Answered step by step

Verified Expert Solution

Question

1 Approved Answer

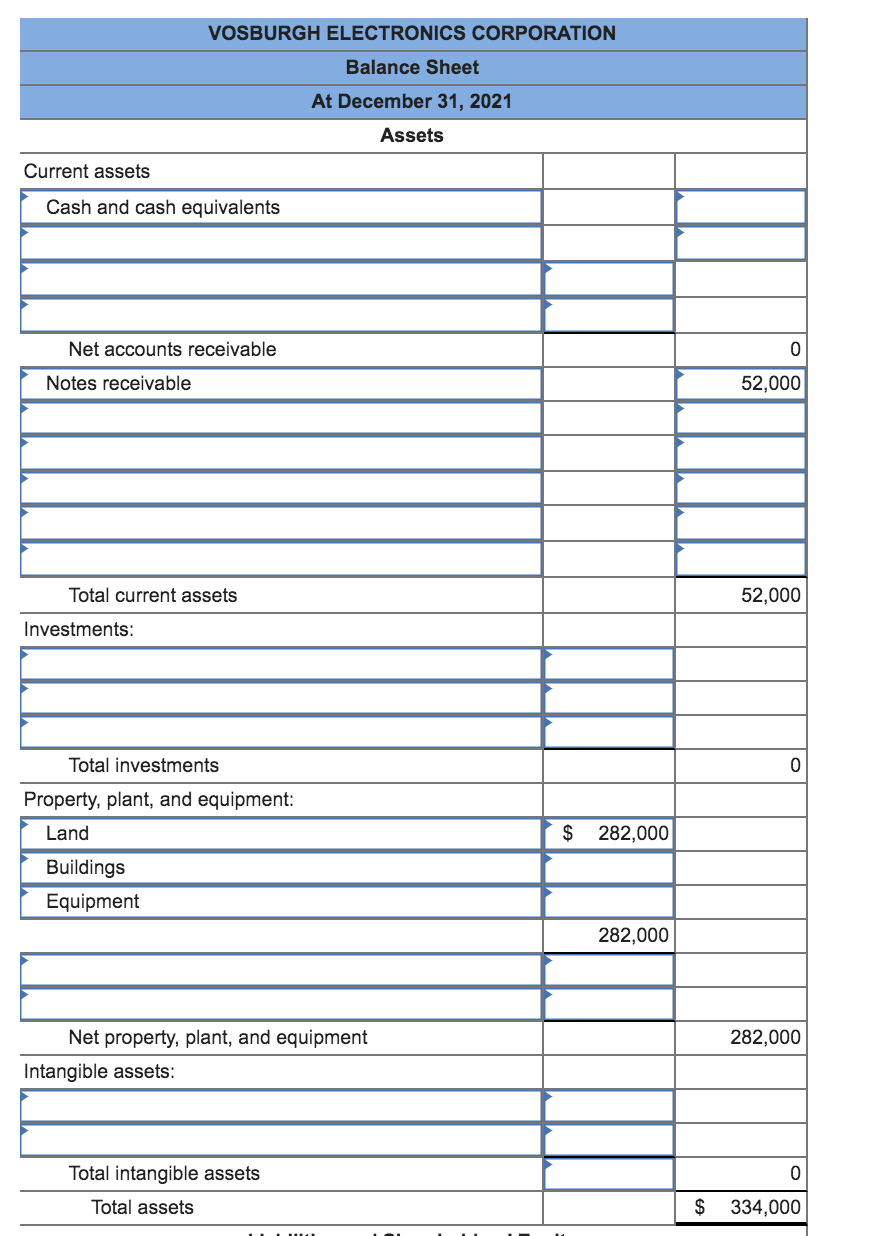

The blue highlighted box is where you have to put the amount, so like the assets, the first 2 accounts goes on the credit side

