Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Betta Group reports taxable income in the amount of $625,000 and has a 30% tax rate. Additionally, the company estimates a deferred tax

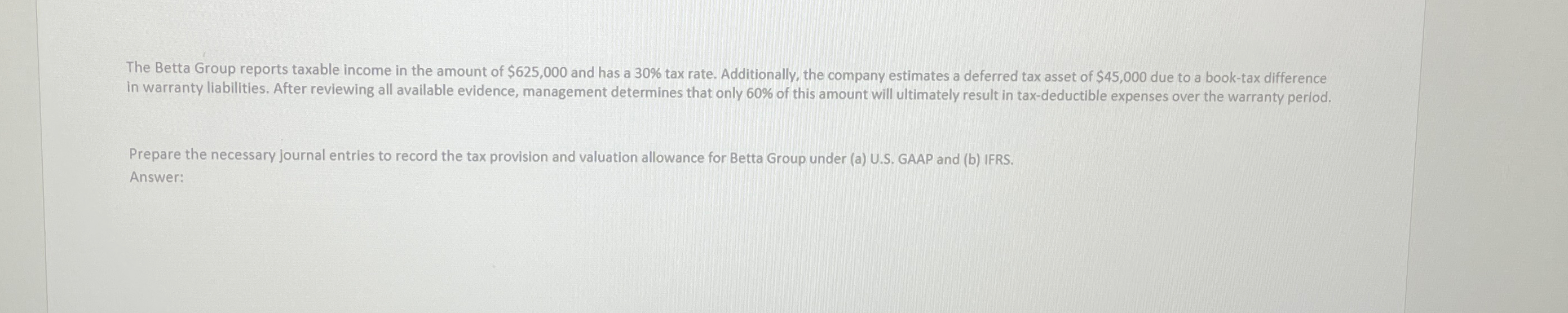

The Betta Group reports taxable income in the amount of $625,000 and has a 30% tax rate. Additionally, the company estimates a deferred tax asset of $45,000 due to a book-tax difference in warranty liabilities. After reviewing all available evidence, management determines that only 60% of this amount will ultimately result in tax-deductible expenses over the warranty period. Prepare the necessary journal entries to record the tax provision and valuation allowance for Betta Group under (a) U.S. GAAP and (b) IFRS. Answer:

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Under US GAAP 1 Journal entry to record the tax provision Income Tax Expense Dr 187500 Income Tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d96124d3a6_964799.pdf

180 KBs PDF File

663d96124d3a6_964799.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started