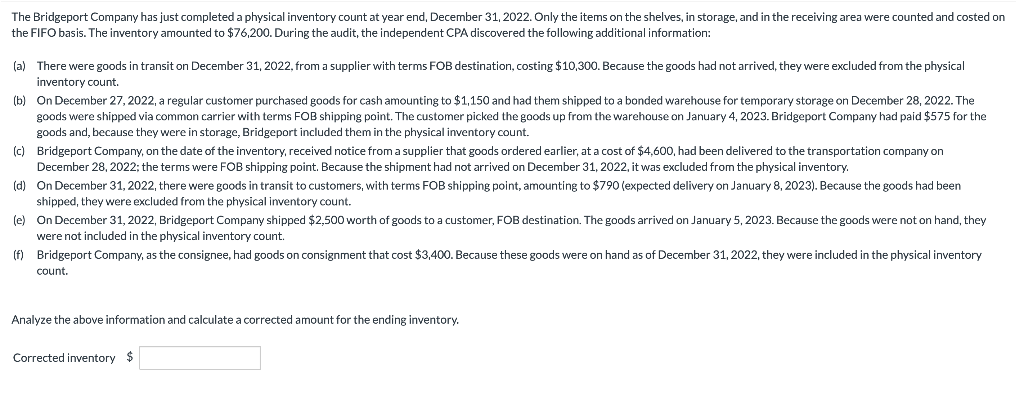

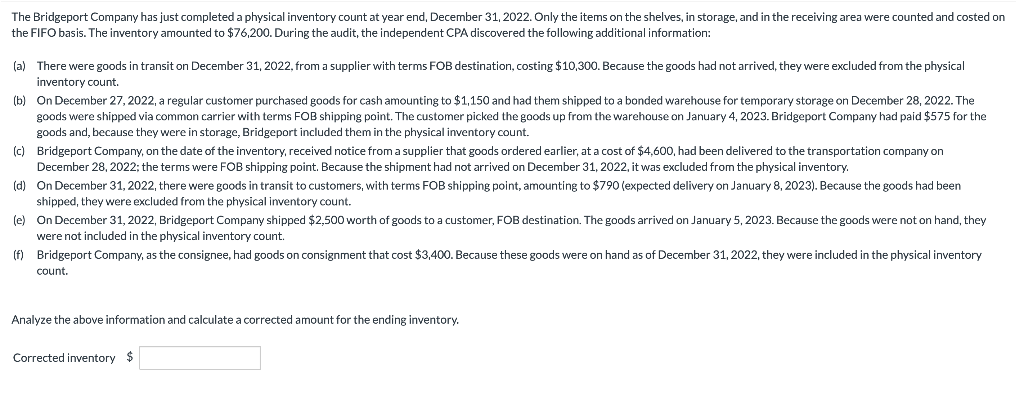

The Bridgeport Company has just completed a physical inventory count at year end, December 31, 2022. Only the items on the shelves, in storage, and in the receiving area were counted and costed on the FIFO basis. The inventory amounted to $76,200. During the audit, the independent CPA discovered the following additional information: (a) There were goods in transit on December 31, 2022, from a supplier with terms FOB destination, costing $10,300. Because the goods had not arrived, they were excluded from the physical inventory count. (b) On December 27, 2022, a regular customer purchased goods for cash amounting to $1,150 and had them shipped to a bonded warehouse for temporary storage on December 28, 2022. The goods were shipped via common carrier with terms FOB shipping point. The customer picked the goods up from the warehouse on January 4, 2023. Bridgeport Company had paid $575 for the goods and, because they were in storage, Bridgeport included them in the physical inventory count. (c) Bridgeport Company, on the date of the inventory, received notice from a supplier that goods ordered earlier, at a cost of $4,600, had been delivered to the transportation company on December 28, 2022; the terms were FOB shipping point. Because the shipment had not arrived on December 31, 202 had not arrived on December 31, 2022, it was excluded from the physical inventory (d) On December 31, 2022, there were goods in transit to customers, with terms FOB shipping point, amounting to $790 (expected delivery on January 8, 2023). Because the goods had been shipped, they were excluded from the physical inventory count. (e) On December 31, 2022, Bridgeport Company shipped $2,500 worth of goods to a customer, FOB destination. The goods arrived on January 5, 2023. Because the goods were not on hand, they were not included in the physical inventory count. (f) Bridgeport Company, as the consignee, had goods on consignment that cost $3,400. Because these goods were on hand as of December 31, 2022, they were included in the physical inventory count. Analyze the above information and calculate a corrected amount for the ending inventory. Corrected inventory $ The Bridgeport Company has just completed a physical inventory count at year end, December 31, 2022. Only the items on the shelves, in storage, and in the receiving area were counted and costed on the FIFO basis. The inventory amounted to $76,200. During the audit, the independent CPA discovered the following additional information: (a) There were goods in transit on December 31, 2022, from a supplier with terms FOB destination, costing $10,300. Because the goods had not arrived, they were excluded from the physical inventory count. (b) On December 27, 2022, a regular customer purchased goods for cash amounting to $1,150 and had them shipped to a bonded warehouse for temporary storage on December 28, 2022. The goods were shipped via common carrier with terms FOB shipping point. The customer picked the goods up from the warehouse on January 4, 2023. Bridgeport Company had paid $575 for the goods and, because they were in storage, Bridgeport included them in the physical inventory count. (c) Bridgeport Company, on the date of the inventory, received notice from a supplier that goods ordered earlier, at a cost of $4,600, had been delivered to the transportation company on December 28, 2022; the terms were FOB shipping point. Because the shipment had not arrived on December 31, 202 had not arrived on December 31, 2022, it was excluded from the physical inventory (d) On December 31, 2022, there were goods in transit to customers, with terms FOB shipping point, amounting to $790 (expected delivery on January 8, 2023). Because the goods had been shipped, they were excluded from the physical inventory count. (e) On December 31, 2022, Bridgeport Company shipped $2,500 worth of goods to a customer, FOB destination. The goods arrived on January 5, 2023. Because the goods were not on hand, they were not included in the physical inventory count. (f) Bridgeport Company, as the consignee, had goods on consignment that cost $3,400. Because these goods were on hand as of December 31, 2022, they were included in the physical inventory count. Analyze the above information and calculate a corrected amount for the ending inventory. Corrected inventory $