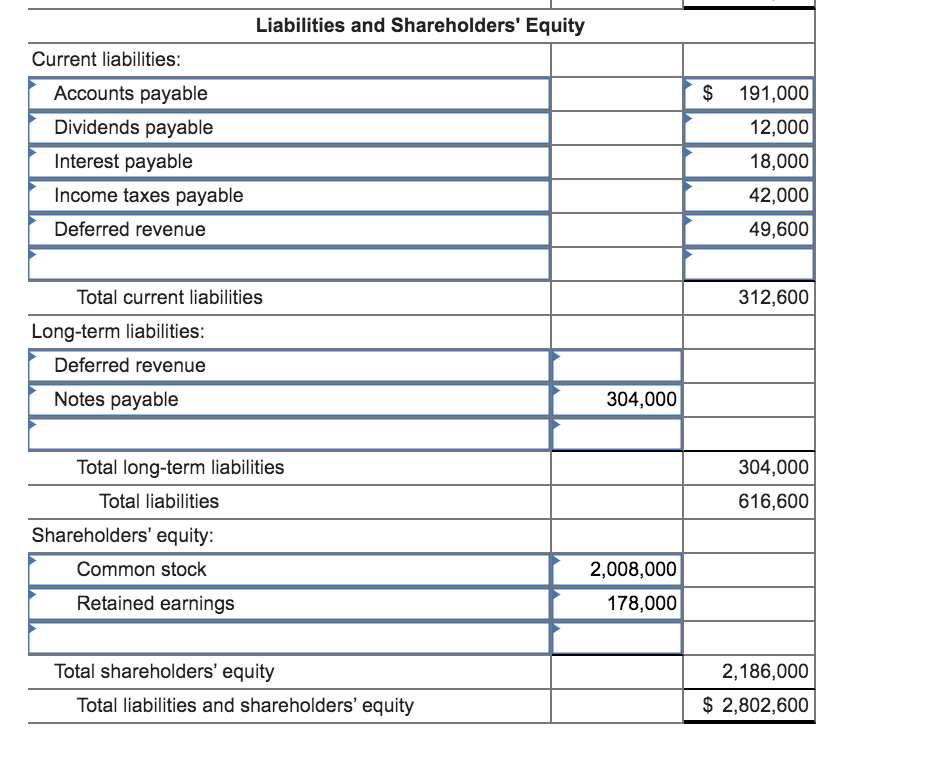

The blue highlighted box is where you have to put the amount, so like the assets, the first 2 accounts goes on the credit side and then the second 2 accounts is in the debit side. This is reposted because the first person had the whole ASSETS part incorrect, but the LIABILITIES AND SHAREHOLDER'S EQUITY, they got it correct, unless you find another missing account etc.,

