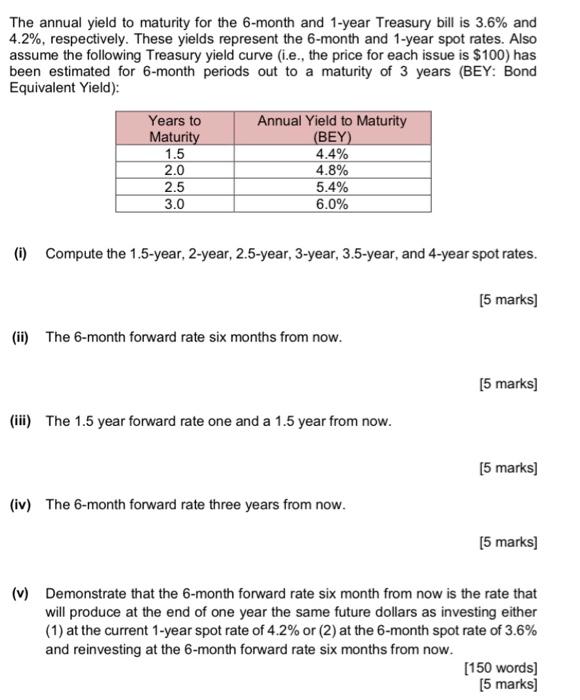

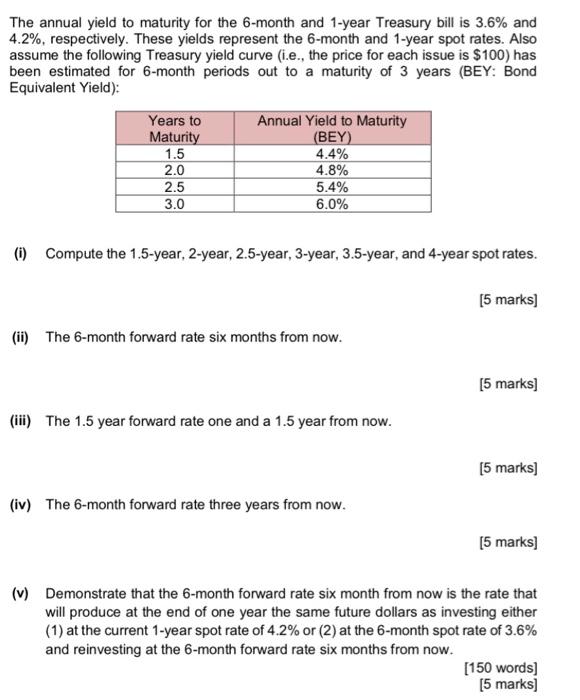

The annual yield to maturity for the 6-month and 1-year Treasury bill is 3.6% and 4.2%, respectively. These yields represent the 6-month and 1-year spot rates. Also assume the following Treasury yield curve (i.e., the price for each issue is $100) has been estimated for 6-month periods out to a maturity of 3 years (BEY: Bond Equivalent Yield): Years to Annual Yield to Maturity Maturity (BEY) 1.5 4.4% 2.0 4.8% 2.5 5.4% 3.0 6.0% (0) Compute the 1.5-year, 2-year, 2.5-year, 3-year, 3.5-year, and 4-year spot rates. [5 marks) (ii) The 6-month forward rate six months from now. [5 marks] (iii) The 1.5 year forward rate one and a 1.5 year from now. [5 marks) (iv) The 6-month forward rate three years from now. [5 marks) (v) Demonstrate that the 6-month forward rate six month from now is the rate that will produce at the end of one year the same future dollars as investing either (1) at the current 1-year spot rate of 4.2% or (2) at the 6-month spot rate of 3.6% and reinvesting at the 6-month forward rate six months from now. [150 words) [5 marks] The annual yield to maturity for the 6-month and 1-year Treasury bill is 3.6% and 4.2%, respectively. These yields represent the 6-month and 1-year spot rates. Also assume the following Treasury yield curve (i.e., the price for each issue is $100) has been estimated for 6-month periods out to a maturity of 3 years (BEY: Bond Equivalent Yield): Years to Annual Yield to Maturity Maturity (BEY) 1.5 4.4% 2.0 4.8% 2.5 5.4% 3.0 6.0% (0) Compute the 1.5-year, 2-year, 2.5-year, 3-year, 3.5-year, and 4-year spot rates. [5 marks) (ii) The 6-month forward rate six months from now. [5 marks] (iii) The 1.5 year forward rate one and a 1.5 year from now. [5 marks) (iv) The 6-month forward rate three years from now. [5 marks) (v) Demonstrate that the 6-month forward rate six month from now is the rate that will produce at the end of one year the same future dollars as investing either (1) at the current 1-year spot rate of 4.2% or (2) at the 6-month spot rate of 3.6% and reinvesting at the 6-month forward rate six months from now. [150 words) [5 marks]