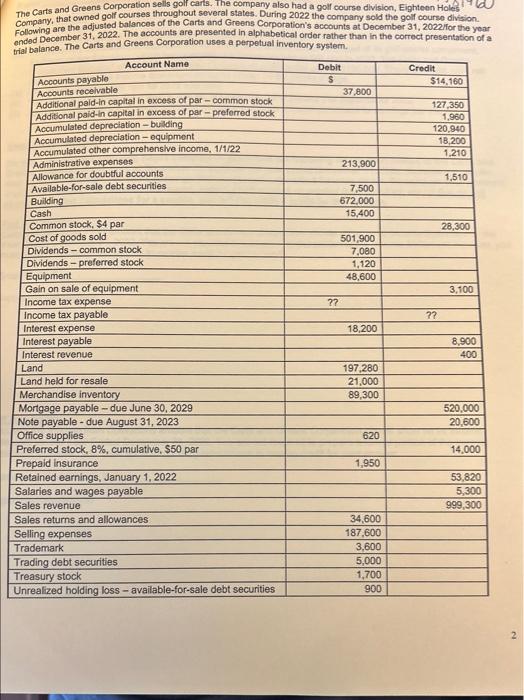

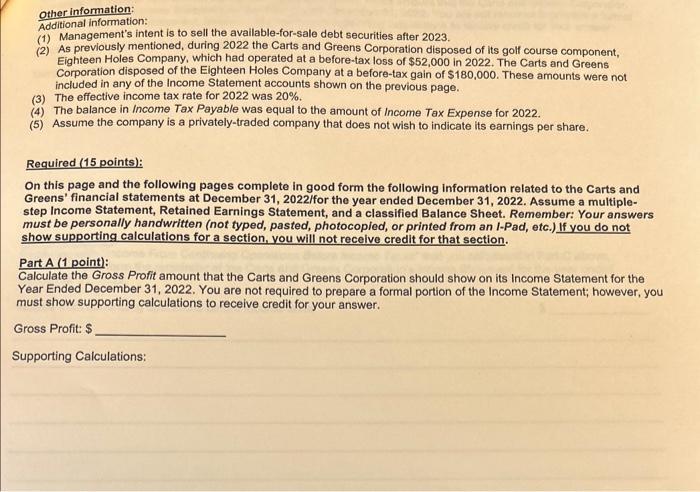

The Carts and Greens Corporation sells golf carts. The company also had a goif course division, Eighteen Holes Company, that owned golf courses throughout several states. During 2022 the cornpany sold the golf courso division. Following are the adjusted balances of the Carts and Greens Corporation's accounts at December 31, 2022/for the year Other information: Additional information: (1) Management's intent is to sell the available-for-sale debt securities after 2023. (2) As previously mentioned, during 2022 the Carts and Greens Corporation disposed of its golf course component, Eighteen Holes Company, which had operated at a before-tax loss of $52,000 in 2022 . The Carts and Greens Corporation disposed of the Eighteen Holes Company at a before-tax gain of $180,000. These amounts were not included in any of the Income Statement accounts shown on the previous page. (3) The effective income tax rate for 2022 was 20%. (4) The balance in Income Tax Payable was equal to the amount of Income Tax Expense for 2022. (5) Assume the company is a privately-traded company that does not wish to indicate its earnings per share. Required (15 points): On this page and the following pages complete in good form the following information related to the Carts and Greens' financial statements at December 31, 2022/for the year ended December 31, 2022. Assume a multiplestep Income Statement, Retained Earnings Statement, and a classified Balance Sheet. Remember: Your answers must be personally handwritten (not typed, pasted, photocopled, or printed from an I-Pad, etc.) If you do not show supporting calculations for a section, you will not recelve credit for that section. Part A (1 point): Calculate the Gross Profit amount that the Carts and Greens Corporation should show on its Income Statement for the Year Ended December 31, 2022. You are not required to prepare a formal portion of the Income Statement; however, you must show supporting calculations to receive credit for your answer. Gross Profit: \$ Supporting Calculations: The Carts and Greens Corporation sells golf carts. The company also had a goif course division, Eighteen Holes Company, that owned golf courses throughout several states. During 2022 the cornpany sold the golf courso division. Following are the adjusted balances of the Carts and Greens Corporation's accounts at December 31, 2022/for the year Other information: Additional information: (1) Management's intent is to sell the available-for-sale debt securities after 2023. (2) As previously mentioned, during 2022 the Carts and Greens Corporation disposed of its golf course component, Eighteen Holes Company, which had operated at a before-tax loss of $52,000 in 2022 . The Carts and Greens Corporation disposed of the Eighteen Holes Company at a before-tax gain of $180,000. These amounts were not included in any of the Income Statement accounts shown on the previous page. (3) The effective income tax rate for 2022 was 20%. (4) The balance in Income Tax Payable was equal to the amount of Income Tax Expense for 2022. (5) Assume the company is a privately-traded company that does not wish to indicate its earnings per share. Required (15 points): On this page and the following pages complete in good form the following information related to the Carts and Greens' financial statements at December 31, 2022/for the year ended December 31, 2022. Assume a multiplestep Income Statement, Retained Earnings Statement, and a classified Balance Sheet. Remember: Your answers must be personally handwritten (not typed, pasted, photocopled, or printed from an I-Pad, etc.) If you do not show supporting calculations for a section, you will not recelve credit for that section. Part A (1 point): Calculate the Gross Profit amount that the Carts and Greens Corporation should show on its Income Statement for the Year Ended December 31, 2022. You are not required to prepare a formal portion of the Income Statement; however, you must show supporting calculations to receive credit for your answer. Gross Profit: \$ Supporting Calculations