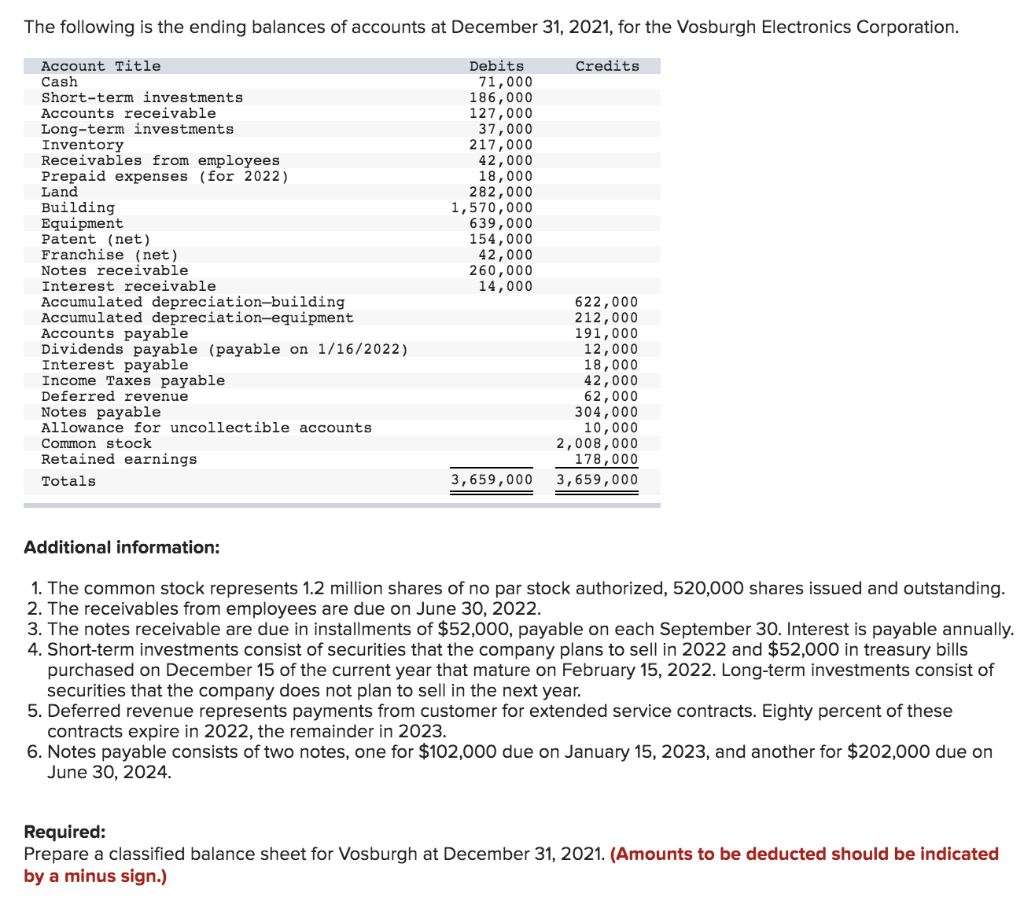

The following is the ending balances of accounts at December 31, 2021, for the Vosburgh Electronics Corporation. Credits Account Title Cash Short-term investments Accounts receivable Long-term investments Inventory Receivables from employees Prepaid expenses (for 2022) Land Building Equipment Patent (net) Franchise (net) Notes receivable Interest receivable Accumulated depreciation-building Accumulated depreciation-equipment Accounts payable Dividends payable (payable on 1/16/2022) Interest payable Income Taxes payable Deferred revenue Notes payable Allowance for uncollectible accounts Common stock Retained earnings Totals Debits 71,000 186,000 127,000 37,000 217,000 42,000 18,000 282,000 1,570,000 639,000 154,000 42,000 260,000 14,000 622,000 212,000 191,000 12,000 18,000 42,000 62,000 304,000 10,000 2,008,000 178,000 3,659,000 3,659,000 Additional information: 1. The common stock represents 1.2 million shares of no par stock authorized, 520,000 shares issued and outstanding. 2. The receivables from employees are due on June 30, 2022. 3. The notes receivable are due in installments of $52,000, payable on each September 30. Interest is payable annually. 4. Short-term investments consist of securities that the company plans to sell in 2022 and $52,000 in treasury bills purchased on December 15 of the current year that mature on February 15, 2022. Long-term investments consist of securities that the company does not plan to sell in the next year. 5. Deferred revenue represents payments from customer for extended service contracts. Eighty percent of these contracts expire in 2022, the remainder in 2023. 6. Notes payable consists of two notes, one for $102,000 due on January 15, 2023, and another for $202,000 due on June 30, 2024. Required: Prepare a classified balance sheet for Vosburgh at December 31, 2021. (Amounts to be deducted should be indicated by a minus sign.) VOSBURGH ELECTRONICS CORPORATION Balance Sheet At December 31, 2021 Assets Current assets Cash and cash equivalents Net accounts receivable Notes receivable 52,000 Total current assets 52,000 Investments: Total investments Property, plant, and equipment: Land $ 282,000 Buildings Equipment 282,000 282,000 Net property, plant, and equipment Intangible assets: Total intangible assets Total assets $ 334,000 Liabilities and Shareholders' Equity Current liabilities: Accounts payable Dividends payable $ Interest payable 191,000 12,000 18,000 42,000 49,600 Income taxes payable Deferred revenue 312,600 Total current liabilities Long-term liabilities: Deferred revenue Notes payable 304,000 Total long-term liabilities 304,000 Total liabilities 616,600 Shareholders' equity: Common stock Retained earnings 2,008,000 178,000 Total shareholders' equity Total liabilities and shareholders' equity 2,186,000 $ 2,802,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started