Answered step by step

Verified Expert Solution

Question

1 Approved Answer

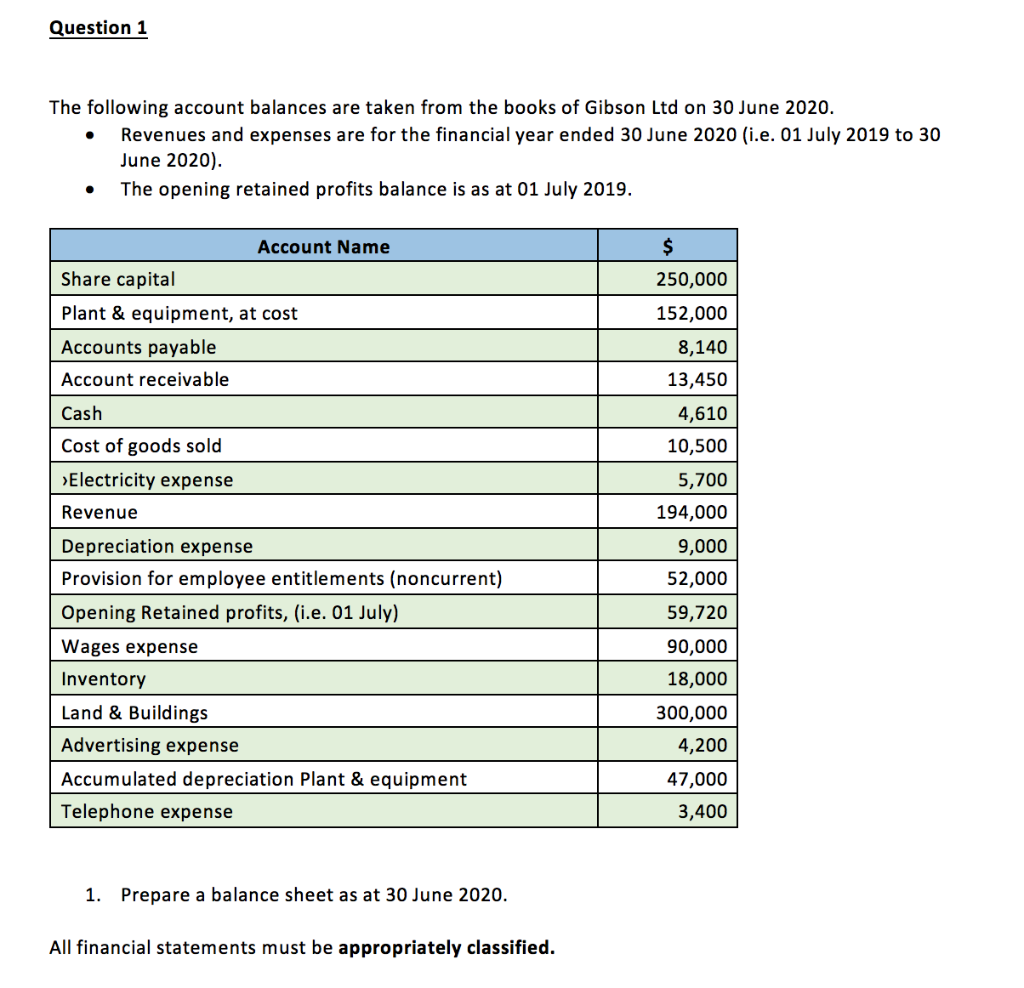

The balance sheet needs to be in this format below: Question 1 . The following account balances are taken from the books of Gibson Ltd

