Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mekgoe Florist is situated in the Western Cape. The business is a registered VAT vendor and makes use of the perpetual inventory system. The VAT

Mekgoe Florist is situated in the Western Cape. The

business is a registered VAT vendor and makes use

of the perpetual inventory system. The VAT rate is

The following transactions must be recorded in the

subsidiary journals of Mekgoe Florist:

Transaction :

On March Mr Mekgoe withdrew R from

Mekgoe Florist's bank account as the impress

amount to start the petty cash float of Mekgoe

Florist. The money was kept by Mr Mekgoe who

acted as petty cashier.

Transaction :

Transaction :

tablePETTY CASH VOUCHER,NoDate: March Amount,Required for:,RcABC Wholesalers : Packaging material,

Signature: Mc Mekgoe

tableABC Wholesalers

tableTilltableBrown paperbags packs aR eachBPIRtableWrappingpaper rolls R eachWPIRTOTALRCashRChange VAT,RSlip no VAT no Tharkyou

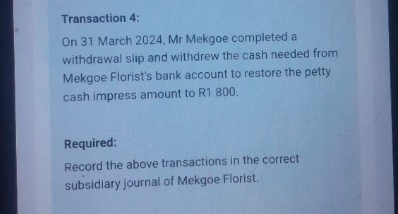

Transaction :

On March Mr Mekgoe completed a

withdrawal slip and withdrew the cash needed from

Mekgoe Florist's bank account to restore the petty

cash impress amount to R

Required:

Record the above transactions in the correct

subsidiary journal of Mekgoe Florist.v

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started