Question

The Chief Executive Officer (CEO) wants the following analysis completed in preparing for a long-term bank loan renewal and to support growth in the future.

The Chief Executive Officer (CEO) wants the following analysis completed in preparing for a long-term bank loan renewal and to support growth in the future. The CEO asks the Chief Financial Officer (CFO) to prepare the following documents and analysis. The CFO believes the bank will want as covenants:

Current Ratio 1.0 minimum

Long-term Debt to Equity 100% maximum

Return on Sales 5.0% minimum

Return on Assets 2.5% minimum

Return on Equity 6.0% minimum

A. A Statement of Cash Flows for 2020 and 2019 using the indirect method.

a. Explain why cash increased in 2020 and 2019 with reference to the cash flow analysis

B. Calculate "days" for accounts receivable, inventory and accounts payable for 2020 and 2019. Use year-end amounts for calculating days

a. Explain the impact of the change in "net days" on cash flows and the net dollar position.

C. Explain the financing strategy the company is using in 2020? (closest strategy)

D. Make a ratio analysis for 2020 and 2019 covering liquidity, solvency and profitability.

a. Explain whether the trends are positive or negative

b. Explain whether the bank covenants were met in 2020

E. What is the internal growth rate for 2020 and what does it mean?

F. What are "financing cash flows" for 2020? The company is not contemplating buying a business or selling redundant assets.

a. Can the company afford the new debt interest cost in 2021? (3 marks)

G. Make a "percentage of sales" forecast for 2021. The CEO wants sales to increase in 2021 by 10%. The CEO feels that all expenses down to Earnings before Taxes will increase using the 2020 percentage of sales. This includes COGS, Other Fixed Costs, Depreciation and Interest. Taxes are 30% of Earnings before Taxes and Dividends will remain 50% of Net Income.

Assets and Accounts Payable for 2021 will be based on the 2020 percentages of sales. Common Stock will remain $105,000. The forecast will calculate the level of Long-term Debt and Retained Earnings.

a. Will the company be able to finance the growth in 2021?

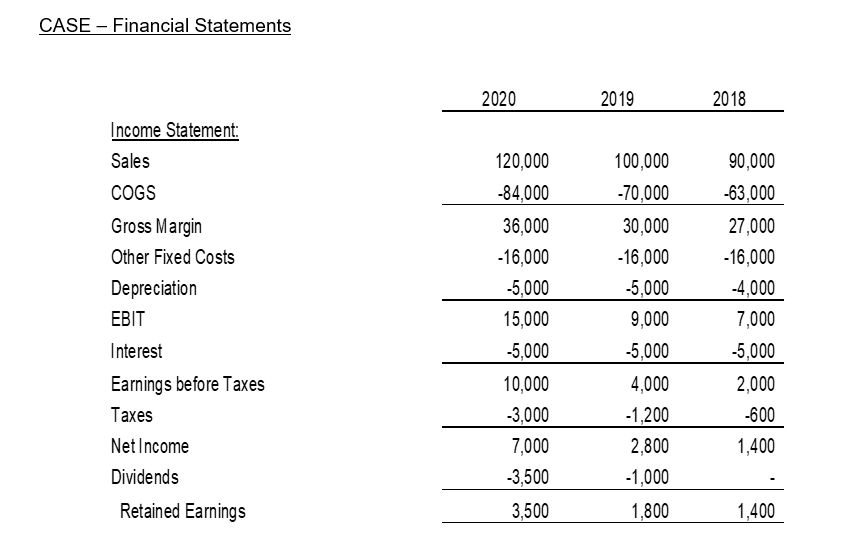

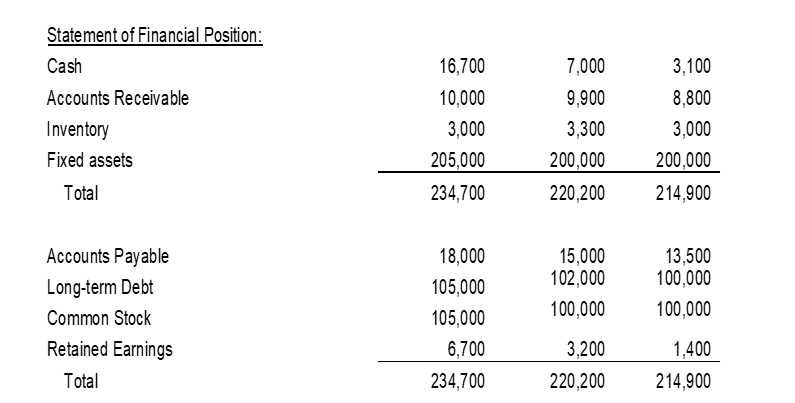

CASE - Financial Statements Income Statement: Sales COGS Gross Margin Other Fixed Costs Depreciation EBIT Interest Earnings before Taxes Taxes Net Income Dividends Retained Earnings 2020 120,000 -84,000 36,000 -16,000 -5,000 15,000 -5,000 10,000 -3,000 7,000 -3,500 3,500 2019 100,000 -70,000 30,000 -16,000 -5,000 9,000 -5,000 4,000 -1,200 2,800 -1,000 1,800 2018 90,000 -63,000 27,000 -16,000 -4,000 7,000 -5,000 2,000 -600 1,400 1,400

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To address the CEOs request the CFO will need to prepare the following documents and analyses A Stat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started