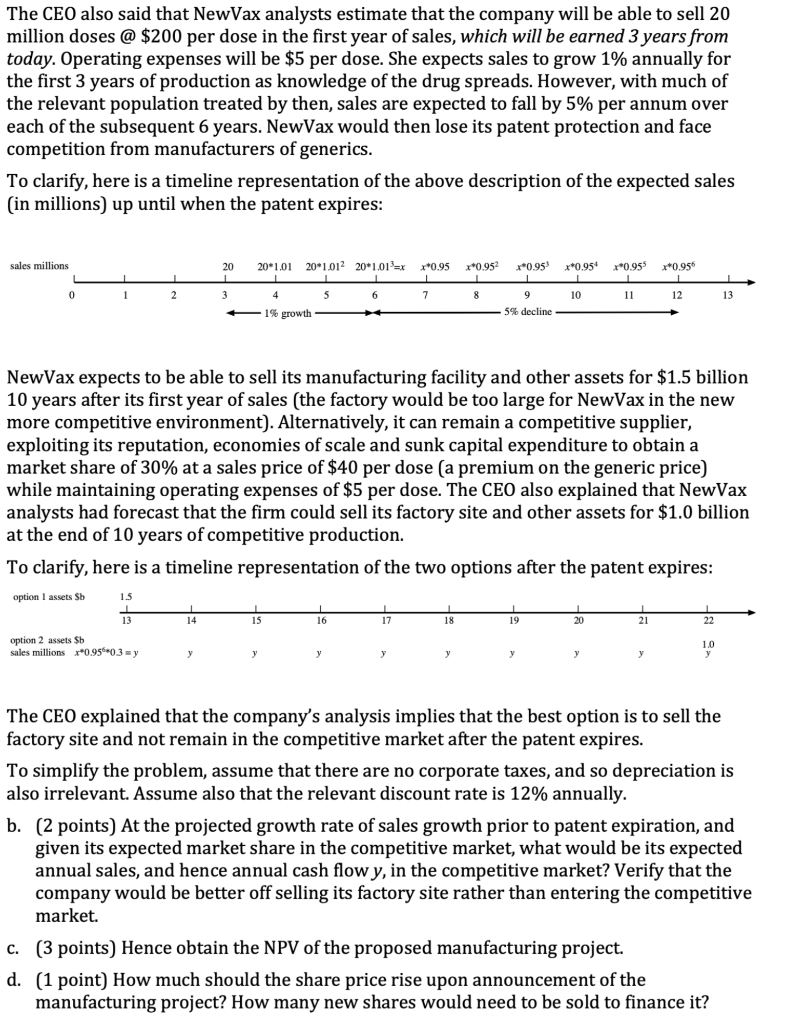

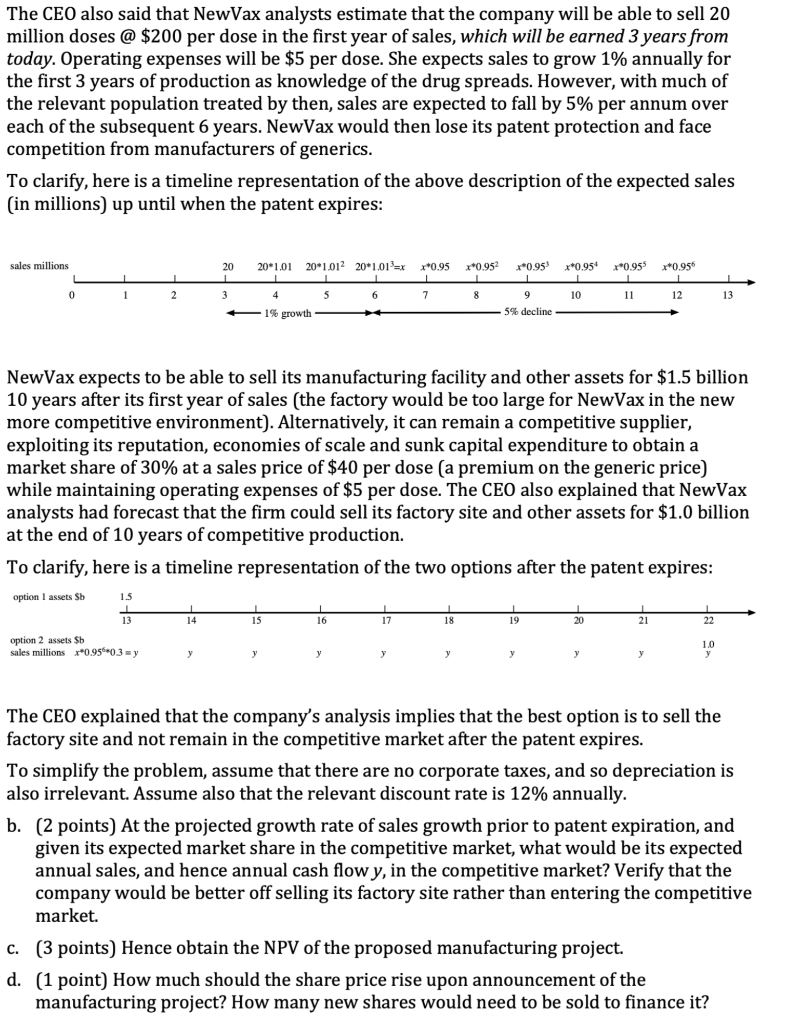

The CEO also said that NewVax analysts estimate that the company will be able to sell 20 million doses @ \$200 per dose in the first year of sales, which will be earned 3 years from today. Operating expenses will be $5 per dose. She expects sales to grow 1% annually for the first 3 years of production as knowledge of the drug spreads. However, with much of the relevant population treated by then, sales are expected to fall by 5% per annum over each of the subsequent 6 years. NewVax would then lose its patent protection and face competition from manufacturers of generics. To clarify, here is a timeline representation of the above description of the expected sales (in millions) up until when the patent expires: NewVax expects to be able to sell its manufacturing facility and other assets for $1.5 billion 10 years after its first year of sales (the factory would be too large for NewVax in the new more competitive environment). Alternatively, it can remain a competitive supplier, exploiting its reputation, economies of scale and sunk capital expenditure to obtain a market share of 30% at a sales price of $40 per dose (a premium on the generic price) while maintaining operating expenses of $5 per dose. The CEO also explained that NewVax analysts had forecast that the firm could sell its factory site and other assets for $1.0 billion at the end of 10 years of competitive production. To clarify, here is a timeline representation of the two options after the patent expires: opti optix sales The CEO explained that the company's analysis implies that the best option is to sell the factory site and not remain in the competitive market after the patent expires. To simplify the problem, assume that there are no corporate taxes, and so depreciation is also irrelevant. Assume also that the relevant discount rate is 12% annually. b. (2 points) At the projected growth rate of sales growth prior to patent expiration, and given its expected market share in the competitive market, what would be its expected annual sales, and hence annual cash flow y, in the competitive market? Verify that the company would be better off selling its factory site rather than entering the competitive market. c. (3 points) Hence obtain the NPV of the proposed manufacturing project. d. (1 point) How much should the share price rise upon announcement of the manufacturing project? How many new