Answered step by step

Verified Expert Solution

Question

1 Approved Answer

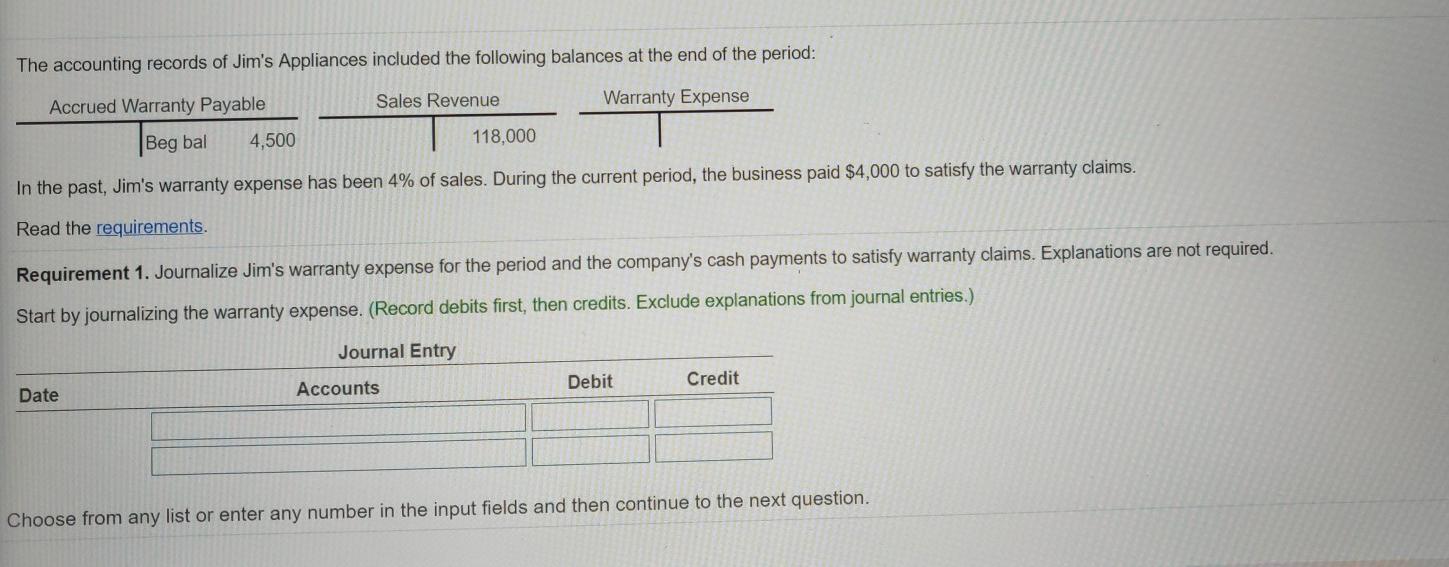

The accounting records of Jim's Appliances included the following balances at the end of the period: Accrued Warranty Payable Sales Revenue Warranty Expense Beg bal

