Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the answer I did is wrong for the first question and the rest is I just want to know how to get that number How

the answer I did is wrong for the first question

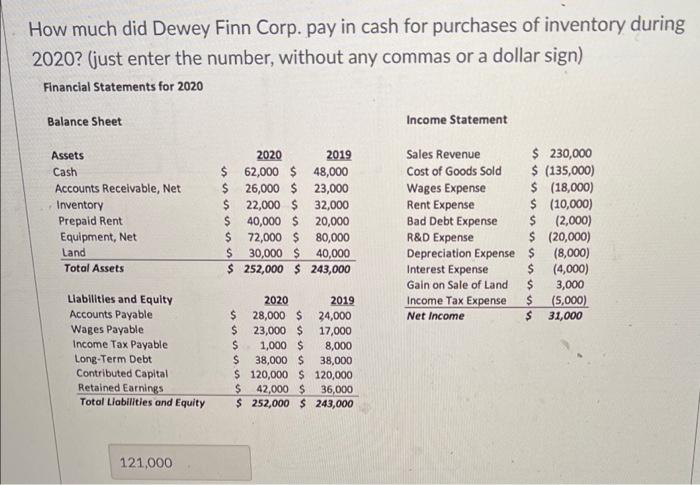

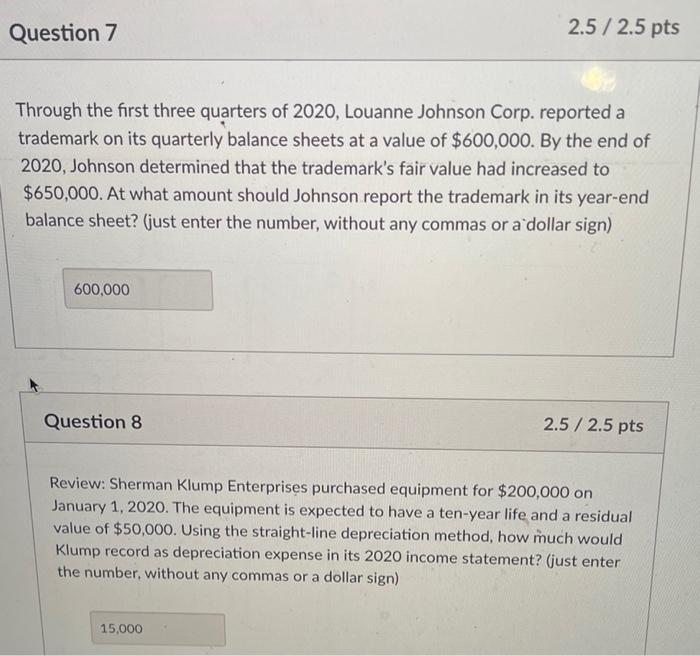

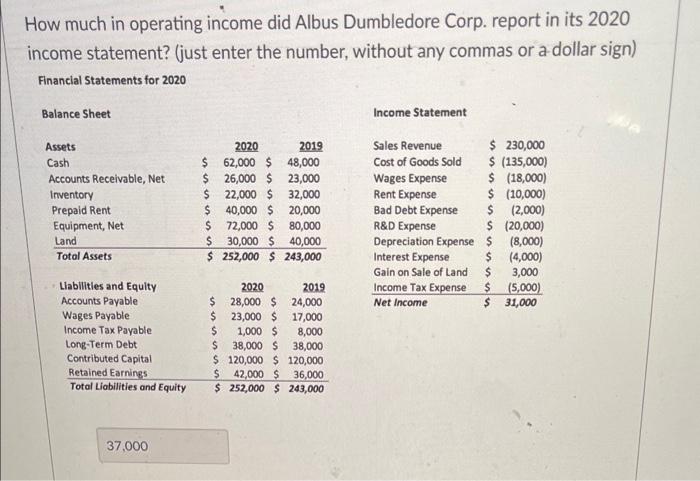

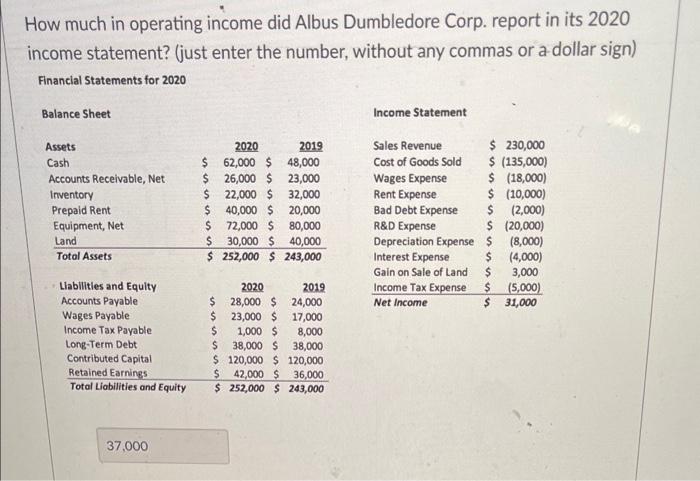

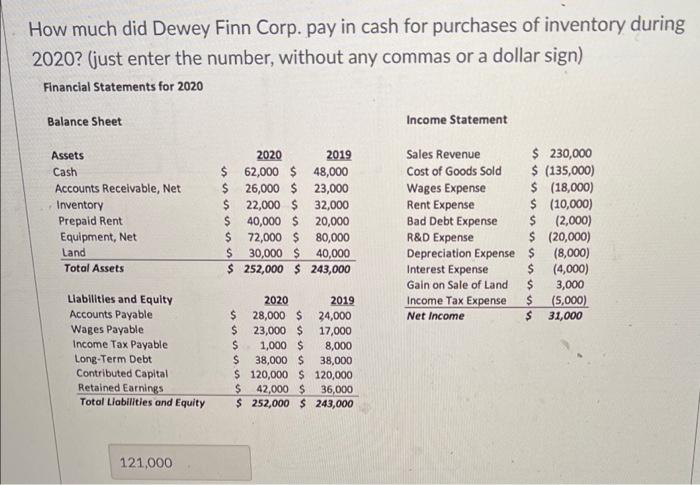

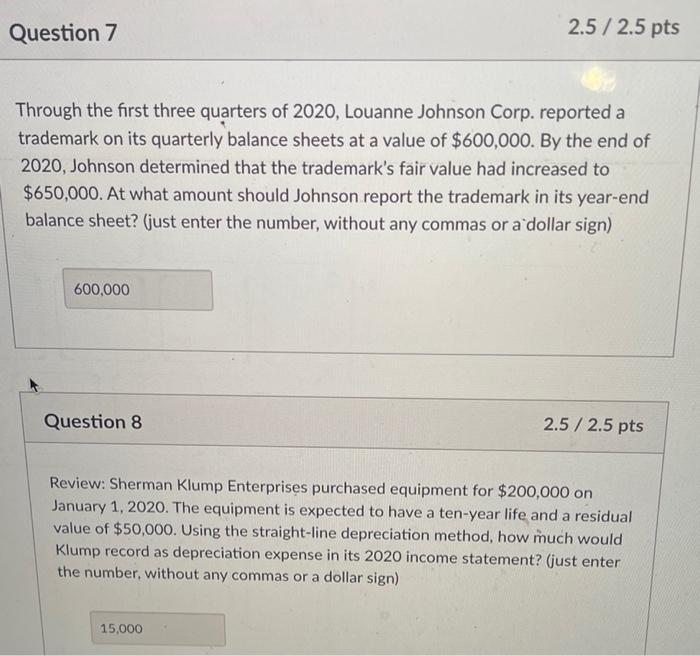

How much in operating income did Albus Dumbledore Corp. report in its 2020 income statement? (just enter the number, without any commas or a dollar sign) Financial Statements for 2020 Balance Sheet Income Statement Assets Cash Accounts Receivable, Net Inventory Prepaid Rent Equipment, Net Land Total Assets 2020 2019 $ 62,000 $ 48,000 $ 26,000 $23,000 $ 22,000 $ 32,000 $ 40,000 $ 20,000 $ 72,000 $80,000 $ 30,000 $ 40,000 $ 252,000 $ 243,000 Sales Revenue $ 230,000 Cost of Goods Sold $ (135,000) Wages Expense $ (18,000) Rent Expense $ (10,000) Bad Debt Expense $ (2,000) R&D Expense $ (20,000) Depreciation Expenses (8,000) Interest Expense $ (4,000) Gain on Sale of Land $ 3,000 Income Tax Expense $ (5,000) Net Income $ 31,000 Llabilities and Equity Accounts Payable Wages Payable Income Tax Payable Long-Term Debt Contributed Capital Retained Earnings Total Liabilities and Equity 2020 2019 $ 28,000 $ 24,000 $ 23,000 $ 17,000 $ 1,000 $ 8,000 $ 38,000 $ 38,000 $ 120,000 $ 120,000 $ 42,000 $ 36,000 $ 252,000 $ 243,000 37.000 How much did Dewey Finn Corp. pay in cash for purchases of inventory during 2020? (just enter the number, without any commas or a dollar sign) Financial Statements for 2020 Balance Sheet Income Statement Assets Cash Accounts