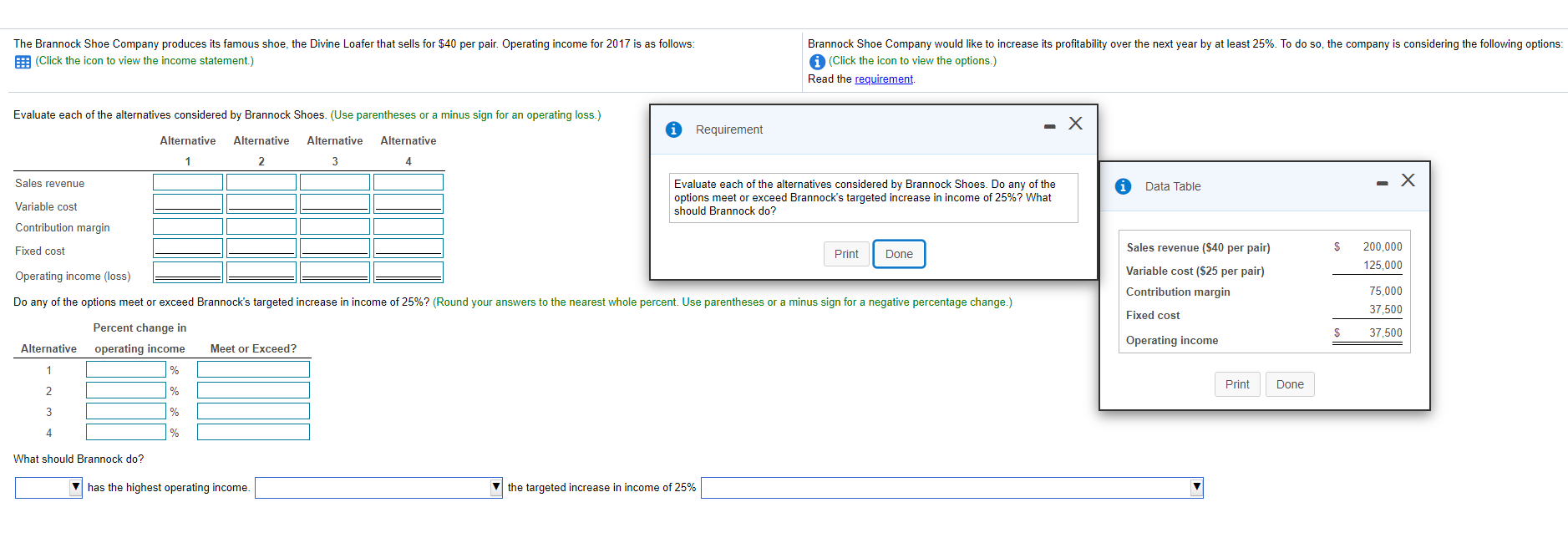

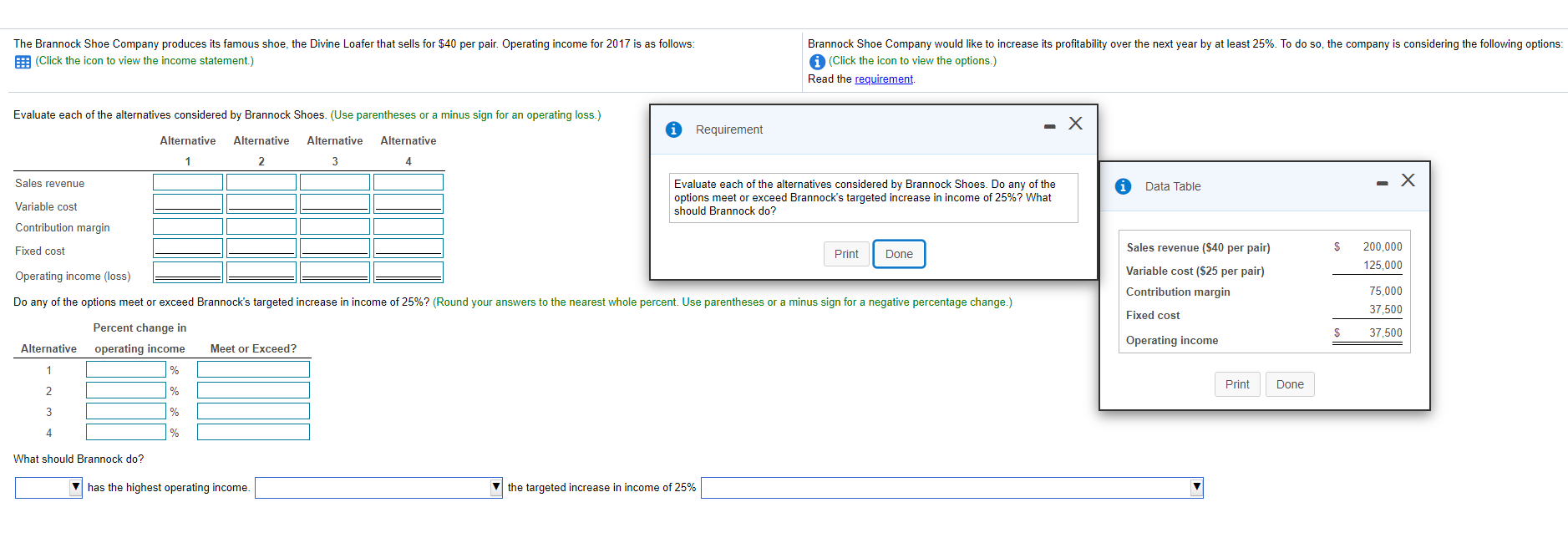

The Brannock Shoe Company produces its famous shoe, the Divine Loafer that sells for $40 per pair. Operating income for 2017 is as follows: = (Click the icon to view the income statement.) Brannock Shoe Company would like to increase its profitability over the next year by at least 25%. To do so, the company is considering the following options: (Click the icon to view the options.) Read the requirement Evaluate each of the alternatives considered by Brannock Shoes. (Use parentheses or a minus sign for an operating loss.) Requirement - X Alternative Alternative Alternative Alternative 4 1 2 3 Sales revenue Data Table Evaluate each of the alternatives considered by Brannock Shoes. Do any of the options meet or exceed Brannock's targeted increase in income of 25%? What should Brannock do? Variable cost Contribution margin $ Fixed cost Print Done Sales revenue ($40 per pair) Variable cost ($25 per pair) Contribution margin 200,000 125.000 Operating income (loss) Do any of the options meet or exceed Brannock's targeted increase in income of 25%? (Round your answers to the nearest whole percent. Use parentheses or a minus sign for a negative percentage change.) 75,000 37,500 Fixed cost $ 37,500 Percent change in operating income % Operating income Alternative Meet or Exceed? 