Question

The Alpine House, Incorporated, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: Amount

The Alpine House, Incorporated, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31:

| Amount | |

|---|---|

| Sales | $ 943,000 |

| Selling price per pair of skis | $ 410 |

| Variable selling expense per pair of skis | $ 46 |

| Variable administrative expense per pair of skis | $ 17 |

| Total fixed selling expense | $ 150,000 |

| Total fixed administrative expense | $ 125,000 |

| Beginning merchandise inventory | $ 65,000 |

| Ending merchandise inventory | $ 105,000 |

| Merchandise purchases | $ 290,000 |

Required (Hint: there are more lines than you need in the tables below - some lines will remain blank):

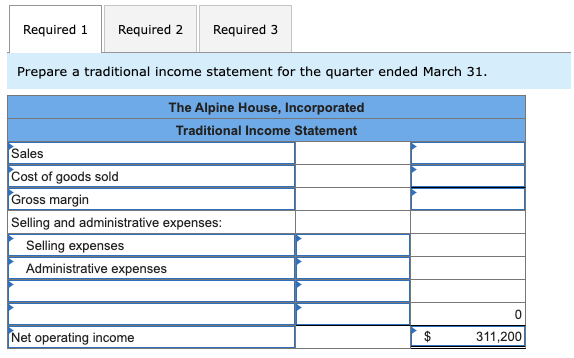

1. Prepare a traditional income statement for the quarter ended March 31. (Hints: (1) you will need to calculate the number of units from the sales information above; (2) if you don't remember how to calculate Cost of Goods Sold from the information above, see p. 43 in your book.)

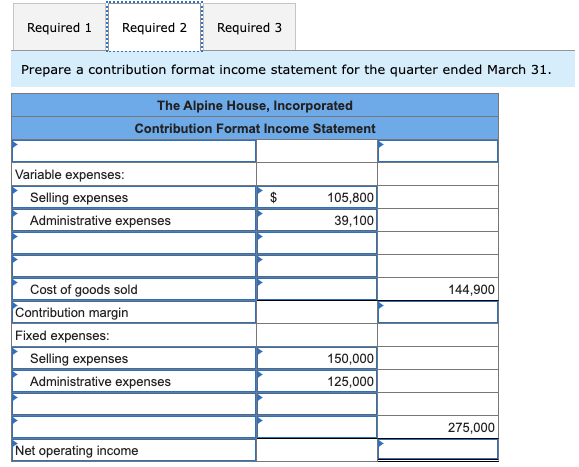

2. Prepare a contribution format income statement for the quarter ended March 31.

3. What was the contribution margin per unit?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started