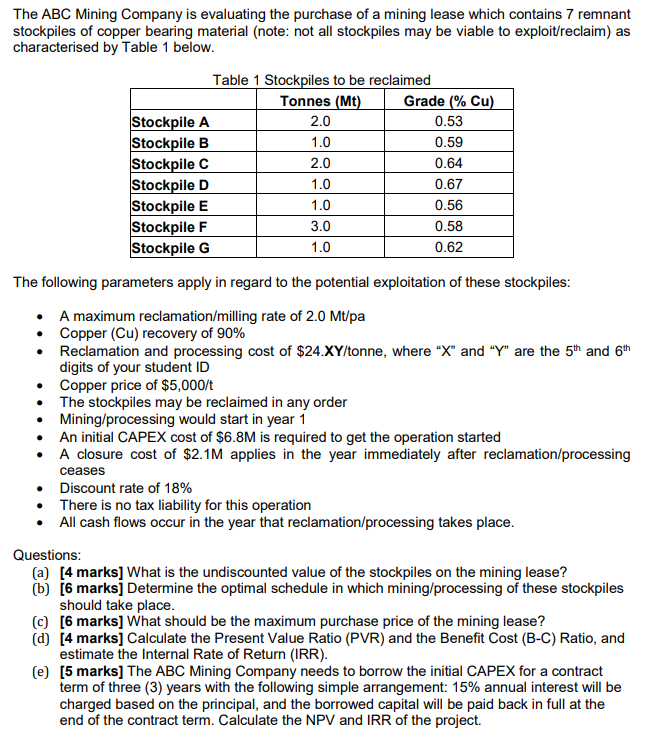

The ABC Mining Company is evaluating the purchase of a mining lease which contains 7 remnant stockpiles of copper bearing material (note: not all stockpiles may be viable to exploit/reclaim) as characterised by Table 1 below. Table 1 Stockpiles to be reclaimed Tonnes (Mt) Grade (% Cu) Stockpile A 2.0 0.53 Stockpile B 1.0 0.59 Stockpile C 2.0 0.64 Stockpile D 1.0 0.67 Stockpile E 1.0 0.56 Stockpile F 3.0 0.58 Stockpile G 1.0 0.62 The following parameters apply in regard to the potential exploitation of these stockpiles: A maximum reclamation/milling rate of 2.0 Mt/pa Copper (Cu) recovery of 90% Reclamation and processing cost of $24.XY/tonne, where "X" and "Y" are the 5th and 6th digits of your student ID Copper price of $5,000/t The stockpiles may be reclaimed in any order Mining processing would start in year 1 An initial CAPEX cost of $6.8M is required to get the operation started A closure cost of $2.1M applies in the year immediately after reclamation/processing ceases Discount rate of 18% There is no tax liability for this operation All cash flows occur in the year that reclamation/processing takes place. Questions: (a) [4 marks] What is the undiscounted value of the stockpiles on the mining lease? (b) [6 marks] Determine the optimal schedule in which mining/processing of these stockpiles should take place. (c) [6 marks] What should be the maximum purchase price of the mining lease? (d) (4 marks] Calculate the Present Value Ratio (PVR) and the Benefit Cost (B-C) Ratio, and estimate the Internal Rate of Return (IRR). (e) [5 marks] The ABC Mining Company needs to borrow the initial CAPEX for a contract term of three (3) years with the following simple arrangement: 15% annual interest will be charged based on the principal, and the borrowed capital will be paid back in full at the end of the contract term. Calculate the NPV and IRR of the project. The ABC Mining Company is evaluating the purchase of a mining lease which contains 7 remnant stockpiles of copper bearing material (note: not all stockpiles may be viable to exploit/reclaim) as characterised by Table 1 below. Table 1 Stockpiles to be reclaimed Tonnes (Mt) Grade (% Cu) Stockpile A 2.0 0.53 Stockpile B 1.0 0.59 Stockpile C 2.0 0.64 Stockpile D 1.0 0.67 Stockpile E 1.0 0.56 Stockpile F 3.0 0.58 Stockpile G 1.0 0.62 The following parameters apply in regard to the potential exploitation of these stockpiles: A maximum reclamation/milling rate of 2.0 Mt/pa Copper (Cu) recovery of 90% Reclamation and processing cost of $24.XY/tonne, where "X" and "Y" are the 5th and 6th digits of your student ID Copper price of $5,000/t The stockpiles may be reclaimed in any order Mining processing would start in year 1 An initial CAPEX cost of $6.8M is required to get the operation started A closure cost of $2.1M applies in the year immediately after reclamation/processing ceases Discount rate of 18% There is no tax liability for this operation All cash flows occur in the year that reclamation/processing takes place. Questions: (a) [4 marks] What is the undiscounted value of the stockpiles on the mining lease? (b) [6 marks] Determine the optimal schedule in which mining/processing of these stockpiles should take place. (c) [6 marks] What should be the maximum purchase price of the mining lease? (d) (4 marks] Calculate the Present Value Ratio (PVR) and the Benefit Cost (B-C) Ratio, and estimate the Internal Rate of Return (IRR). (e) [5 marks] The ABC Mining Company needs to borrow the initial CAPEX for a contract term of three (3) years with the following simple arrangement: 15% annual interest will be charged based on the principal, and the borrowed capital will be paid back in full at the end of the contract term. Calculate the NPV and IRR of the project