Answered step by step

Verified Expert Solution

Question

1 Approved Answer

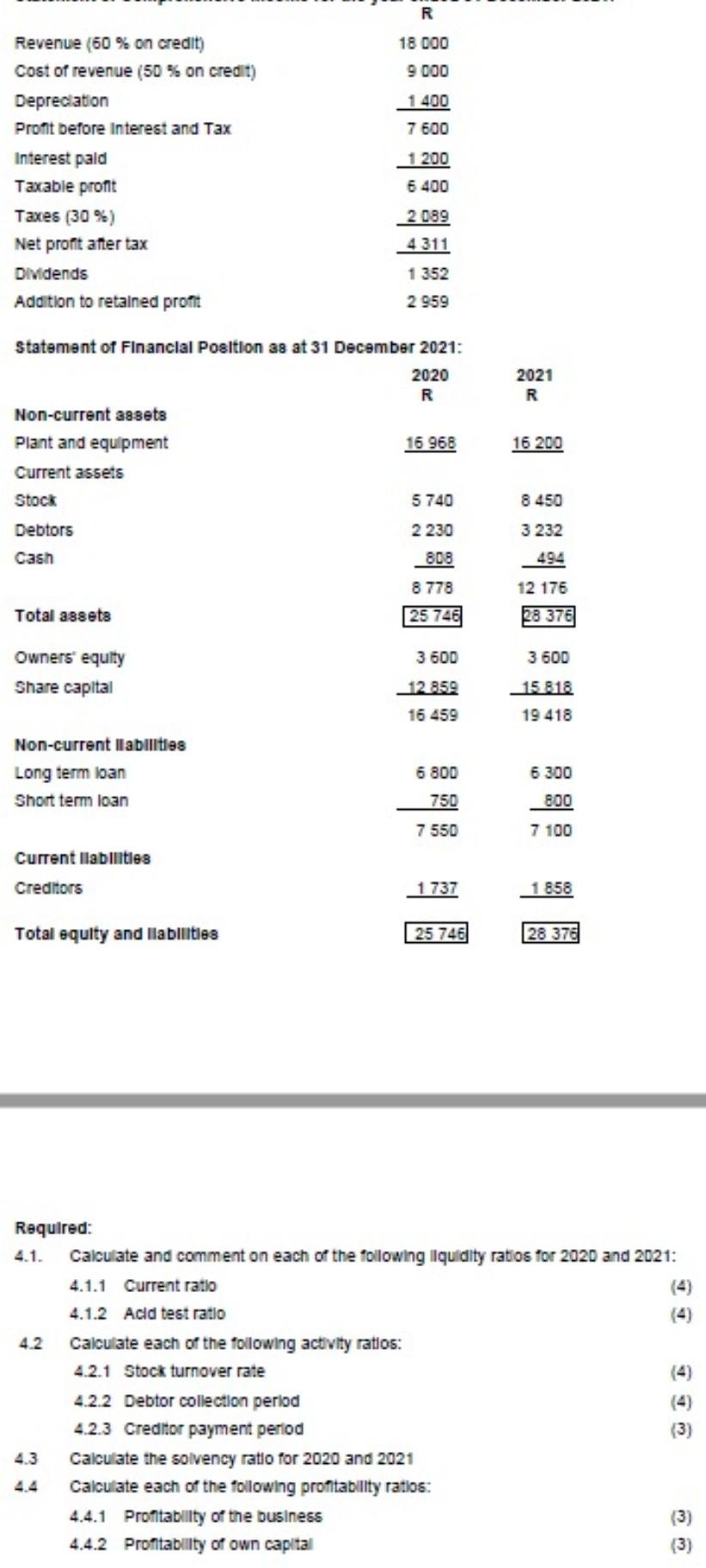

calculations R Revenue (60% on credit) 18 000 Cost of revenue (50% on credit) 9 000 Depreciation 1400 Profit before Interest and Tax 7 600

calculations

R Revenue (60% on credit) 18 000 Cost of revenue (50% on credit) 9 000 Depreciation 1400 Profit before Interest and Tax 7 600 Interest pald 1 200 Taxable profit 6 400 Taxes (30%) 2 089 Net profit after tax 4311 Dividends 1 352 Addition to retained profit 2959 Statement of Financial Position as at 31 December 2021: 2020 R Non-current assets Plant and equipment 16 968 Current assets Stock 5 740 Debtors 2 230 Cash 808 8 778 Total assets 25 746 28 376 Owners' equity 3600 3 600 Share capital 12 859 15 818 16 459 19 418 Non-current liabilities Long term loan 6 800 6 300 Short term loan 750 800 7 550 7 100 Current llabilities Creditors 1 737 1858 Total equity and liabilities 25 746 28 376 Required: 4.1. calculate and comment on each of the following liquidity ratios for 2020 and 2021: 4.1.1 Current ratio 4.1.2 Acid test ratio 4.2 Calculate each of the following activity ratios: 4.2.1 Stock turnover rate 4.2.2 Debtor collection period 4.2.3 Creditor payment period (3) Calculate the solvency ratio for 2020 and 2021 Calculate each of the following profitability ratios: 4.4.1 Profitability of the business (3) 4.4.2 Profitability of own capital (3) 4.3 2021 R 16 200 8 450 3232 494 12 176Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started