Answered step by step

Verified Expert Solution

Question

1 Approved Answer

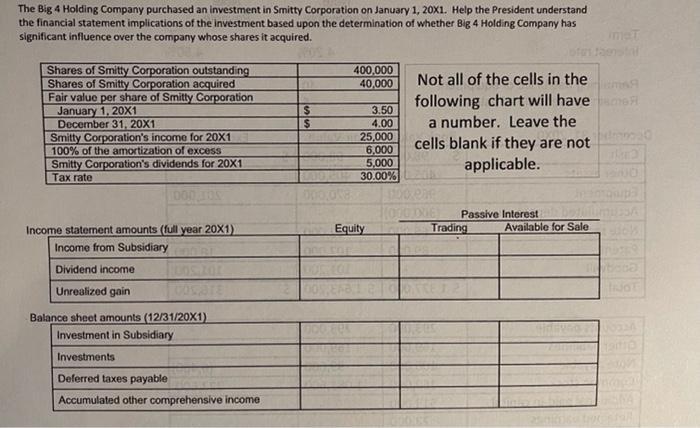

. The Big 4 Holding Company purchased an investment in Smitty Corporation on January 1, 20X1. Help the President understand the financial statement implications of

.

. The Big 4 Holding Company purchased an investment in Smitty Corporation on January 1, 20X1. Help the President understand the financial statement implications of the investment based upon the determination of whether Big 4 Holding Company has significant influence over the company whose shares it acquired. imet Shares of Smitty Corporation outstanding Shares of Smitty Corporation acquired Fair value per share of Smitty Corporation January 1, 20X1 December 31, 20X1 Smitty Corporation's income for 20X1 100% of the amortization of excess Smitty Corporation's dividends for 20X1 Tax rate 400,000 40,000 Not all of the cells in the following chart will haveeR 3.50 4.00 a number. Leave the 25,000 6,000 5,000 30.00% cells blank if they are not applicable. Passive Interest Income statement amounts (full year 20X1) Equity Trading Available for Sale Income from Subsidiary Dividend income Unrealized gain Balance sheet amounts (12/31/20X1) Investment in Subsidiary Investments Deferred taxes payable Accumulated other comprehensive income

Step by Step Solution

★★★★★

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution Percentage of ownership 40000400000 10 Income statement amoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started