Receivable, Net Inventory Prepaid Rent Equipment, Net Land Total Assets 2020 2019 $ 62,000 $ 48,000 $ 26,000 $ 23,000 $ 22,000 $ 32,000 $ 40,000 $ 20,000 $ 72,000 $80,000 S 30,000 $ 40,000 $ 252,000 $ 243,000 Sales Revenue $ 230,000 Cost of Goods Sold $ (135,000) Wages Expense $ (18,000) Rent Expense $ (10,000) Bad Debt Expense $ 2,000) R&D Expense $ (20,000) Depreciation Expense $ (8,000) Interest Expense $ (4,000) Gain on Sale of Land $ 3,000 Income Tax Expense $ (5,000) Net Income $ 31,000 Liabilities and Equity Accounts Payable Wages Payable Income Tax Payable Long-Term Debt Contributed Capital Retained Earnings Total Liabilities and Equity 2020 2019 $ 28,000 $ 24,000 $ 23,000 $ 17,000 $ 1,000 $ 8,000 $ 38,000 $ 38,000 $ 120,000 $ 120,000 $ 42,000 $ 36,000 $ 252,000 $ 243,000 121,000 Question 7 2.5 / 2.5 pts Through the first three quarters of 2020, Louanne Johnson Corp. reported a trademark on its quarterly balance sheets at a value of $600,000. By the end of 2020, Johnson determined that the trademark's fair value had increased to $650,000. At what amount should Johnson report the trademark in its year-end balance sheet? (just enter the number, without any commas or a dollar sign) 600,000 Question 8 2.5/2.5 pts Review: Sherman Klump Enterprises purchased equipment for $200,000 on January 1, 2020. The equipment is expected to have a ten-year life and a residual value of $50,000. Using the straight-line depreciation method, how much would Klump record as depreciation expense in its 2020 income statement? (just enter the number, without any commas or a dollar sign) 15,000 and the rest is I just want to know how to get that number

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started