shares would need to be sold to finance it? The CEO also said that NewVax analysts estimate that the company will be able to sell 20 million doses @ \$200 per dose in the first year of sales, which will be earned 3 years from today. Operating expenses will be $5 per dose. She expects sales to grow 1% annually for the first 3 years of production as knowledge of the drug spreads. However, with much of the relevant population treated by then, sales are expected to fall by 5% per annum over each of the subsequent 6 years. NewVax would then lose its patent protection and face competition from manufacturers of generics. To clarify, here is a timeline representation of the above description of the expected sales (in millions) up until when the patent expires: NewVax expects to be able to sell its manufacturing facility and other assets for $1.5 billion 10 years after its first year of sales (the factory would be too large for NewVax in the new more competitive environment). Alternatively, it can remain a competitive supplier, exploiting its reputation, economies of scale and sunk capital expenditure to obtain a market share of 30% at a sales price of $40 per dose (a premium on the generic price) while maintaining operating expenses of $5 per dose. The CEO also explained that NewVax analysts had forecast that the firm could sell its factory site and other assets for $1.0 billion at the end of 10 years of competitive production. To clarify, here is a timeline representation of the two options after the patent expires: opti optix sales The CEO explained that the company's analysis implies that the best option is to sell the factory site and not remain in the competitive market after the patent expires. To simplify the problem, assume that there are no corporate taxes, and so depreciation is also irrelevant. Assume also that the relevant discount rate is 12% annually. b. (2 points) At the projected growth rate of sales growth prior to patent expiration, and given its expected market share in the competitive market, what would be its expected annual sales, and hence annual cash flow y, in the competitive market? Verify that the company would be better off selling its factory site rather than entering the competitive market. c. (3 points) Hence obtain the NPV of the proposed manufacturing project. d. (1 point) How much should the share price rise upon announcement of the manufacturing project? How many new shares would need to be sold to finance it