Question

The attached chart for this question is an option quote on IBM from the CBOE website. a. Which option contract had the most trades today?

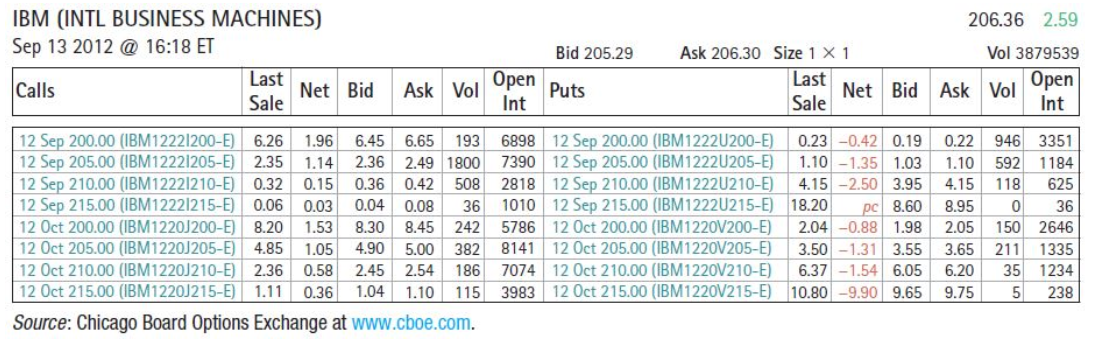

- The attached chart for this question is an option quote on IBM from the CBOE website.

a. Which option contract had the most trades today?

b. Which option contract is being held the most overall?

c. Suppose you purchase one option contract with symbol IBM1222I210-E. How much will you need to pay your broker for the option contract (ignoring commissions)?

d. Suppose you sell one option contract with symbol IBM1222I210-E. How much will you receive for the option contract (ignoring commissions)?

e. The calls with which strike prices are currently in-the-money? Which puts are in-the-money?

A. 12 Oct 200.00 put

B. 12 Sep 200.00 put

C. 12 Sep 205.00 call

D. 12 Oct 205.00 call

IBM (INTL BUSINESS MACHINES) Sep 13 2012 @ 16:18 ET Calls Last Net Bid Sale 206.36 2.59 Vol 3879539 Ask 206.30 Size 1 X 1 Ask Bid 205.29 Vol Open Puts Int Last Net Bid Ask Vol Sale Int 12 Sep 200.00 (IBM12221200-E) 6.26 12 Sep 205.00 (IBM12221205-E) 2.35 12 Sep 210.00 (IBM12221210-E) 0.32 12 Sep 215.00 (IBM12221215-E) 0.06 12 Oct 200.00 (IBM1220J200-E) 8.20 12 Oct 205.00 (IBM1220J205-E) 4.85 12 Oct 210.00 (IBM1220J210-E) 2.36 12 Oct 215.00 (IBM1220J215-E) 1.11 1.96 1.14 0.15 0.03 1.53 1.05 0.58 0.36 6.45 2.36 0.36 0.04 8.30 4.90 2.45 1.04 6.65 193 2.49 1800 0.42 508 0.08 36 8.45 242 5.00 382 2.54 186 1.10 115 6898 12 Sep 200.00 (IBM12220200-E) 0.23 -0.42 0.19 7390 12 Sep 205.00 (IBM1222U205-E) 1.10-1.35 1.03 2818 12 Sep 210.00 (IBM12220210-E) 4.15 -2.50 3.95 1010 12 Sep 215.00 (IBM12220215-E) 18.20 pc 8.60 5786 12 Oct 200.00 (IBM1220V200-E) 2.04 -0.88 1.98 8141 12 Oct 205.00 (IBM1220V205-E) 3.50 -1.31 3.55 7074 12 Oct 210.00 (IBM12201210-E) 6.37 -1.54 6.05 3983 12 Oct 215.00 (IBM1220V215-E) 10.80 -9.90 9.65 0.22 1.10 4.15 8.95 2.05 3.65 6.20 9.75 946 592 118 0 150 211 35 5 3351 1184 625 3 6 2646 1335 1234 238 Source: Chicago Board Options Exchange at www.cboe.comStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started