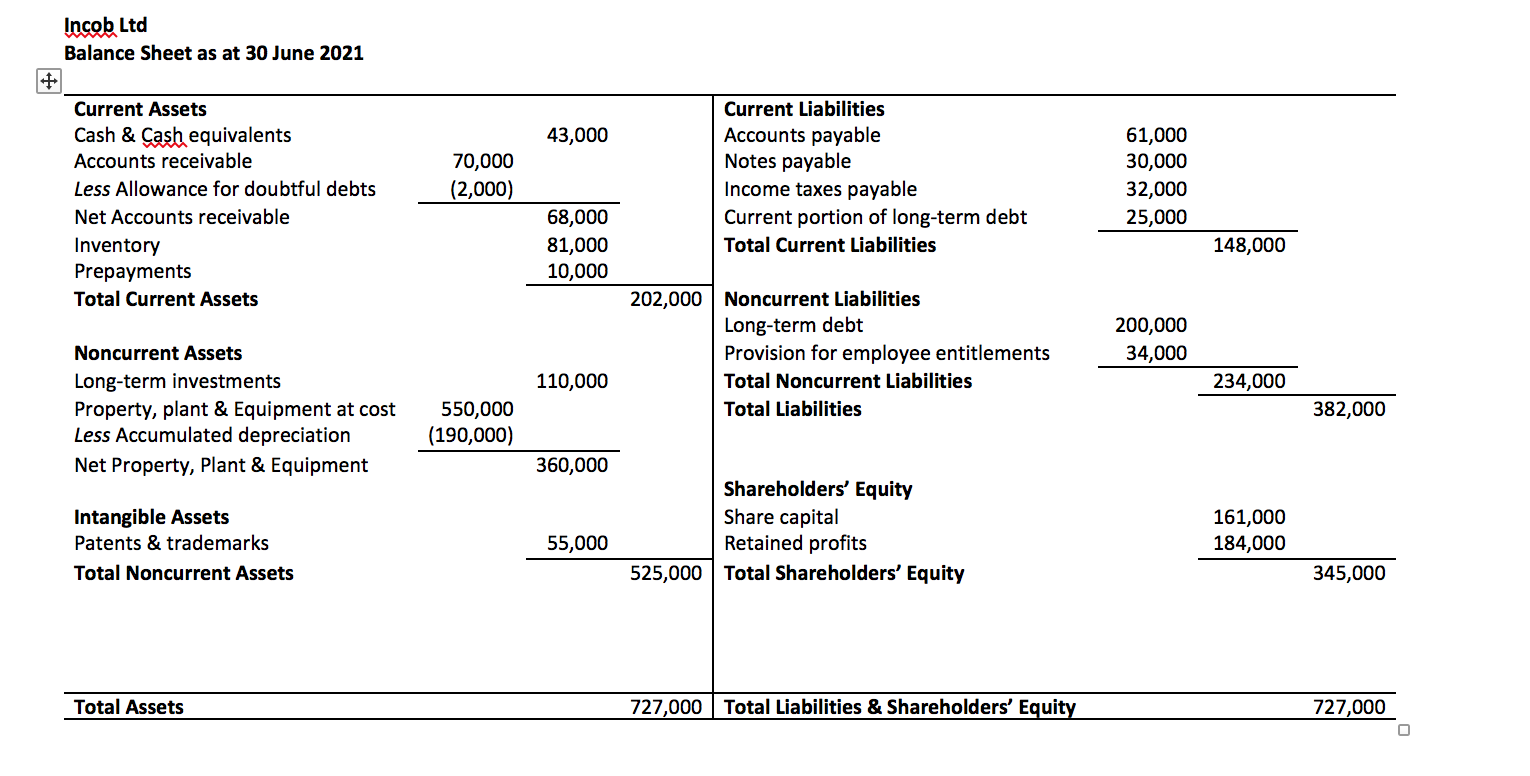

The balance sheet needs to be in this format below:

Question 1 . The following account balances are taken from the books of Gibson Ltd on 30 June 2020. Revenues and expenses are for the financial year ended 30 June 2020 (i.e. 01 July 2019 to 30 June 2020). The opening retained profits balance is as at 01 July 2019. Account Name Share capital Plant & equipment, at cost Accounts payable Account receivable $ 250,000 152,000 8,140 13,450 Cash Cost of goods sold > Electricity expense Revenue Depreciation expense Provision for employee entitlements (noncurrent) Opening Retained profits, (i.e. 01 July) Wages expense Inventory Land & Buildings Advertising expense Accumulated depreciation Plant & equipment Telephone expense 4,610 10,500 5,700 194,000 9,000 52,000 59,720 90,000 18,000 300,000 4,200 47,000 3,400 1. Prepare a balance sheet as at 30 June 2020. All financial statements must be appropriately classified. Incob Ltd Balance Sheet as at 30 June 2021 43,000 70,000 (2,000) Current Assets Cash & Cash equivalents Accounts receivable Less Allowance for doubtful debts Net Accounts receivable Inventory Prepayments Total Current Assets Current Liabilities Accounts payable Notes payable Income taxes payable Current portion of long-term debt Total Current Liabilities 61,000 30,000 32,000 25,000 68,000 81,000 10,000 148,000 202,000 Noncurrent Liabilities Long-term debt Provision for employee entitlements Total Noncurrent Liabilities Total Liabilities 200,000 34,000 110,000 Noncurrent Assets Long-term investments Property, plant & Equipment at cost Less Accumulated depreciation Net Property, Plant & Equipment 234,000 382,000 550,000 (190,000) 360,000 Intangible Assets Patents & trademarks Total Noncurrent Assets Shareholders' Equity Share capital Retained profits 525,000 Total Shareholders' Equity 161,000 184,000 55,000 345,000 Total Assets 727,000 | Total Liabilities & Shareholders' Equity 727,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started