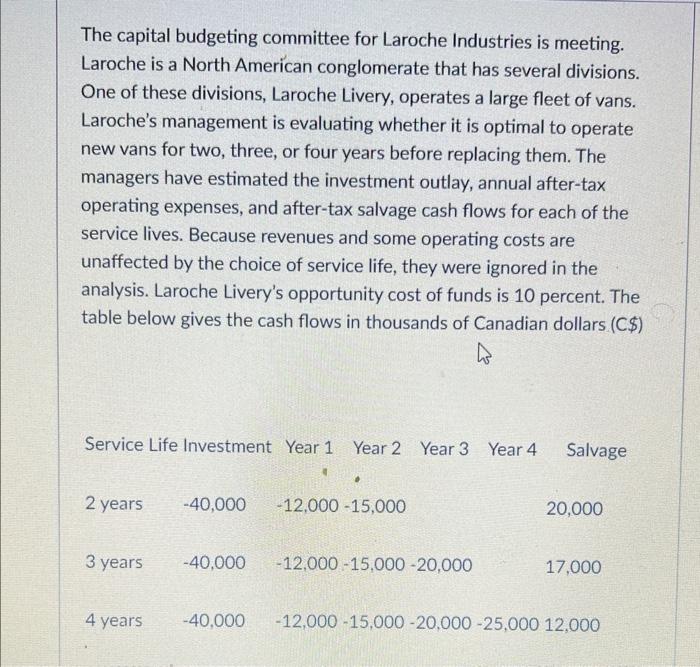

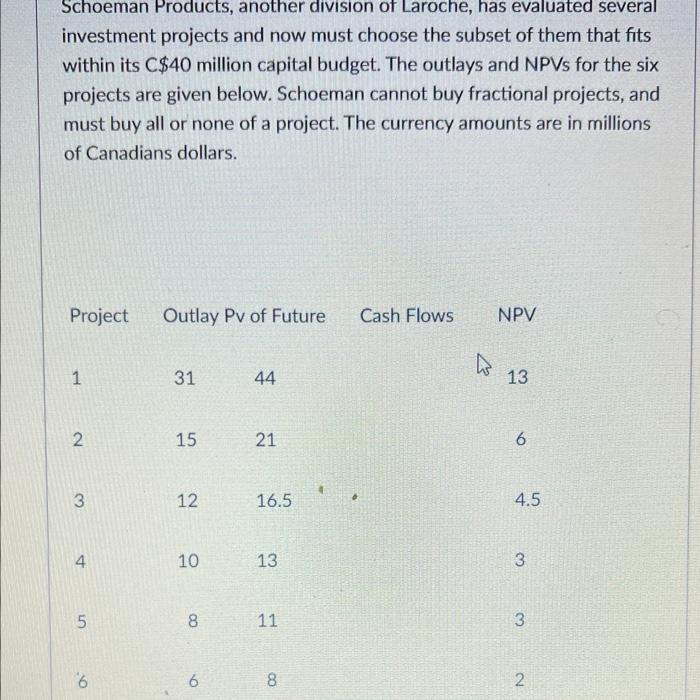

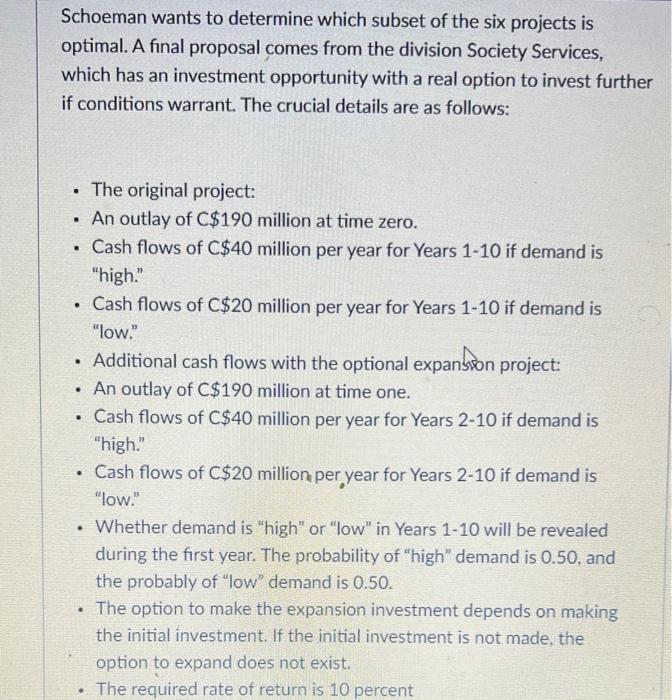

The capital budgeting committee for Laroche Industries is meeting. Laroche is a North American conglomerate that has several divisions. One of these divisions, Laroche Livery, operates a large fleet of vans. Laroche's management is evaluating whether it is optimal to operate new vans for two, three, or four years before replacing them. The managers have estimated the investment outlay, annual after-tax operating expenses, and after-tax salvage cash flows for each of the service lives. Because revenues and some operating costs are unaffected by the choice of service life, they were ignored in the analysis. Laroche Livery's opportunity cost of funds is 10 percent. The table below gives the cash flows in thousands of Canadian dollars (C\$) Schoeman Products, another division of Laroche, has evaluated several investment projects and now must choose the subset of them that fits within its C$40 million capital budget. The outlays and NPVs for the six projects are given below. Schoeman cannot buy fractional projects, and must buy all or none of a project. The currency amounts are in millions of Canadians dollars. Schoeman wants to determine which subset of the six projects is optimal. A final proposal comes from the division Society Services, which has an investment opportunity with a real option to invest further if conditions warrant. The crucial details are as follows: - The original project: - An outlay of C$190 million at time zero. - Cash flows of C$40 million per year for Years 110 if demand is "high." - Cash flows of C$20 million per year for Years 1-10 if demand is "low." - Additional cash flows with the optional expanswon project: - An outlay of C$190 million at time one. - Cash flows of C$40 million per year for Years 2-10 if demand is "high." - Cash flows of C$20 million per year for Years 2-10 if demand is "low." - Whether demand is "high" or "low" in Years 1-10 will be revealed during the first year. The probability of "high" demand is 0.50, and the probably of "low" demand is 0.50. - The option to make the expansion investment depends on making the initial investment. If the initial investment is not made, the option to expand does not exist. - The required rate of return is 10 percent the probably of "low" demand is 0.50. - The option to make the expansion investment depends on making the initial investment. If the initial investment is not made, the option to expand does not exist. - The required rate of return is 10 percent What is the NPV (C $ millions) of the optimal set of investment decisions for Society Services including the expansion option? (Example answer: Enter 1.234 for 1,234,000,000 ) What is the NPV (C\$ millions) of the original project for Society Services without considering the expansion option? (Example answer: Enter 1.234 for 1,234,000,000)