1 Print Done 2 % 3 4 % What should Brannock do? has the highest operating income. the targeted increase in income of 25% The Brannock Shoe Company produces its famous shoe, the Divine Loafer that sells for $40 per pair. Operating income for 2017 is as follows: = (Click the icon to view the income statement.) Brannock Shoe Company would like to increase its profitability over the next year by at least 25%. To do so, the company is considering the following options: (Click the icon to view the options.) Read the requirement Evaluate each of the alternatives considered by Brannock Shoes. (Use parentheses or a minus sign for an operating loss.) Requirement - X Alternative Alternative Alternative Alternative 4 1 2 3 Sales revenue Data Table Evaluate each of the alternatives considered by Brannock Shoes. Do any of the options meet or exceed Brannock's targeted increase in income of 25%? What should Brannock do? Variable cost Contribution margin $ Fixed cost Print Done Sales revenue ($40 per pair) Variable cost ($25 per pair) Contribution margin 200,000 125.000 Operating income (loss) Do any of the options meet or exceed Brannock's targeted increase in income of 25%? (Round your answers to the nearest whole percent. Use parentheses or a minus sign for a negative percentage change.) 75,000 37,500 Fixed cost $ 37,500 Percent change in operating income % Operating income Alternative Meet or Exceed? 1 Print Done 2 % 3 4 % What should Brannock do? has the highest operating income. the targeted increase in income of 25%