Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The blanks are yes, no or not sure. Choosing one of them Part I and Part II are independent questions that are not related to

The blanks are yes, no or not sure. Choosing one of them

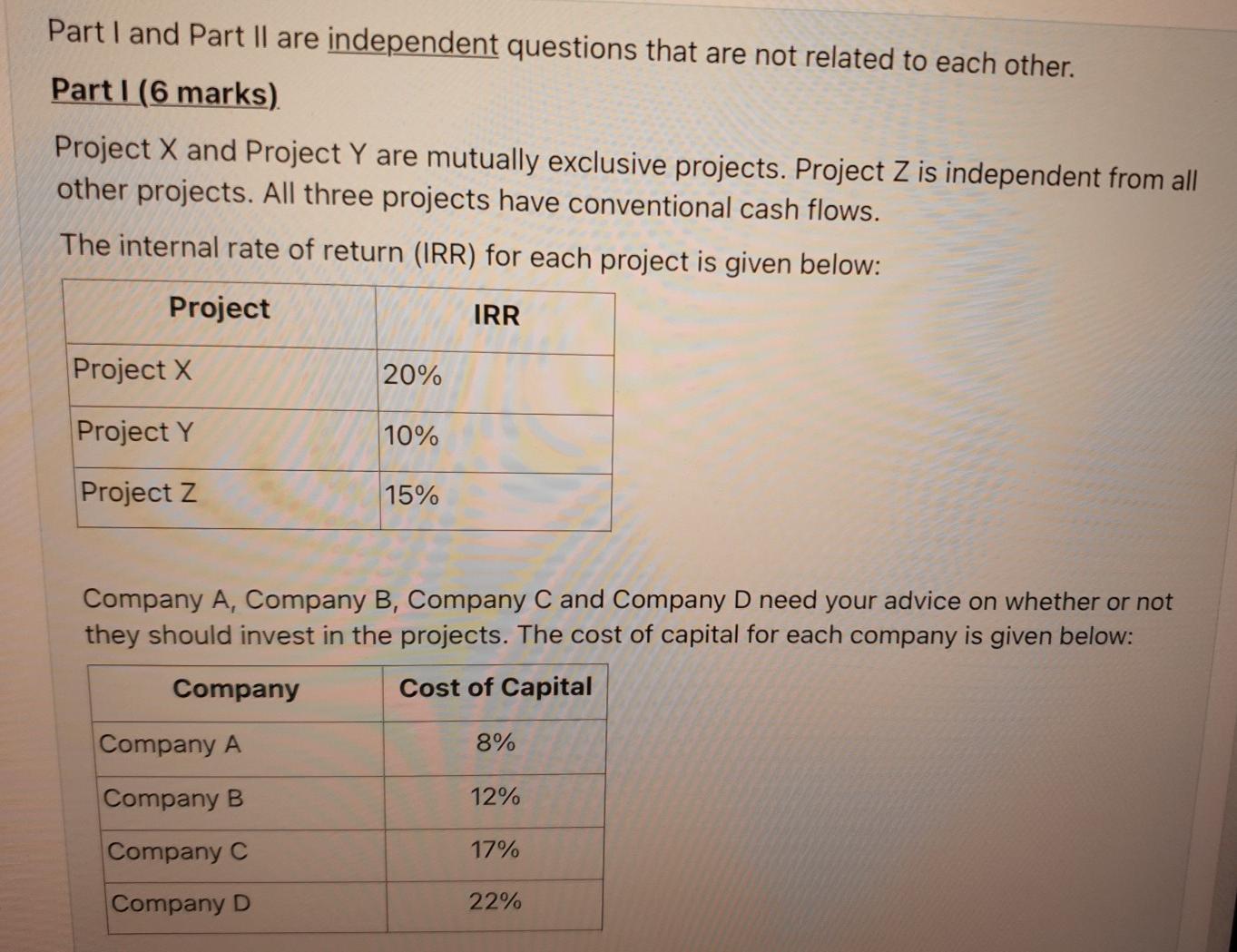

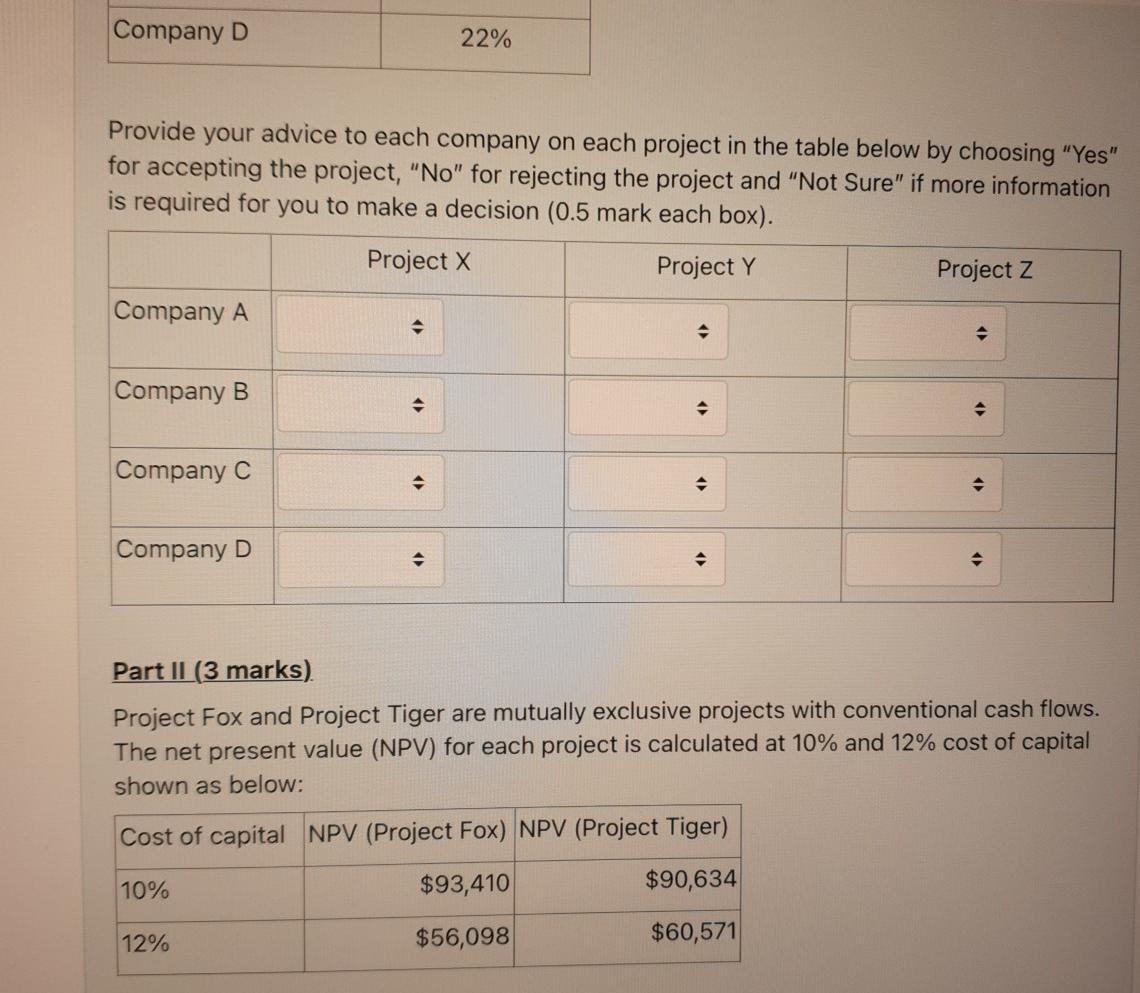

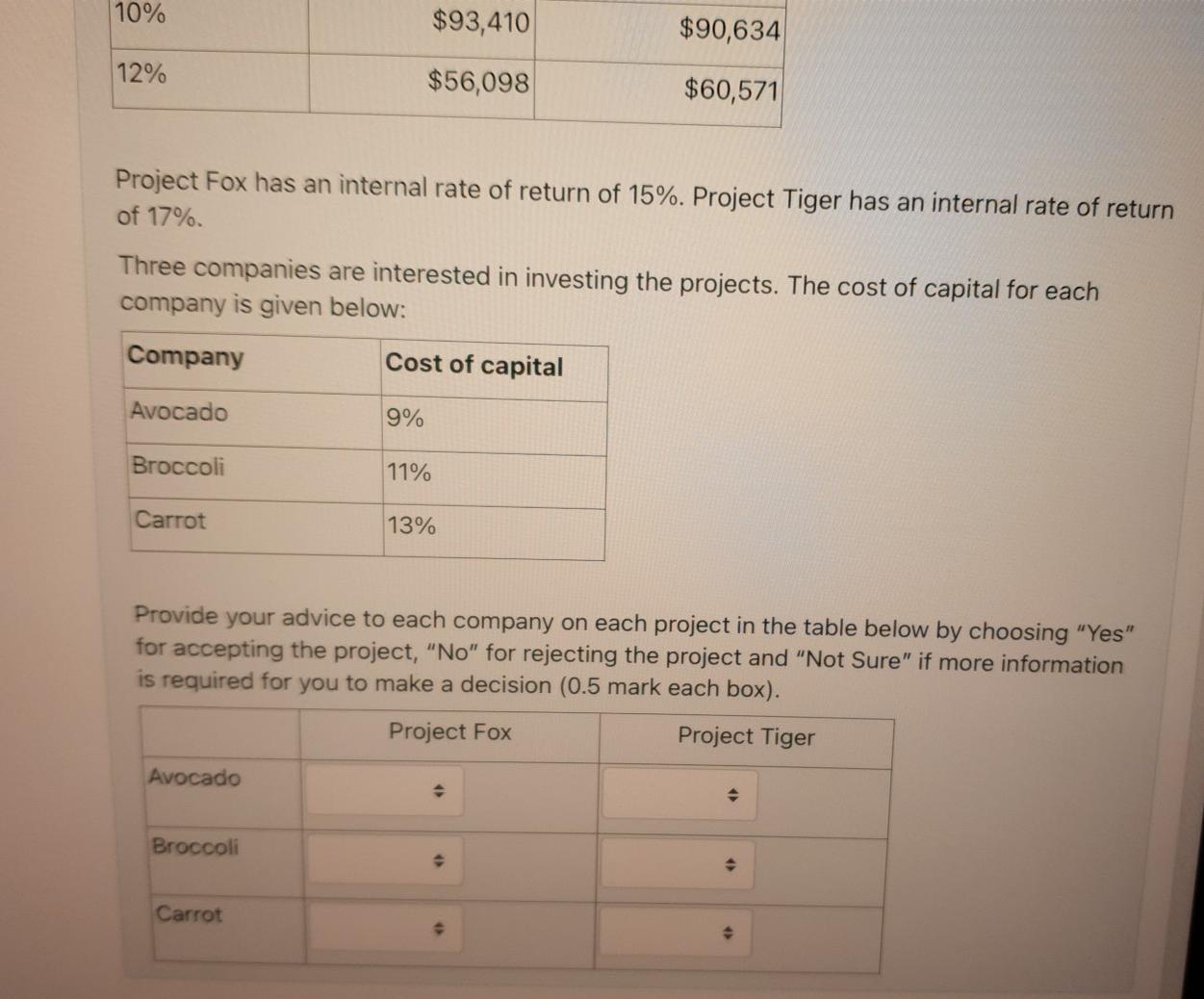

Part I and Part II are independent questions that are not related to each other. Partl (6 marks) Project X and Project Y are mutually exclusive projects. Project Z is independent from all other projects. All three projects have conventional cash flows. The internal rate of return (IRR) for each project is given below: Project IRR Project X 20% Project Y 10% Project Z 15% Company A, Company B, Company