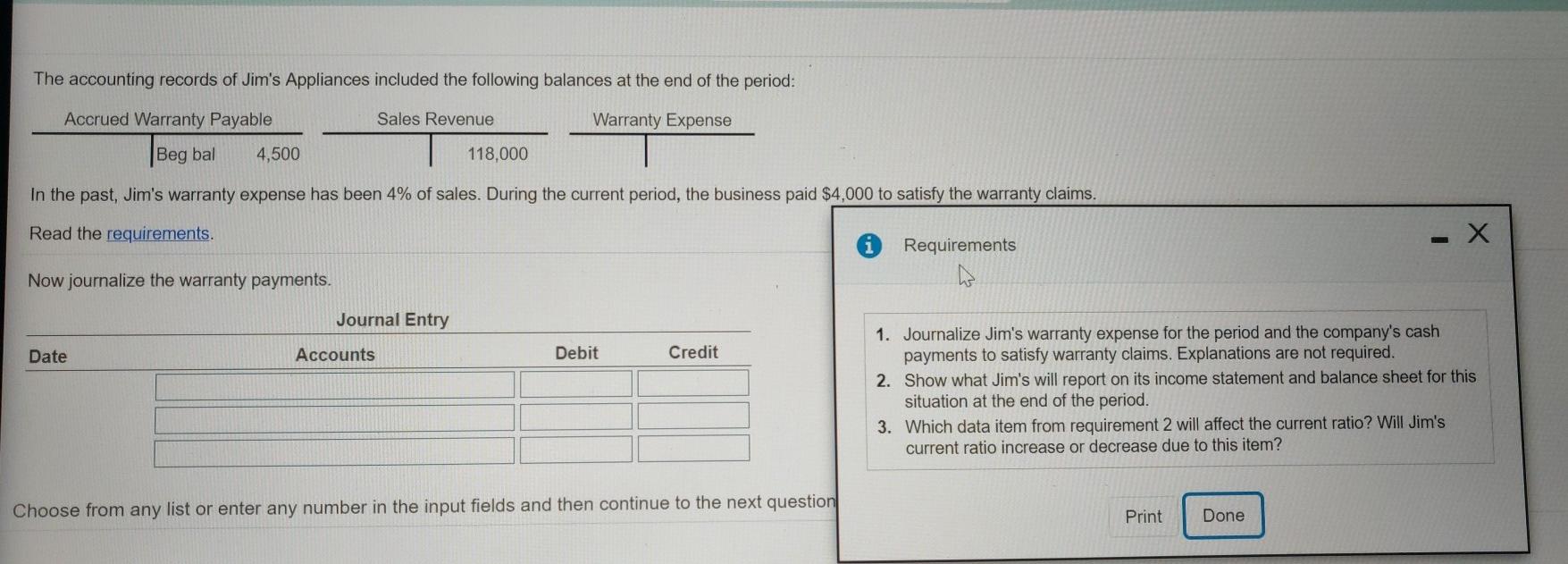

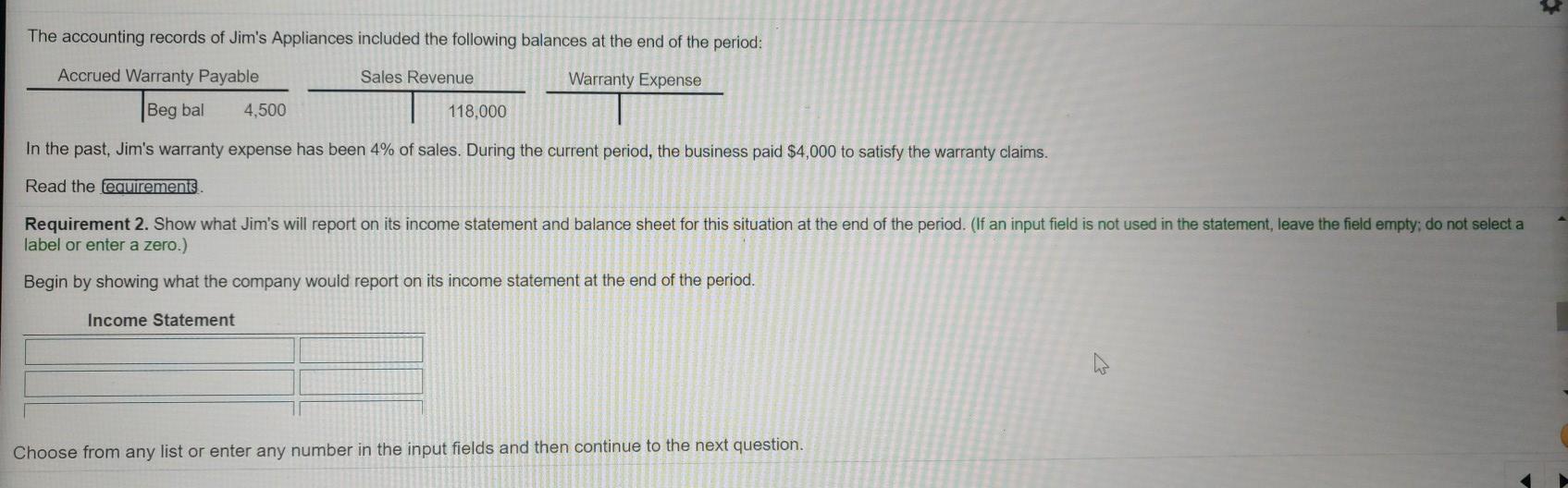

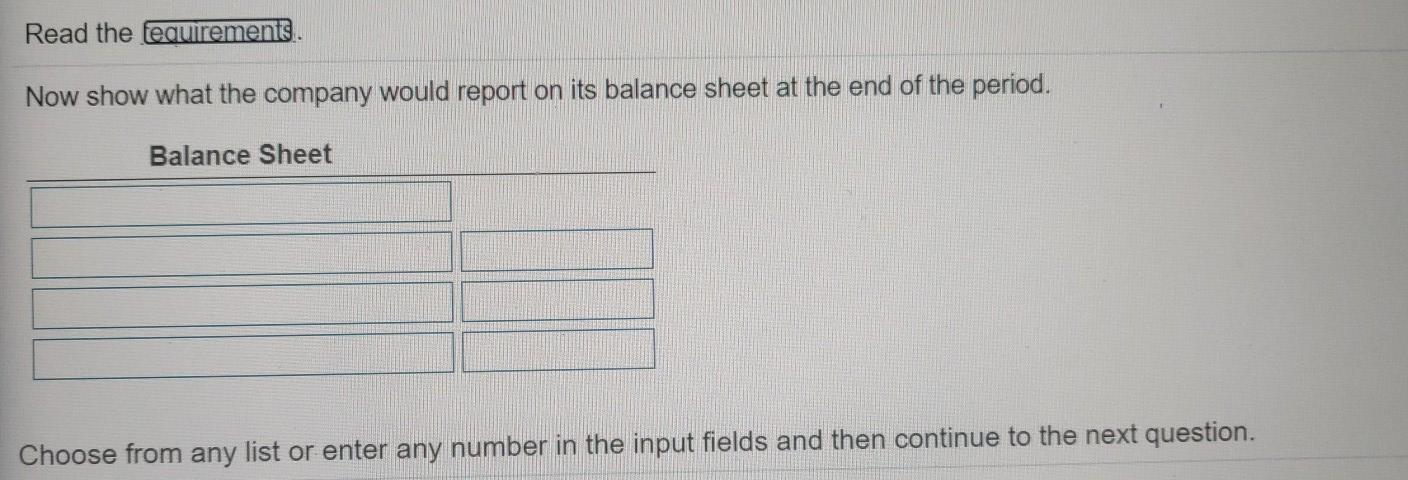

The accounting records of Jim's Appliances included the following balances at the end of the period: Accrued Warranty Payable Sales Revenue Warranty Expense Beg bal 4,500 118,000 In the past, Jim's warranty expense has been 4% of sales. During the current period, the business paid $4,000 to satisfy the warranty claims. Read the requirements. Requirement 1. Journalize Jim's warranty expense for the period and the company's cash payments to satisfy warranty claims. Explanations are not required. Start by journalizing the warranty expense. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Debit Credit Date Accounts Choose from any list or enter any number in the input fields and then continue to the next question. The accounting records of Jim's Appliances included the following balances at the end of the period: Accrued Warranty Payable Sales Revenue Warranty Expense Beg bal 4,500 118,000 In the past, Jim's warranty expense has been 4% of sales. During the current period, the business paid $4,000 to satisfy the warranty claims. Read the requirements. Requirements Now journalize the warranty payments. Journal Entry Date Accounts Debit Credit 1. Journalize Jim's warranty expense for the period and the company's cash payments to satisfy warranty claims. Explanations are not required. 2. Show what Jim's will report on its income statement and balance sheet for this situation at the end of the period. 3. Which data item from requirement 2 will affect the current ratio? Will Jim's current ratio increase or decrease due to this item? Choose from any list or enter any number in the input fields and then continue to the next question Print Done The accounting records of Jim's Appliances included the following balances at the end of the period: Sales Revenue Warranty Expense Accrued Warranty Payable 4,500 Beg bal 118,000 In the past, Jim's warranty expense has been 4% of sales. During the current period, the business paid $4,000 to satisfy the warranty claims. Read the requirements Requirement 2. Show what Jim's will report on its income statement and balance sheet for this situation at the end of the period. (If an input field is not used in the statement, leave the field empty: do not select a label or enter a zero.) Begin by showing what the company would report on its income statement at the end of the period. Income Statement Choose from any list or enter any number in the input fields and then continue to the next question. Read the requirements Now show what the company would report on its balance sheet at the end of the period. Balance Sheet Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 3. Which data item from requirement 2 will affect the current ratio? Will Jim's current ratio increase or decrease due to this item? Which data item from Requirement 2 will affect Jim's current ratio? Will Jim's current ratio increase or decrease as a result of an increase in this item? Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started