C and Company D need your advice on whether or not they should invest in the projects. The cost of capital for each company is given below: Company Cost of Capital Company A 8% Company B 12% Company C 17% Company D 22% Company D 22% Provide your advice to each company on each project in the table below by choosing "Yes" for accepting the project, "No" for rejecting the project and "Not Sure" if more information is required for you to make a decision (0.5 mark each box). Project x Project Y Project Z Company A - Company B Company C Company D . Part II (3 marks) Project Fox and Project Tiger are mutually exclusive projects with conventional cash flows. The net present value (NPV) for each project is calculated at 10% and 12% cost of capital shown as below: Cost of capital NPV (Project Fox) NPV (Project Tiger) 10% $93,410 $90,634 12% $56,098 $60,571 10% $93,410 $90,634 12% $56,098 $60,571 Project Fox has an internal rate of return of 15%. Project Tiger has an internal rate of return of 17% Three companies are interested in investing the projects. The cost of capital for each company is given below: Company Cost of capital Avocado 9% Broccoli 11% Carrot 13% Provide your advice to each company on each project in the table below by choosing "Yes" for accepting the project, "No" for rejecting the project and "Not Sure" if more information is required for you to make a decision (0.5 mark each box). Project Fox Project Tiger Avocado Broccoli CarrotStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started